The Hartford 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

In the fourth quarter of 2005, the Company accrued an estimated $46 for regular assessments based on estimates of the deficits in each

account at the time. In the second quarter of 2006, the Florida legislature approved the use of $715 of state tax revenues to partially

offset the deficits in Citizens' High Risk, Commercial Lines and Personal Lines accounts. During the second quarter of 2006, Citizens'

management also finalized its estimate of the 2004 and 2005 hurricane losses that would be used in calculating the deficits in each

account. In the third quarter of 2006, the Board of Governors of Citizens approved a final assessment for the 2005 account year and the

Company received the assessment notice during the fourth quarter of 2006. The estimates of the deficits in the Personal Lines account

and Commercial Lines account were lower than previously anticipated by the Company. As a result of these changes in estimates,

during 2006, the Company reduced its accrual for Citizens’ assessments by $41, from $46 to $5. The reduction in the amount of the

estimated regular assessment also reduces the amount of surcharges that will be billed to policyholders to recoup the assessments in the

future.

Servicing of flood insurance

The Company does not provide residential flood insurance under its insurance policies. However, the Company acts as an administrator

for the Write Your Own flood program on behalf of the National Flood Insurance Program under FEMA, for which it earns a fee for

collecting premiums and processing claims. Under the program, the Company services both personal lines and commercial lines flood

insurance policies and does not assume any underwriting risk.

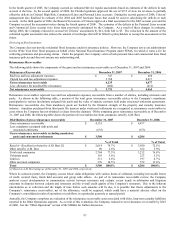

Reinsurance Recoverables

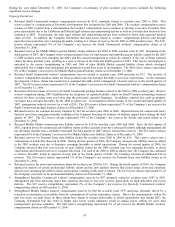

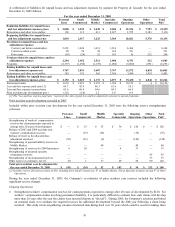

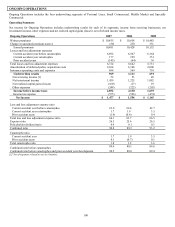

The following table shows the components of the gross and net reinsurance recoverable as of December 31, 2007 and 2006:

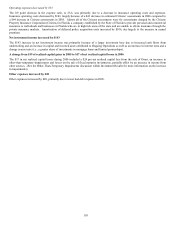

Reinsurance Recoverable December 31, 2007 December 31, 2006

Paid loss and loss adjustment expenses $ 347 $ 460

Unpaid loss and loss adjustment expenses 3,788 4,417

Gross reinsurance recoverable 4,135 4,877

Less: allowance for uncollectible reinsurance (404) (412)

Net reinsurance recoverable $ 3,731 $ 4,465

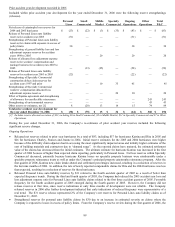

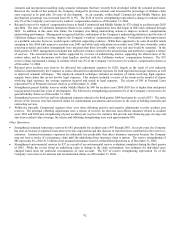

Reinsurance recoverables represent loss and loss adjustment expenses recoverable from a number of entities, including reinsurers and

pools. As shown in the following table, a portion of the total gross reinsurance recoverable relates to the Company’ s mandatory

participation in various involuntary assigned risk pools and the value of annuity contracts held under structured settlement agreements.

Reinsurance recoverables due from mandatory pools are backed by the financial strength of the property and casualty insurance

industry. Annuities purchased from third party life insurers under structured settlements are recognized as reinsurance recoverables in

cases where the Company has not obtained a release from the claimant. Of the remaining gross reinsurance recoverable as of December

31, 2007 and 2006, the following table shows the portion of recoverables due from companies rated by A.M. Best.

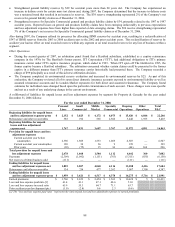

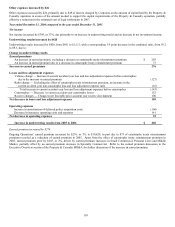

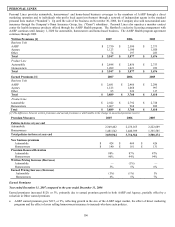

Distribution of gross reinsurance recoverable December 31, 2007 December 31, 2006

Gross reinsurance recoverable $ 4,135 $ 4,877

Less: mandatory (assigned risk) pools and

structured settlements (635)

(673)

Gross reinsurance recoverable excluding mandatory

pools and structured settlements $ 3,500

$

4,204

% of Total % of Total

Rated A- (Excellent) or better by A.M. Best [1] $ 2,614 74.7% $ 3,050 72.5%

Other rated by A.M. Best 90 2.6% 162 3.9%

Total rated companies 2,704 77.3% 3,212 76.4%

Voluntary pools 195 5.6% 223 5.3%

Captives 231 6.6% 197 4.7%

Other not rated companies 370 10.5% 572 13.6%

Total $ 3,500 100.0% $ 4,204 100.0%

[1] Based on A.M. Best ratings as of December 31, 2007 and 2006, respectively.

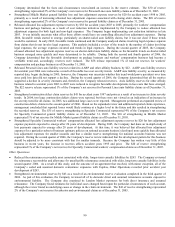

Where its contracts permit, the Company secures future claim obligations with various forms of collateral, including irrevocable letters

of credit, secured trusts, funds held accounts and group wide offsets. As part of its reinsurance recoverable review, the Company

analyzes recent developments in commutation activity between reinsurers and cedants, recent trends in arbitration and litigation

outcomes in disputes between cedants and reinsurers and the overall credit quality of the Company’ s reinsurers. Due to the inherent

uncertainties as to collection and the length of time before such amounts will be due, it is possible that future adjustments to the

Company’ s reinsurance recoverables, net of the allowance, could be required, which could have a material adverse effect on the

Company’s consolidated results of operations or cash flows in a particular quarterly or annual period.

Annually, the Company completes an evaluation of the reinsurance recoverable asset associated with older, long-term casualty liabilities

reported in the Other Operations segment. As a result of this evaluation, the Company reduced its net reinsurance recoverable by $243

in 2006. See the “Other Operations” section of the MD&A for further discussion.