The Hartford 2007 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

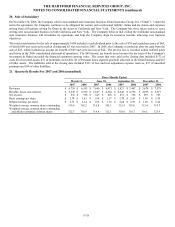

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-68

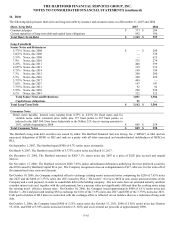

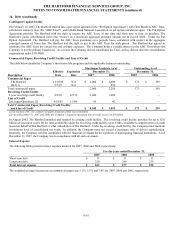

14. Debt (continued)

Consumer Notes

Institutional Solutions Group began issuing Consumer Notes through its Retail Investor Notes Program in September 2006. A

Consumer Note is an investment product distributed through broker-dealers directly to retail investors as medium-term, publicly traded

fixed or floating rate, or a combination of fixed and floating rate, notes. In addition, discount notes, amortizing notes and indexed notes

may also be offered and issued. Consumer Notes are part of the Company’ s spread-based business and proceeds are used to purchase

investment products, primarily fixed rate bonds. Proceeds are not used for general operating purposes. Consumer Notes are offered

weekly with maturities up to 30 years and varying interest rates and may include a call provision. Certain Consumer Notes may be

redeemed by the holder in the event of death. Redemptions are subject to certain limitations, including calendar year aggregate and

individual limits equal to the greater of $1 or 1% of the aggregate principal amount of the notes and $250 thousand per individual,

respectively. Derivative instruments will be utilized to hedge the Company’ s exposure to interest rate risk in accordance with

Company policy.

As of December 31, 2007 and 2006, $809 and $258 of consumer notes had been issued. These notes have interest rates ranging from

4.75% to 6.25% for fixed notes and for variable notes, either consumer price index plus 157 basis points to 267 basis points, or indexed

to the S&P 500, Dow Jones Industrials or the Nikkei 225. The aggregate maturities of consumer notes are as follows: $222 in 2008,

$494 in 2009, $34 in 2010, $19 in 2011 and $40 thereafter. For 2007 and 2006, interest credited to holders of Consumer Notes was $11

and $2, respectively.

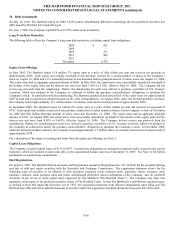

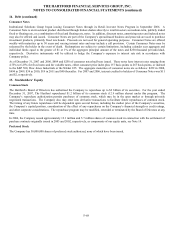

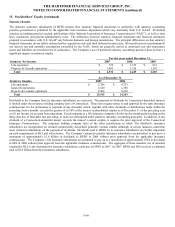

15. Stockholders’ Equity

Common Stock

The Hartford’ s Board of Directors has authorized the Company to repurchase up to $2 billion of its securities. For the year ended

December 31, 2007, The Hartford repurchased $1.2 billion of its common stock (12.9 million shares) under this program. The

Company’s repurchase authorization permits purchases of common stock, which may be in the open market or through privately

negotiated transactions. The Company also may enter into derivative transactions to facilitate future repurchases of common stock.

The timing of any future repurchases will be dependent upon several factors, including the market price of the Company’ s securities,

the Company’ s capital position, consideration of the effect of any repurchases on the Company’ s financial strength or credit ratings,

and other corporate considerations. The repurchase program may be modified, extended or terminated by the Board of Directors at any

time.

In 2006, the Company issued approximately 12.1 million and 5.7 million shares of common stock in connection with the settlement of

purchase contracts originally issued in 2003 and 2002, respectively, as components of our equity units, see Note 14.

Preferred Stock

The Company has 50,000,000 shares of preferred stock authorized, none of which have been issued.