CenturyLink 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Summary Annual Report and

2016 Annual Meeting Documents

Table of contents

-

Page 1

2015 Summary Annual Report and 2016 Annual Meeting Documents -

Page 2

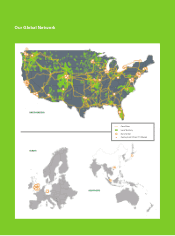

Our Global Network NORTH AMERICA Core Fiber Local Territory Data Center CenturyLink® Prism® TV Market EUROPE ASIA PACIFIC -

Page 3

... company. PATHWAY TO GROWTH During 2015, we grew revenues from business high-bandwidth data services, consumer highspeed Internet services and other strategic services by over $500 million, a 9.2 percent growth rate. Demand for these services is expected to continue to increase in the coming years... -

Page 4

...the country. As we move into 2016, we are committed to increasing the market competitiveness of our broadband access service offerings. We will continue to expand both our gigabit-capable footprint and the number of customers able to receive speeds of up to 100-200 Mbps through bonding and vectoring... -

Page 5

... return of cash to our shareholders makes CenturyLink a compelling investment opportunity. over the past eighteen months are part of that focus on improved execution. In addition, we have declared the following key operational objectives to drive outstanding performance and an exceptional customer... -

Page 6

... we see for our customers, our employees and our shareholders. We are eager to deliver on the promise we see in the future of our company, and we appreciate your support as we work to drive CenturyLink's growth and success in the months ahead. Glen F. Post, III Chief Executive Ofï¬cer and... -

Page 7

2016 Notice of Annual Meeting and Proxy Statement and Annual Financial Report May 18, 2016 10:00 a.m. local time 100 CenturyLink Drive Monroe, Louisiana -

Page 8

..." refers to our executive officers and a limited number of additional officers whose compensation is determined by the Compensation Committee of our Board, (vi) "Embarq" refers to Embarq Corporation, which we acquired on July 1, 2009, (vii) "Qwest" refers to Qwest Communications International Inc... -

Page 9

..., Louisiana 71203 Notice of Annual Meeting of Shareholders TIME AND DATE ...PLACE ...10:00 a.m. local time on May 18, 2016 Corporate Conference Room CenturyLink Headquarters 100 CenturyLink Drive Monroe, Louisiana (1) Elect as directors the 11 nominees named in the accompanying proxy statement... -

Page 10

...to Executive Compensation ...COMPENSATION COMMITTEE REPORT ...EXECUTIVE COMPENSATION ...Overview ...Incentive Compensation and Other Awards ...Pension Benefits ...Deferred Compensation ...Potential Termination Payments ...DIRECTOR COMPENSATION ...Overview ...Cash and Stock Payments ...Other Benefits... -

Page 11

...or Adjournment of the Meeting ...OTHER MATTERS ...Deadlines for Submitting Shareholder Nominations and Proposals for the 2017 Annual Meeting ...Proxy Materials ...Annual Financial Report ...Appendix A - CenturyLink, Inc. 2011 Equity Incentive Plan ...Appendix B - Annual Financial Report ... 78 78 79... -

Page 12

... will be held at 10:00 a.m. local time on Wednesday, May 18, 2016, in the corporate conference room at our corporate headquarters, 100 CenturyLink Drive, Monroe, Louisiana. If you would like directions to the meeting, please see our website, http://ir.centurylink.com. You do not need to attend the... -

Page 13

... of those shares. If I am a shareholder of record, how do I vote? If you are a shareholder of record, you may vote in person at the meeting or by proxy in any of the following three ways call 1-800-652-8683 and follow the instructions provided; log on to the Internet at www.envisionreports.com/ctl... -

Page 14

... broadband wireless access services, from January 2012 to December 2015; venture partner at The Prometheus Partners, a business services company, from April 2012 to May 2014; Chairperson and Chief Executive Officer of Wipro Infocrossing Inc., a U.S.-based cloud services affiliate of Wipro Limited... -

Page 15

... planning company, since 2005; Athletic Director of the University of Louisiana at Monroe from 2001 to 2004; held various executive positions at CenturyLink from 1980 through 2001, most notably Chief Operating Officer, Senior Vice President - Corporate Development and Strategy, Chief Financial... -

Page 16

... technology management and business consulting, since October 2015; Chief Executive Officer of Aero Communications, Inc., which provides installation, engineering and support services to the communications industry, from July 2013 to October 2015; interim Chief Executive Officer of ACAL Energy... -

Page 17

... Officer of Science Applications International Corporation, a technology and engineering company, from 1996 to 1998; served in the U.S. military from 1962 to 1996, holding various key leadership positions, including Vice Chairman of the Joint Chiefs of Staff; currently a director of Wipro Limited... -

Page 18

...years. Key Qualifications, Experiences and Skills Experience as a chief executive Marketing and branding expertise Director of another publicly-held company Qualifies as an "audit committee financial expert" Laurie A. Siegel, age 60; a director since 2009; a business and human resources consultant... -

Page 19

Dean J. Douglas, age 58; President - Sales and Marketing since February 16, 2016; served as Chief Executive Officer at Unify GmbH & Co. KG, a provider of software-based enterprise unified communications services from January 2014 to January 2016; served in senior leadership positions at Westcon ... -

Page 20

... its acquisition by Chicago Bridge & Iron Company N.V. in February 2013; served as Vice President of Human Resources for Honeywell International Inc. from 2005 to June 2010. Girish K. Varma, age 66; President - Global Information Technology Services and New Market Development since November 1, 2014... -

Page 21

... term if he or she would be age 75 or older at the time of the election or appointment. Annually, the Board will determine affirmatively which of our directors are independent for purposes of complying with our corporate governance guidelines and the listing standards of the New York Stock Exchange... -

Page 22

...any year during which an executive or director does not meet his or her ownership target, the executive or director is expected to hold a specified percentage of the CenturyLink stock that the executive or director acquires through our equity compensation programs, excluding shares sold to pay taxes... -

Page 23

... review of the performance of our Chief Executive Officer, including interviewing each of our other senior officers, and (vii) reporting to the Board on succession planning for executive officers and appointing an interim CEO if the Board does not make such an appointment within 72 hours of the CEO... -

Page 24

... prices of any CenturyLink securities sold pursuant to our outstanding shelf registration statement. This ad hoc committee is comprised of Peter C. Brown, W. Bruce Hanks and Glen F. Post, III. During 2015, all of our directors attended at least 75% of the aggregate number of all board meetings... -

Page 25

... our reports filed with the SEC, by accessing our website at www.centurylink.com, or by contacting our Secretary in the manner specified below under "Other Matters." Role of Nominating Committee. The Nominating Committee will consider candidates properly and timely nominated by shareholders in... -

Page 26

... industry or technical expertise financial, accounting or capital markets expertise public company board experience business combination or investment banking experience brand marketing expertise government, labor or human resources expertise international business experience legal expertise. In... -

Page 27

...further on our website, you may contact Adm. Owens by writing a letter to the Chairman and Lead Outside Director, c/o Post Office Box 5061, Monroe, Louisiana 71211, or by sending an email to [email protected]. As indicated above, the non-management directors meet in executive session at... -

Page 28

... Company believes that Adm. Owens' service as Chairman over the last seven years uniquely qualifies him to assist the Board in on-boarding new directors in an orderly manner. Our director retirement policy remains in effect and the Board has no current plans to amend it or waive its application in... -

Page 29

...2014 2015 Audit ...Audit-Related Fees(2) ...Tax Fees(3) ...Other ...Total Fees ... Fees(1) $ 8,900,049 320,117 1,013,633 - $10,233,799 $ 9,146,142 274,417 967,076 - $10,387,635 (1) Includes the cost of services rendered in connection with (i) auditing our annual consolidated financial statements... -

Page 30

...reviewed the performance of the lead engagement partner of our independent auditor; reviewed and discussed each quarterly and annual earnings press release before issuance; received periodic reports from the director of internal audit, and met with other members of the internal audit staff; received... -

Page 31

... shareholder reapproval of the material terms of the performance goals of the Plan, as required every five years by Section 162(m) of the Internal Revenue Code (the "Code") in order to preserve our ability to take a federal income tax deduction for certain compensation granted or paid under the Plan... -

Page 32

... directors, officers, and key employees for several more years. However, because the Plan was last approved by our shareholders in 2011, we are seeking shareholder reapproval of the material terms of the performance goals under the Plan in order to preserve our ability to take a federal income tax... -

Page 33

...the limitations specified in the Plan, the Committee may delegate its authority to our Chief Executive Officer or his designee with respect to grants to employees or consultants who are not subject to Section 16 of Exchange Act or Section 162(m) of the Code. Eligibility. Key employees, officers, and... -

Page 34

... the Plan to each non-employee director of CenturyLink during a single calendar year to $500,000. For purposes of determining the maximum number of Common Shares available for delivery under the Plan, shares that are not delivered because an Incentive is forfeited, canceled, or settled in cash will... -

Page 35

...162(m) Awards. Performance-based compensation does not count toward the $1 million limit on CenturyLink's federal income tax deduction for compensation paid to each of its most highly-compensated executive officers. Grants of restricted stock, restricted stock units, or other stock-based awards that... -

Page 36

... by a certain date; require the surrender to CenturyLink of some or all outstanding Incentives in exchange for a stock or cash payment for each Incentive equal in value to the per share change of control value, calculated as described in the Plan, over the exercise or base price; make any equitable... -

Page 37

... do not completely avoid federal income tax by using preference items. An employee will recognize capital gain or loss in the amount of the difference between the exercise price and the sale price on the sale or exchange of shares acquired pursuant to the exercise of an incentive stock option... -

Page 38

... market value of the shares as of that date, and we will be allowed a corresponding federal income tax deduction at that time, subject to any applicable limitations under Section 162(m). If the participant files an election under Section 83(b) within 30 days of the date of grant of restricted stock... -

Page 39

... of our named executive officers as disclosed in our annual proxy statements pursuant to the rules of the SEC. Under our executive compensation programs, our named executive officers are rewarded for achieving specific annual and long-term goals, as well as increased shareholder value. We believe... -

Page 40

... some as formal shareholder proposals. We give careful consideration to all suggestions, and assess whether they promote the best long-term interests of CenturyLink and its shareholders. The Board of Trustees of the International Brotherhood of Electrical Workers Pension Fund, located at 900 Seventh... -

Page 41

...ratio for shares received by senior executives from the Company's equity compensation plans. A 2009 report by the Conference Board Task Force on Executive Compensation observed that such hold-through-retirement requirements give executives 'an ever growing incentive to focus on long-term stock price... -

Page 42

... plans and policies are carefully designed to further align the long-term interests of our senior executives and shareholders. Typically, a substantial majority of our annual executive compensation consists of awards of time-vested restricted stock that vests over a three-year period and performance... -

Page 43

OWNERSHIP OF OUR SECURITIES Principal Shareholders The following table sets forth information regarding ownership of our Common Shares by the persons known to us to have beneficially owned more than 5% of the outstanding Common Shares on December 31, 2015, unless otherwise noted. Amount and Nature ... -

Page 44

... restricted stock granted to our executive officers, the number of shares that will vest if we attain target levels of performance. (3) Reflects shares that the person has the right to acquire within 60 days of the record date pursuant to options granted under our incentive compensation plans; does... -

Page 45

...plan by two of our executive officers who no longer participate in such plan, and (iv) 15,667 shares held beneficially through a trust. As of the record date, neither Mr. McCray nor Mr. Melville met their ownership target under our stock ownership guidelines discussed under the heading "Compensation... -

Page 46

... the Federal Communications Commission's Connect America Fund Phase 2 program that will enable us to offer high-speed Internet services to approximately 1.2 million rural households and businesses in 33 states. Added approximately 44,000 Prism TV customers during the year, and expanded availability... -

Page 47

...named executive officers in 2015 consisted of a combination of performance-based restricted stock (60% of the target grant value) and time-based restricted stock (40% of the target grant value). Other than relatively modest increases necessary to address a limited number of below-market pay packages... -

Page 48

...year revenue target Performance-Based Restricted Stock Time-Based Restricted Stock Annual long-term equity awards that vest based on years of service The Committee feels our incentive programs supported our strategic and cultural priorities for 2015 as described below: • • Our senior officers... -

Page 49

...on August 31, 2015. • • A fixed annual salary represents 10% of our CEO's total target compensation and 22% of our other NEOs average target total compensation. Variable pay is comprised of a short-term incentive ("STI") bonus, time-vested restricted stock awards ("RSAs") and performance-based... -

Page 50

Linkage of Long-Term Incentive Performance Objectives with our Compensation Philosophy. We believe we can increase shareholder value by outperforming our industry peers' three-year total shareholder return and consistently achieving and surpassing the sum of our annual revenue targets over three-... -

Page 51

... performance through the end of the year, valuing the shares based on the closing price of our common stock on the last business day of the year. 2013-2015 Realizable Pay 2013 Total Target Comp 2013 Realizable Pay 2014 Total Target Comp 2014 Realizable Pay 2015 Total Target Comp 2015 Realizable Pay... -

Page 52

... Limit the maximum number of performance shares to vest if our total shareholder return is negative Review realizable pay of our senior officers and total compensation "tally" sheets Require shareholders to approve any future severance agreements valued at more than 2.99 times the executive's target... -

Page 53

... a number of steps in connection with setting annual salaries, including reviewing compensation tally sheets and benchmarking data, discussing with the CEO each senior officer's pay and performance relative to other senior officers, and considering when the officer last received a pay increase. More... -

Page 54

... annual bonuses for 2015 payable to our senior officers in accordance with Section 162(m) of the Internal Revenue Code, and (ii) the following threshold, target, and maximum performance levels for 2015 operating cash flow and core revenue. Financial Performance Objectives Weighting Performance... -

Page 55

... individual performance objectives and (iv) the officer's individual scoring under our management performance rating system. 2015 Performance Results. In February 2016, the Compensation Committee reviewed audited results of the Company's performance as compared to the financial performance targets... -

Page 56

... to certain limits, to either increase or decrease the bonus amounts determined on the basis of actual performance earned for financial and individual targets and objectives. Nonetheless, the Committee elected not to apply discretionary adjustments for the 2015 annual incentive bonus payments to any... -

Page 57

... of time-vested restricted shares. Performance Benchmarks. On an annual basis, the Committee reviews the relevance of our performance benchmarks for alignment with our long-term strategic plan. In 2015, we kept the same two performance benchmarks, relative TSR and absolute revenue, that we used for... -

Page 58

... legacy and strategic revenue, in each case defined in the same manner we reported such amounts in our Annual Report on Form 10-K for the prior year. Performance Period: January 1, 2015 through December 31, 2017. Performance Vesting: The ultimate number of our absolute revenue performance... -

Page 59

... 2015. Types of Awards. We strive to pay equity compensation in forms that create appropriate incentives to optimize performance at reasonable cost, that minimize enterprise risk, that align the interests of our officers and shareholders, that foster our long-term financial and strategic objectives... -

Page 60

...sum cash severance payment equal to a multiple of the officer's annual cash compensation, (ii) the officer's annual bonus, based on actual performance and the portion of the year served, (iii) certain welfare benefits are continued for a limited period, and (iv) the value or benefit of any long-term... -

Page 61

... Severance Benefits. Our executive severance plan provides cash severance payments equal to two years of total targeted cash compensation (defined as salary plus the targeted amount of annual incentive bonus) for our CEO or one year of total targeted cash compensation for any other senior officer in... -

Page 62

... The strategic and financial imperatives of our business Setting Competitive Compensation Pay Levels Market data regarding the officer's base salary, short-term incentive target, long-term incentive target and total target compensation paid to comparable executives at peer companies reflected... -

Page 63

... play in achieving our operational and strategic goals Pay for Performance Performance of our Company in relation to our peers and our key performance objectives (operating cash flow, core revenues and total shareholder return) The business performance under the officer's leadership and scope of... -

Page 64

..., recommend to the Committee business goals to be used in establishing incentive compensation performance targets and awards for our senior officers. In addition, our Executive Vice President, Human Resources, works closely with the Committee and its compensation consultant to ensure that the... -

Page 65

... groups in support of pay decisions for our senior officers in 2015 in order to benchmark compensation levels for our executives against individuals who work in similarly-situated positions at companies that are comparable to ours based on revenue size, market cap, industry and business model: Core... -

Page 66

...Communications Corporation, Rackspace Hosting, Inc. and Spok Holdings, Inc. Thereafter, it approved the below-listed 26company TSR Peer Group for 2015 performance benchmarking. The Core Peer Group for compensation benchmarking is somewhat constrained by the number of companies and revenue and market... -

Page 67

.... Our 2016 Executive Officers ShortTerm Incentive Plan contains substantially similar forfeiture provisions. Our Corporate Governance Guidelines authorize the Board to recover, or "clawback," compensation from an executive officer if the Board determines that any bonus, incentive payment, equity... -

Page 68

..., and in our outside directors' executive physical program in early 2012. We continue to provide these tax benefits to a limited number of our officers under legacy employment agreements that are expected to lapse over the next couple of years and to all of our employees who qualify for relocation... -

Page 69

... Internal Revenue Code (the "Code") limits the amount of compensation paid to our CEO and our other three most highly compensated executive officers, other than our CFO, that may be deducted by us for federal income tax purposes in any fiscal year to $1,000,000. "Performance-based" compensation that... -

Page 70

... Plan Compensation(2) Change in Pension Value(3) All Other Compensation(4) Total Current Executives: Glen F. Post, III ...Chief Executive Officer and President R. Stewart Ewing, Jr...Executive Vice President, Chief Financial Officer and Assistant Secretary 2015 $1,250,000 2014 1,100,000 2013 1,100... -

Page 71

... we used to calculate the fair value of these stock awards. (2) The amounts shown in this column reflect cash payments made under our annual incentive bonus plans for actual performance in the respective years. For additional information, see "- Incentive Compensation and Other Awards - 2015 Awards... -

Page 72

... were granted to each named officer on the dates indicated below with respect to performance during 2015, and grants of long-term compensation awarded to each named officer on the dates indicated below, consisting of (i) the number of shares of time-vested restricted stock awarded, (ii) the range of... -

Page 73

... terms for our outstanding restricted stock granted in earlier years is substantially the same as noted above. Shares Issuable Under Performance-Based Restricted Stock. In the preceding "Grants of Plan-Based Awards" table, the number of performance-based restricted shares listed under the "target... -

Page 74

... annual return on average assets during the performance period. If we do, all shares of the absolute performance-based restricted stock will vest if we attain the "target" amount of our consolidated legacy and strategic revenue (as defined in our federal securities law reports) over the three-year... -

Page 75

... 31, 2015(1) Option Awards Number of Securities Underlying Unexercised Options(2) Stock Awards Equity Incentive Plan Awards(3) Market Value of Unvested Shares All Other Stock Awards Market Value of Unvested Shares Name Option Exercise Price Option Expiration Date Grant Date Unvested Shares... -

Page 76

... to Compensation Philosophy and Objectives - Actual Payouts of Performance-Based Restricted Stock." (2) Based on the closing trading price of the Common Shares on the applicable vesting date. (3) See "-Potential Terminations Payments - Amounts Paid to Former Executive." Pension Benefits Amount... -

Page 77

... increases 4% per year, compounded annually through the earlier of December 31, 2015 or the termination of the participant's employment. Under both Pension Plans, "average monthly compensation" is determined based on the participant's salary plus annual cash incentive bonus. Although the retirement... -

Page 78

...result of leaving the Company in 2015, Ms. Puckett received all of her deferred compensation held under the plan on March 1, 2016. Under our Supplemental Dollars & Sense Plan, certain of our senior officers may defer up to 50% of their salary in excess of the federal limit on annual contributions to... -

Page 79

... Committee a cash severance payment in the amount described under "Compensation Discussion and Analysis - Our Compensation Program Objectives and Components of Pay - Other Benefits - Severance Benefits" plus the receipt of any short-term incentive bonus payable under their applicable bonus plan and... -

Page 80

...or a portion of, unvested time-vested restricted stock if approved by our Compensation Committee payment of their annual incentive bonus or a pro rata portion thereof, depending on their retirement date post-retirement life, health and welfare benefits all of the benefits described under the heading... -

Page 81

... of Pay - Other Benefits - Change of Control Arrangements." We have filed copies or forms of these agreements with the SEC. Participants in our supplemental defined benefit plan whose service is terminated within two years of the change in control of CenturyLink will receive a cash payment equal... -

Page 82

... available to all salaried full-time employees and (ii) benefits, awards or amounts that the officer was entitled to receive prior to termination of employment. (3) The amounts listed in this column reflect payments to which the named officer would be entitled to under our executive severance plan... -

Page 83

... our executive severance plan. Under that plan, Ms. Puckett received a cash severance payment equal to one year of total target compensation ($1,560,599) and the continuation of health and welfare benefits for one year and outplacement services (valued at $36,500), both of which are reported above... -

Page 84

...commencement of service on our board following the Qwest merger). For further information on our directors' stock ownership, see "Ownership of Our Securities - Executive Officers and Directors," and for information on certain deferred fee arrangements pertaining to Mr. Roberts, see "- Other Benefits... -

Page 85

... director education program. Currently, William A. Owens, in his capacity as the non-executive Chairman of the Board, receives supplemental board fees at the rate of $200,000 per year payable in shares of time-vested restricted stock (valued using the 15-trading day average closing price specified... -

Page 86

...2005 by Qwest directors who joined our Board following the merger were converted, based on the merger exchange ratio, to phantom units based on the value of one of our Common Shares. Other than the crediting and "reinvestment" of dividends for outstanding phantom units, CenturyLink does not make any... -

Page 87

... of dividends. $250.00 CenturyLink Inc. Standard & Poor 500 S&P 500 Integrated Telecom Services (1) $200.00 $178.10 $180.56 $156.70 $150.00 $125.73 $139.98 $148.95 $144.16 $106.32 $100.00 $100.00 $102.08 $86.95 $112.51 $118.39 $98.35 $85.49 $76.92 $50.00 2010 2011 2012 2013 2014 2015 2010... -

Page 88

... disclosures under the federal proxy rules. Review Procedures Early each year, our management distributes to the Audit Committee a written report listing our payments to vendors, including a list of transactions with our directors, officers or employees. This annual report permits the independent... -

Page 89

... any retirement plan of CenturyLink, then you will receive a separate voting instruction card that will enable you to direct the voting of these shares. This voting instruction card entitles you, on a confidential basis, to instruct the trustees how to vote the shares allocated to your plan account... -

Page 90

...Information About the Annual Meeting." Cost of Proxy Solicitation We will pay all expenses of soliciting proxies for the meeting. Proxies may be solicited personally, by mail, by telephone or by facsimile by our directors, officers and employees, who will not be additionally compensated therefor. We... -

Page 91

... with applicable federal proxy rules and our bylaws. See "Corporate Governance - Director Nomination Process." These shareholder proposals must be in writing and received by the deadline described above at our principal executive offices at 100 CenturyLink Drive, Monroe, Louisiana 71203, Attention... -

Page 92

... report without charge by writing to Stacey W. Goff, Secretary, CenturyLink, Inc., 100 CenturyLink Drive, Monroe, Louisiana 71203, or by visiting our website at www.centurylink.com. You may view online this proxy statement and related materials at www.envisionreports. com/ctl. By Order of the Board... -

Page 93

... Eligibility. Key employees, officers, and directors of the Company and persons providing services as consultants or advisors to the Company shall become eligible to receive Incentives under the Plan when designated by the Committee. Delegation of Authority to Chief Executive Officer. With respect... -

Page 94

...Plan to each nonemployee director of CenturyLink during any single calendar year shall be $500,000, with any shares granted under such Incentives valued at Fair Market Value on the date of grant. (c) 5.4 Adjustment. (a) In the event of any recapitalization, reclassification, stock dividend, stock... -

Page 95

...when employment or service commences, such later date shall be the date of grant. Number. The number of shares of Common Stock subject to the option shall be determined by the Committee, subject to Section 5, including, but not limited to, any adjustment as provided in Section 5.4. Duration and Time... -

Page 96

... time by a participant during any calendar year (under the Plan or any other plan of CenturyLink or any of its subsidiaries) shall not exceed $100,000. To the extent that such limitation is exceeded, the excess options shall be treated as non-qualified stock options for federal income tax purposes... -

Page 97

... the date of grant; and (b) an outstanding SAR that has been granted under this Plan may not, as of any date that such SAR has a Base Price that is greater than the then-current Fair Market Value of a share of Common Stock, be surrendered to the Company as consideration for the grant of a new option... -

Page 98

... 11, the Restricted Period shall be a minimum of one year. No minimum Restricted Period applies to grants to non-employee directors, to grants issued in payment of cash amounts earned under the Company's annual incentive plan, or to grants made under Section 5.2(a). 8.3 Escrow. The participant... -

Page 99

... non-employee directors, to grants issued in payment of cash amounts earned under the Company's annual incentive plan, or to grants made under Section 5.2(a). 9.2 9.3 Dividend Equivalent Accounts. Subject to the terms and conditions of this Plan and the applicable Incentive Agreement, as well as... -

Page 100

...; shareholder return; target levels of, or changes in, revenues, operating income, cash flow, cash provided by operating activities, earnings, or earnings per share; achievement of business or operational goals such as market share, customer growth, customer satisfaction, new product or services... -

Page 101

... the then outstanding shares of common stock of the corporation resulting from such Business Combination or 20% or more of the combined voting power of the then outstanding voting securities of such corporation, and at least a majority of the members of the board of directors of the PostTransaction... -

Page 102

...by such Incentive, the number and class of shares of stock or other securities or property (including cash) to which the holder would have been entitled pursuant to the terms of the agreement providing for the reorganization, share exchange, merger, consolidation or asset sale, if, immediately prior... -

Page 103

... events, the fair market value of a share of Common Stock, as determined by the Committee as of the time determined by the Committee to be immediately prior to the effective time of the conversion or exchange. (e) In the event that the consideration offered to shareholders of CenturyLink in any... -

Page 104

... or her participation in the Plan, to continue to serve as an employee, officer, director, consultant, or advisor of the Company for any period of time or to any right to continue his or her present or any other rate of compensation. 13.7 Deferral Permitted. Payment of an Incentive may be deferred... -

Page 105

...maximum number of shares of Common Stock that may be issued through the Plan, (ii) a material increase to the benefits accruing to participants under the Plan, (iii) a material expansion of the classes of persons eligible to participate in the Plan, (iv) an expansion of the types of awards available... -

Page 106

... parties may require. Whenever any provision of this Plan authorizes the Committee to take action or make determinations with respect to outstanding Incentives that have been granted or awarded by the chief executive officer of CenturyLink under Section 3.2 hereof, each such reference to "Committee... -

Page 107

APPENDIX B to Proxy Statement CENTURYLINK, INC. ANNUAL FINANCIAL REPORT December 31, 2015 -

Page 108

INDEX TO ANNUAL FINANCIAL REPORT December 31, 2015 The materials included in this Appendix B are excerpted from Items 5, 6, 7 and 8 of our Annual Report on Form 10-K for the year ended December 31, 2015. We filed the Form 10-K with the Securities and Exchange Commission on February 25, 2016, and ... -

Page 109

...common stock during 2015 and 2014 were paid each quarter. On February 23, 2016, our Board of Directors declared a common stock dividend of $0.54 per share. As described in greater detail in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2015, the declaration and payment of... -

Page 110

... pension settlement charge. For additional information, see Note 13-Quarterly Financial Data (Unaudited) to our consolidated financial statements included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2015. (4) During 2013, we recorded a non-cash, non-tax-deductible... -

Page 111

... 7 our Annual Report on Form 10-K for the year ended December 31, 2015. Selected financial information from our consolidated statements of cash flows is as follows: 2015 Years Ended December 31, 2014 2013 2012 (Dollars in millions) 2011 Net cash provided by operating activities ...Net cash used in... -

Page 112

...selected operational metrics: As of December 31, 2015 2014 2013 2012 2011 (in thousands except for data centers, which are actuals) Operational metrics: Total access lines(1) ...Total high-speed Internet subscribers(1) ...Prism TV subscribers ...Total data centers(2) ... 11,748 6,048 285 59 12,394... -

Page 113

.... Our communications services include local and long-distance voice, high-speed Internet, Multi-Protocol Label Switching ("MPLS"), private line (including special access), data integration, Ethernet, colocation, managed hosting (including cloud hosting), network, public access, video, wireless and... -

Page 114

... pension settlement charge. For additional information, see Note 13-Quarterly Financial Data (Unaudited) to our consolidated financial statements included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2015. (3) During 2013, we recorded a non-cash, non-tax-deductible... -

Page 115

...• Strategic services, which include primarily high-speed Internet, MPLS (which is a data networking technology that can deliver the quality of service required to support real-time voice and video), private line (including special access), Ethernet, colocation, hosting (including cloud hosting and... -

Page 116

... in high-speed Internet, Ethernet, MPLS, facilities-based video and IT services and from rate increases on various services, which were substantially offset by declines in private line (including special access) services, colocation and hosting services. The level of strategic revenue growth in 2015... -

Page 117

... for using other carriers' networks to provide services to our customers); rents and utilities expenses; equipment sales expenses (such as data integration and modem expenses); payments to universal service funds (which are federal and state funds that are established to promote the availability of... -

Page 118

... former employees in settlement of their future retirement benefits. We record an accounting settlement charge associated with these lump sum payments only if, in the aggregate, they exceed the sum of the annual service and interest costs for the plan's net periodic pension benefit cost, which... -

Page 119

... our acquisitions of Qwest in April 2011 and Savvis in July 2011. These expenses are reflected in cost of services and products and selling, general and administrative expenses in our consolidated statements of operations, as summarized below. Years Ended December 31, 2015 2014 2013 (Dollars in... -

Page 120

... the remaining economic lives of certain switch and circuit network equipment, which resulted in increased 2014 annual depreciation expense. Additionally, we developed a plan to migrate customers from one of our networks to another between late 2014 and late 2015. As a result, we implemented changes... -

Page 121

...31, Increase / 2015 2014 (Decrease) (Dollars in millions) % Change Interest expense ...Other income, net ...Total other expense, net ...Income tax expense ... $(1,312) (1,311) 23 11 $(1,289) (1,300) $ 438 338 1 12 (11) 100 -% 109 % (1)% 30 % % Change Years Ended December 31, Increase / 2014 2013... -

Page 122

...-Income Taxes" below for additional information. Segment Results The results for our business and consumer segments are summarized below for the years ended December 31, 2015, 2014 and 2013: Years Ended December 31, 2015 2014 2013 (Dollars in millions) Total segment revenues ...Total segment... -

Page 123

... of total business segment revenues continues to migrate from legacy services to strategic services as our small, medium and enterprise business, wholesale and governmental customers increasingly demand integrated data, Internet, hosting and voice services. During 2015, our strategic revenues were... -

Page 124

... access revenue loss. Beginning in 2016, we expect that a recent FCC order will also reduce our revenue that we collect for local voice and long-distance services provided to correctional facilities. Although our legacy services generally face fewer direct competitors than certain of our strategic... -

Page 125

... Business Segment Years Ended December 31, Increase / 2014 2013 (Decrease) (Dollars in millions) % Change Segment revenues: Strategic services High-bandwidth data services(1) ...$ 2,579 Low-bandwidth data services(2) ...2,345 Hosting services(3) ...1,316 Other strategic services(4) ...76 Total... -

Page 126

... private line and high-speed Internet revenue (3) Includes colocation, hosting (including cloud hosting and managed hosting) and hosting area network revenue (4) Includes primarily VoIP, video and IT services revenue (5) Includes local and long-distance voice revenue (6) Includes UNEs, public access... -

Page 127

... market in which most consumers already have broadband services and growth rates in new subscribers have slowed. Moreover, as described further in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2015, certain of our competitors continue to provide high-speed Internet... -

Page 128

......Total revenues ...Segment expenses: Total expenses ...Segment income ...Segment income margin percentage ...(1) (2) (3) (4) Includes high-speed Internet and related services revenue Includes video and Verizon wireless revenue Includes local and long-distance voice revenue Includes switched access... -

Page 129

... in strategic services revenues was primarily due to increases in the number of Prism TV customers, as well as from 2015 price increases on various services. The decline in legacy services revenues was primarily due to declines in local and long-distance services volumes associated with access line... -

Page 130

... $237 million of our capitalized software costs, which represents costs to develop an integrated billing and customer care system which is amortized using the straight-line method over a 20 year period. We annually review the estimated lives and methods used to amortize our other intangible assets... -

Page 131

... to this tax qualified pension plan, we also maintain several nonqualified pension plans for certain eligible highly compensated employees. We also maintain post-retirement benefit plans that provide health care and life insurance benefits for certain eligible retirees. In 2015, approximately 45... -

Page 132

... result from our active management of the assets. The expected rate of return on plan assets is reviewed annually and revised, as necessary, to reflect changes in the financial markets and our investment strategy. To compute the expected return on pension and post-retirement benefit plan assets, we... -

Page 133

... the Federal Communications Commission ("FCC") of approximately $500 million per year for six years to fund the deployment of voice and high-speed Internet infrastructure for approximately 1.2 million rural households and businesses (living units) in 33 states under the CAF Phase 2 high-cost support... -

Page 134

... bank accounts for the purpose of funding our foreign operations. Due to various factors, our access to foreign cash is generally much more restricted than our access to domestic cash. In connection with our budgeting process in early 2016, our executive officers and our Board of Directors reviewed... -

Page 135

... that we previously utilized to support voice services in high-cost rural markets in these 33 states. In September of 2015, we began receiving these payments from the FCC under the new CAF Phase 2 support program, which included (i) monthly support payments at a higher rate than under the interstate... -

Page 136

... downgrades of CenturyLink, Inc.'s or Qwest Corporation's senior unsecured debt ratings could impact our access to debt capital or further raise our borrowing costs. See "Risk Factors-Risks Affecting our Liquidity and Capital Resources" in Item 1A of our Annual Report on Form 10-K for the year ended... -

Page 137

... managing our business, paying our fixed commitments and returning cash to our shareholders. Assuming continued payment during 2016 at this rate of $0.54 per share, our total dividends paid each quarter would be approximately $292 million based on our current number of outstanding shares (which does... -

Page 138

... or issuance of new debt. Interest on our floating rate debt was calculated for all years using the rates effective at December 31, 2015. (3) We have various long-term, non-cancelable purchase commitments for advertising and promotion services, including advertising and marketing at sports arenas... -

Page 139

... 7-Employee Benefits to our consolidated financial statements in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2015; contract termination fees. These fees are non-recurring payments, the timing and payment of which, if any, is uncertain. In the ordinary course of business... -

Page 140

...in the changes in accounts payable and retirement benefits. During the year ended December 31, 2015, we made a voluntary cash contribution to the trust of $100 million to fund our qualified pension plan. During the years ended December 31, 2014 and 2013, and prior to the pension plan merger, we made... -

Page 141

... line of credit with one of the lenders under the Credit Facility. Certain Matters Related to Acquisitions When we acquired Qwest and Savvis in 2011, Qwest's pre-acquisition debt obligations consisted primarily of debt securities issued by Qwest and two of its subsidiaries while Savvis' long-term... -

Page 142

...: Years Ended December 31, 2015 2014 From April 1, 2011 through December 31, 2013 (Dollars in millions) Total Since Acquisition Amortized ...Extinguished(1) ...Total ... $22 1 $23 42 - 42 302 276 578 366 277 643 (1) Extinguished in connection with the payment of Qwest debt securities prior... -

Page 143

... Offered Rate (LIBOR). A hypothetical increase of 100 basis points in LIBOR relative to this debt would decrease our annual pre-tax earnings by $7 million. By operating internationally, we are exposed to the risk of fluctuations in the foreign currencies used by our international subsidiaries... -

Page 144

... disclosed by us from time to time if market conditions vary from the assumptions used in the analyses performed. These analyses only incorporate the risk exposures that existed at December 31, 2015. OFF-BALANCE SHEET ARRANGEMENTS We have no special purpose or limited purpose entities that provide... -

Page 145

... STATEMENTS AND SUPPLEMENTARY DATA REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders CenturyLink, Inc.: We have audited the accompanying consolidated balance sheets of CenturyLink, Inc. and subsidiaries (the Company) as of December 31, 2015 and 2014... -

Page 146

... PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders CenturyLink, Inc.: We have audited CenturyLink, Inc. and subsidiaries' (the Company) internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control-Integrated Framework (2013... -

Page 147

CENTURYLINK, INC. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31, 2015 2014 2013 (Dollars in millions, except per share amounts and shares in thousands) OPERATING REVENUES ...OPERATING EXPENSES Cost of services and products (exclusive of depreciation and amortization) ...Selling, ... -

Page 148

... INCOME (LOSS) Years Ended December 31, 2015 2014 2013 (Dollars in millions) NET INCOME (LOSS) ...OTHER COMPREHENSIVE INCOME (LOSS): Items related to employee benefit plans: Change in net actuarial gain (loss), net of $(12), $742 and $(606) tax . . Change in net prior service credit (costs), net of... -

Page 149

CENTURYLINK, INC. CONSOLIDATED BALANCE SHEETS As of December 31, 2015 2014 (Dollars in millions and shares in thousands) ASSETS CURRENT ASSETS Cash and cash equivalents ...Accounts receivable, less allowance of $152 and $162 ...Other ...Total current assets ...NET PROPERTY, PLANT AND EQUIPMENT ... -

Page 150

... long-term debt ...(966) Net payments on credit facility and revolving line of credit ...(315) Early retirement of debt costs ...(1) Dividends paid ...(1,198) Net proceeds from issuance of common stock ...11 Repurchase of common stock ...(819) Other, net ...(2) Net cash used in financing activities... -

Page 151

CENTURYLINK, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Years Ended December 31, 2015 2014 2013 (Dollars in millions) COMMON STOCK (represents dollars and shares) Balance at beginning of period ...Issuance of common stock through dividend reinvestment, incentive and benefit plans ...... -

Page 152

.... Our communications services include local and long-distance voice, high-speed Internet, Multi-Protocol Label Switching ("MPLS"), private line (including special access), data integration, Ethernet, colocation, managed hosting (including cloud hosting), network, public access, wireless, video and... -

Page 153

...eighteen months to over ten years depending on the service. We also defer costs for customer activations and installations. The deferral of customer activation and installation costs is limited to the amount of revenue deferred on advance payments. Costs in excess of advance payments are recorded as... -

Page 154

... authority, we record the taxes on a net basis and do not include them in our revenues and costs of services and products. Advertising Costs Costs related to advertising are expensed as incurred and included in selling, general and administrative expenses in our consolidated statements of operations... -

Page 155

...of our business, we incur costs to hire and retain external legal counsel to advise us on regulatory, litigation and other matters. We expense these costs as the related services are received. Income Taxes We file a consolidated federal income tax return with our eligible subsidiaries. The provision... -

Page 156

... acquired in connection with our acquisitions was recorded based on its estimated fair value as of its acquisition date plus the estimated value of any associated legally or contractually required retirement obligations. Purchased and constructed property, plant and equipment is recorded at cost... -

Page 157

... in our accumulated other comprehensive loss. Pension and post-retirement benefit expenses are recognized over the period in which the employee renders service and becomes eligible to receive benefits. We make significant assumptions (including the discount rate, expected rate of return on plan B-49 -

Page 158

... taxes. We adopted both ASU 2015-03 and 2015-17 by retrospectively applying the requirements of the ASUs to our previously issued consolidated financial statements. The retrospective application had no impact on our net income (loss) or earnings (loss) per share for the years ended December 31, 2014... -

Page 159

... in total pension or post-retirement plan assets as of December 31, 2014 due to the adoption of ASU 2015-07. Recent Accounting Pronouncements Revenue Recognition On May 28, 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers" ("ASU 2014-09" or "new standard"). The new standard... -

Page 160

...1,338 41 1,647 Total amortization expense for intangible assets for the years ended December 31, 2015, 2014 and 2013 was $1.353 billion, $1.470 billion and $1.589 billion, respectively. As of December 31, 2015, the gross carrying amount of goodwill, customer relationships, indefinite-life and other... -

Page 161

... of goodwill assigned to our reportable segments from December 31, 2013 through December 31, 2015. Business Consumer Wholesale Hosting (Dollars in millions) Total As of December 31, 2013 ...Purchase accounting adjustments ...November 1, 2014 reorganization ...Acquisitions ...As of December 31... -

Page 162

..., including Qwest Corporation, Qwest Capital Funding, Inc. and Embarq Corporation and subsidiaries ("Embarq"), were as follows: Interest Rates Maturities As of December 31, 2015 2014 (Dollars in millions) CenturyLink, Inc. Senior notes ...Credit facility and revolving line of credit(1) ...Term loan... -

Page 163

... at a price of 101% of the aggregate principal amount plus accrued and unpaid interest to the repurchase date. In October 2015, CenturyLink, Inc. exchanged all of the unregistered Notes issued on March 19, 2015 for fully-registered Notes. 2014 On September 29, 2014, Qwest Corporation issued $500... -

Page 164

... for base rate loans depending on Qwest Corporation's then current senior unsecured long-term debt rating. At December 31, 2015, the outstanding principal balance on this term loan was $100 million. In January 2015, CenturyLink, Inc. entered into a $100 million uncommitted revolving line of credit... -

Page 165

... the above-listed indentures of CenturyLink, Inc., Qwest Corporation, Qwest Capital Funding, Inc. and Embarq contain any financial covenants or restrictions on the ability to issue new securities in accordance with the terms of the indenture. Several of our Embarq subsidiaries have outstanding first... -

Page 166

... to the redemption date. (4) Accounts Receivable The following table presents details of our accounts receivable balances: As of December 31, 2015 2014 (Dollars in millions) Trade and purchased receivables ...Earned and unbilled receivables ...Other ...Total accounts receivable ...Less: allowance... -

Page 167

... billion for the years ended December 31, 2015, 2014 and 2013, respectively. In 2014, we recorded an impairment charge of $17 million in connection with a sale-leaseback transaction involving an office building which closed in the fourth quarter of 2014. This impairment charge is included in selling... -

Page 168

...Qwest Communications International, Inc. ("Qwest") and legacy Embarq employees. On December 31, 2014, we merged our existing qualified pension plans, which included merging the Qwest Pension Plan and Embarq Retirement Pension Plan into the CenturyLink Retirement Plan. The CenturyLink Retirement Plan... -

Page 169

... retirement benefits. We record these payments as a settlement only if, in the aggregate, they exceed the sum of the annual service and interest costs for the plan's net periodic pension benefit costs, which represents the settlement threshold. In September 2015, we offered to make cash settlement... -

Page 170

...in 2016 to an ultimate rate of 4.50% in 2025. Our post-retirement benefit expense, for certain eligible legacy Qwest retirees and certain eligible legacy CenturyLink retirees, is capped at a set dollar amount. Therefore, those health care benefit obligations are not subject to increasing health care... -

Page 171

...2015 Pension Plans 2014 2013 2015 Post-Retirement Benefit Plans 2014 2013 Actuarial assumptions at beginning of year: Discount rate ...3.50% - 4.10% 4.20% - 5.10% 3.50% - 4.20% 3.80% 4.50% 3.60% Rate of compensation increase ...3.25% 3.25% 3.25% N/A N/A N/A Expected long-term rate of return on plan... -

Page 172

... available as of December 31, 2015 and 2014 and are as follows: Pension Plans December 31, 2015 2014 Post-Retirement Benefit Plans December 31, 2015 2014 Actuarial assumptions at end of year: Discount rate ...3.50% - 4.50% Rate of compensation increase ...3.25% Initial health care cost trend rate... -

Page 173

... the payment of pension benefits and certain eligible plan expenses. The post-retirement benefit plan's assets are used to pay health care benefits and premiums on behalf of eligible retirees and to pay certain eligible plan expenses. The expected rate of return on plan assets is the long-term rate... -

Page 174

... percent allocation to existing private market investments is expected to increase as liquid, publicly traded stocks are drawn down for the reimbursement of health care costs. At the beginning of 2016, our expected annual long-term rate of return on post-retirement benefit plan assets is assumed to... -

Page 175

... an actual cash investment. Gross Notional Exposure Post-Retirement Pension Plans Benefit Plans Years Ended December 31, 2015 2014 2015 2014 (Dollars in millions) Derivative instruments: Exchange-traded U.S. equity futures ...Exchange-traded Treasury and other interest rate futures ...Interest... -

Page 176

... Value of Post-Retirement Plan Assets at December 31, 2015 Level 1 Level 2 Level 3 Total (Dollars in millions) Investment grade bonds(a) ...High yield bonds(b) ...U.S. stocks(f) ...Non-U.S. stocks(g) ...Emerging market stocks(h) ...Cash equivalents and short-term investments(o) ...Total investments... -

Page 177

..., minus its liabilities, divided by the number of shares outstanding. Commingled funds can be redeemed at NAV within a year of the financial statement date. Investments in limited partnerships represent long-term commitments with a fixed maturity date, typically ten years and are also valued at NAV... -

Page 178

... published prices for exchange traded securities, bid prices for government bonds, and spreads and yields available for comparable fixed income securities with similar credit ratings. (f) U.S. stocks represent investments in stocks of U.S. based companies as well as commingled U.S. stock funds. The... -

Page 179

... in interest rates, foreign currency exchange rates, security prices, or other factors. (o) Cash equivalents and short-term investments represent investments that are used in conjunction with derivatives positions or are used to provide liquidity for the payment of benefits or other purposes... -

Page 180

... for a difference of $486 million. The short-term annual returns on plan assets will almost always be different from the expected long-term returns and the plans could experience net gains or losses, due primarily to the volatility occurring in the financial markets during any given year. B-72 -

Page 181

... AOCL 2015 (Dollars in millions) Accumulated other comprehensive loss: Pension plans: Net actuarial (loss) gain ...Prior service (cost) benefit ...Deferred income tax benefit (expense) ...Total pension plans ...Post-retirement benefit plans: Net actuarial (loss) gain ...Prior service (cost) benefit... -

Page 182

...annual compensation up to certain maximums, as defined by the plans and by the Internal Revenue Service ("IRS"). Currently, we match a percentage of employee contributions in cash. At both December 31, 2015 and 2014, the assets of the plans included approximately 8 million shares of our common stock... -

Page 183

...certain key employees as part of our annual equity compensation program. These awards contained only service conditions and will vest on a straight-line basis on March 12, 2016, 2017 and 2018. During the third quarter of 2015 we granted shares to certain key employees as part of our long-term equity... -

Page 184

...certain key employees as part of our annual equity compensation program. These awards contained only service conditions and will vest on a straight-line basis on March 26, 2015, 2016 and 2017. During the third quarter of 2014 we granted shares to certain key employees as part of our long-term equity... -

Page 185

...than the average market price of our common stock. We also exclude unvested restricted stock awards that are antidilutive as a result of unrecognized compensation cost. Such shares averaged 3.1 million, 2.5 million and 2.7 million for 2015, 2014 and 2013, respectively. For the year ended December 31... -

Page 186

...$19,800 19,473 19,994 21,255 Years Ended December 31, 2015 2014 2013 (Dollars in millions) Income tax expense was as follows: Federal Current ...Deferred ...State Current ...Deferred ...Foreign Current ...Deferred ...Total income tax expense ... $ 28 329 40 21 16 4 $438 18 305 26 (14) 3 - 338... -

Page 187

... charge, a favorable settlement with the Internal Revenue Service of $33 million, a $22 million reduction due to the reversal of an uncertain tax position and the tax effect of a $17 million unfavorable accounting adjustment for non-deductible life insurance costs. Also in 2013, the tax rate... -

Page 188

... federal alternative minimum tax, or AMT, credits. Our acquisitions of Qwest and SAVVIS, Inc. ("Savvis") caused "ownership changes" within the meaning of Section 382 of the Internal Revenue Code ("Section 382"). As a result, our ability to use these NOLs and AMT credits are subject to annual limits... -

Page 189

... relevant taxing authorities. In 2013, Qwest filed an amended 2009 federal income tax return primarily to report the carryforward impact of prior year settlements. The refund for the 2009 amended return filed in 2013 was received in 2014. In 2014, Qwest filed an amended federal income tax return for... -

Page 190

... MPLS, private line (including special access), Ethernet, high-speed Internet, colocation, managed hosting, cloud hosting and other ancillary services. Our legacy services offered to these customers primarily include switched access and local and long-distance voice services, including the sale of... -

Page 191

...• Strategic services, which include primarily high-speed Internet, MPLS (which is a data networking technology that can deliver the quality of service required to support real-time voice and video), private line (including special access), Ethernet, colocation, hosting (including cloud hosting and... -

Page 192

... hosting) and hosting area network revenue (4) Includes primarily VoIP, video and IT services revenue (5) Includes high-speed Internet and related services revenue (6) Includes video and Verizon wireless revenue (7) Includes local and long-distance voice revenue (8) Includes UNEs, public access... -

Page 193

... December 31, 2015, 2014 and 2013: Years Ended December 31, 2015 2014 2013 (Dollars in millions) Total segment income ...Other operating revenues ...Depreciation and amortization ...Impairment of goodwill ...Other unassigned operating expenses ...Other expenses, net ...Income tax expense ...Net... -

Page 194

... Financial Data (Unaudited) First Second Third Fourth Quarter Quarter Quarter Quarter Total (Dollars in millions, except per share amounts) 2015 Operating revenues ...Operating income ...Net income ...Basic earnings per common share ...Diluted earnings per common share ...2014 Operating revenues... -

Page 195

... petitioned the Federal Communications Commission to address these issues on an industry-wide basis. As both an interexchange carrier and a local exchange carrier, we both pay and assess significant amounts of the access charges in question. The outcome of these disputes and suits, as well as any... -

Page 196

... of long-term debt, including current maturities in our consolidated statements of cash flows. The tables below summarize our capital lease activity: Years Ended December 31, 2015 2014 2013 (Dollars in millions) Assets acquired through capital leases ...Depreciation expense ...Cash payments towards... -

Page 197

... also received sublease rental income for the years ended December 31, 2015, 2014 and 2013 of $12 million, $14 million and $16 million, respectively. At December 31, 2015, our future rental commitments for operating leases were as follows: Future Minimum Payments (Dollars in millions) 2016 ...2017... -

Page 198

... service. As a result of changes in market conditions and prevailing spectrum prices, we recorded an impairment charge of $14 million, which is included in other income, net in our consolidated statements of operations for the for the year ended December 31, 2014. The sale closed on November 3, 2014... -

Page 199

... Total Year Ended December 31, 2015 Decrease (Increase) in Net Income (Dollars in millions) Amortization of pension & postretirement plans Net actuarial loss ...Prior service cost ...Total before tax ...Income tax expense (benefit) ...Net of tax ... $161 24 185 (70) $115 B-91 See Note 7-Employee... -

Page 200

... 7-Employee Benefits See Note 7-Employee Benefits Income tax expense (19) Dividends Our Board of Directors declared the following dividends payable in 2015 and 2014: Date Declared Record Date Dividend Per Share Total Amount (in millions) Payment Date November 10, 2015 ...11/24/2015 August 25, 2015... -

Page 201

-

Page 202

... Drive Monroe, Louisiana 71203 800.833.1188 www.centurylink.com If you would like more complete information about us or a copy of our 2015 Annual Report on Form 10-K, please refer to the accompanying Proxy Statement (which forms part of this report) or to our website at www.centurylink.com, or call...