The Hartford 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

Other-Than-Temporary Impairments

The Company has a security monitoring process overseen by a committee of investment and accounting professionals that, on a

quarterly basis, identifies securities that could potentially be other-than-temporarily impaired. When a security is deemed to be other-

than-temporarily impaired, its cost or amortized cost is written down to current market value and a realized loss is recorded in the

Company’ s consolidated statements of operations. For fixed maturities, the Company accretes the new cost basis to par or to the

estimated future value over the expected remaining life of the security by adjusting the security’ s yield. For further discussion regarding

the Company’s other-than-temporary impairment policy, see “Evaluation of Other-Than-Temporary Impairments on Available-for-Sale

Securities” included in the Critical Accounting Estimates section of the MD&A and Note 1 of Notes to Consolidated Financial

Statements.

The Company categorizes impairments as credit related and other. The Company characterizes an impairment as credit related if it has

current concerns regarding the issuers ability to pay future interest and principal amounts based upon the securities contractual terms or

the depression in the security value is primarily related to significant issuer specific or sector credit spread widening. Company

management uses average credit related impairment amounts, net of recoveries, within Life and Property & Casualty product pricing

assumptions. The other-than-temporary impairments recorded in Other are primarily related to securities that had declined in value

primarily due to changes in interest rate or general or modest spread widening and for which the Company was uncertain of its intent to

retain the investment for a period of time sufficient to allow recovery to cost or amortized cost.

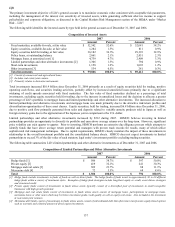

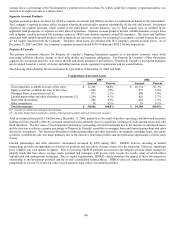

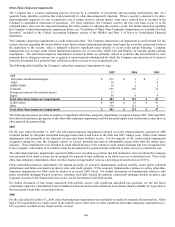

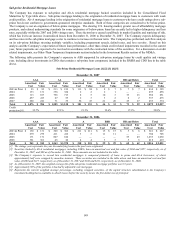

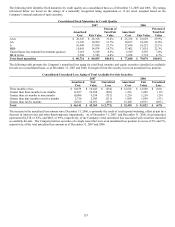

The following table identifies the Company’ s other-than-temporary impairments by type.

2007 2006 2005

ABS

Sub-prime residential mortgages $212 $ 1 $ 1

Other 19 7 4

CMBS/CMOs 18 2 1

Corporate 165 103 32

Foreign government/Government agency 13 — —

Equity 56 8 9

Total other-than-temporary impairments $483 $ 121 $47

Credit related $304 $ 10 $41

Other 179 111 6

Total other-than-temporary impairments $483 $ 121 $47

The following discussion provides an analysis of significant other-than-temporary impairments recognized during 2007, 2006 and 2005,

the related circumstances giving rise to the other-than-temporary impairments and the potential impact such circumstances may have on

other material investments held.

2007

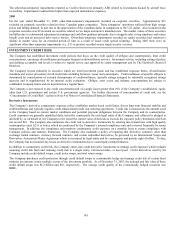

For the year ended December 31, 2007, the other-than-temporary impairments reported as Credit related primarily consisted of ABS

securities backed by sub-prime residential mortgage loans rated A and below in the 2006 and 2007 vintage years. Other credit related

impairments were primarily in the financial services and home builders sectors. For the majority of the credit related impairments

recognized during the year, the Company expects to recover principal and interest substantially greater than what the market price

indicates. These impairments were included in credit related because of the extensive credit spread widening and were recognized due

to the Company’ s uncertainty of its intent to retain the investments for a period of time sufficient to allow recovery to amortized cost.

The other-than-temporary impairments reported in Other were recorded on securities that had declined in value for which the Company

was uncertain of its intent to retain the investments for a period of time sufficient to for allow recovery to amortized cost. Prior to the

other-than-temporary impairments, these securities had an average market value as a percentage of amortized cost of 83%.

Future other-than-temporary impairments will depend primarily on economic fundamentals, political stability, issuer and/or collateral

performance and future movements in interest rates and credit spreads. If the economic fundamentals continue to soften, other-than-

temporary impairments for 2008 could be similar to or exceed 2007 levels. For further discussions on fundamentals related to sub-

prime residential mortgage-backed securities, consumer receivable backed investments, commercial mortgage-backed securities, and

corporate securities in the financial services sector, see the Investment Credit Risk section.

For further discussion of risk factors associated with portfolio sectors with significant unrealized loss positions, see the risk factor

commentary under the Consolidated Total Available-for-Sale Securities with Unrealized Loss Greater than Six Months by Type table in

the Investment Credit Risk section that follows.

2006

For the year ended December 31, 2006, other-than-temporary impairments were primarily recorded on corporate fixed maturities. Other

than a $16 impairment on a single issuer in the utilities sector, there were no other significant other-than-temporary impairments (i.e.,

$15 or greater) recorded on any single security or issuer.