CenturyLink 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

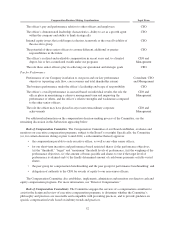

Stock Ownership Guidelines

Under our current stock ownership guidelines, our executive officers are required to beneficially own

CenturyLink stock in market value equal to a multiple of their annual salary, as outlined in the table below, and

each outside director must beneficially own CenturyLink stock equal in market value to five times the annual

cash retainer payable to outside directors. Each executive officer and outside director has three and five years,

respectively, to attain these targets.

Executive Officer Stock Ownership Guidelines

Stock

Ownership

Guidelines

CEO ........................ 6times base salary $7.5 million(1)

All Other Executive Officers ..... 3times base salary $1.6 million(2)

Outside Directors .............. 5times annual cash retainer $325,000

(1) Based on annual salary as of December 31, 2015

(2) Based on average annual salary for all other executive officers as of December 31, 2015

For any year during which an executive or outside director does not meet his or her ownership target, the

executive or director is expected to hold 65% of the CenturyLink stock that he or she acquires through our equity

compensation programs, excluding shares sold to pay related taxes.

As of the record date for the meeting, all of our executive officers and all but two of our directors were in

compliance with, and in most cases significantly exceeded, our stock ownership guidelines. For additional

information on our stock ownership guidelines, see “Governance Guidelines.”

Use of Employment Agreements

We have a long-standing practice of not providing employment agreements to our officers, and none of our

long-standing executives have been granted an employment agreement. In connection with our recent mergers,

however, we have assumed several employment agreements formerly granted by Embarq, Qwest or Savvis to its

officers, and in a couple of instances have extended or renewed these arrangements to retain officers critical to

our future plans.

Tax Gross-ups

We eliminated the use of tax “gross-up” benefits in our executives’ change of control agreements and split-

dollar insurance policies in 2010, and in our outside directors’ executive physical program in early 2012. We

continue to provide these tax benefits to a limited number of our officers under legacy employment agreements

that are expected to lapse over the next couple of years and to all of our employees who qualify for relocation

benefits under our broad-based relocation policy. Subject to these limited exceptions, we do not intend to provide

tax gross-up benefits in any new compensation programs.

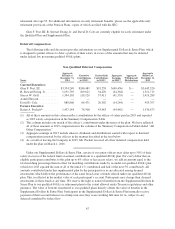

Anti-Hedging and Anti-Pledging Policies

Under our insider trading policy, our employees and directors may not:

• purchase or sell short-term options with respect to CenturyLink shares,

• engage in “short sales” of CenturyLink shares, or

• engage in hedging transactions involving CenturyLink shares which allow employees to fix the value

of their CenturyLink shareholdings without all the risks of ownership or cause them to no longer have

the same interests or objectives as our other shareholders.

57