The Hartford 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

(Dollar amounts in millions, except for per share data, unless otherwise stated)

Management’ s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) addresses the financial condition

of The Hartford Financial Services Group, Inc. and its subsidiaries (collectively, “The Hartford” or the “Company”) as of December 31,

2007, compared with December 31, 2006, and its results of operations for each of the three years in the period ended December 31,

2007. This discussion should be read in conjunction with the Consolidated Financial Statements and related Notes beginning on page F-

1. Certain reclassifications have been made to prior year financial information to conform to the current year presentation.

Certain of the statements contained herein are forward-looking statements. These forward-looking statements are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and include estimates and assumptions related to

economic, competitive and legislative developments. These forward-looking statements are subject to change and uncertainty which

are, in many instances, beyond the Company’ s control and have been made based upon management’s expectations and beliefs

concerning future developments and their potential effect upon the Company. There can be no assurance that future developments will

be in accordance with management’ s expectations or that the effect of future developments on The Hartford will be those anticipated by

management. Actual results could differ materially from those expected by the Company, depending on the outcome of various factors,

including, but not limited to, those set forth in Part I, Item 1A, Risk Factors. These factors include: the difficulty in predicting the

Company’ s potential exposure for asbestos and environmental claims; the possible occurrence of terrorist attacks; the response of

reinsurance companies under reinsurance contracts and the availability, pricing and adequacy of reinsurance to protect the Company

against losses; changes in financial and capital markets, including changes in interest rates, credit spreads, equity prices and foreign

exchange rates; the inability to effectively mitigate the impact of equity market volatility on the Company’ s financial position and

results of operations arising from obligations under annuity product guarantees; the possibility of unfavorable loss development; the

incidence and severity of catastrophes, both natural and man-made; stronger than anticipated competitive activity; unfavorable judicial

or legislative developments; the potential effect of domestic and foreign regulatory developments, including those which could increase

the Company’ s business costs and required capital levels; the possibility of general economic and business conditions that are less

favorable than anticipated; the Company’ s ability to distribute its products through distribution channels, both current and future; the

uncertain effects of emerging claim and coverage issues; a downgrade in the Company’ s financial strength or credit ratings; the ability

of the Company’ s subsidiaries to pay dividends to the Company; the Company’ s ability to adequately price its property and casualty

policies; the ability to recover the Company’ s systems and information in the event of a disaster or other unanticipated event; potential

for difficulties arising from outsourcing relationships; potential changes in Federal or State tax laws, including changes impacting the

availability of the separate account dividend received deduction; losses due to defaults by others; the Company’s ability to protect its

intellectual property and defend against claims of infringement; and other factors described in such forward-looking statements.

INDEX

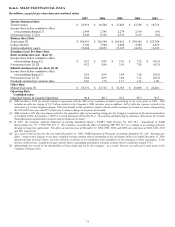

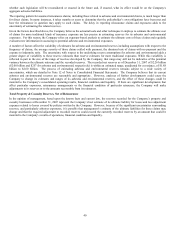

Overview 32 Total Property & Casualty 99

Critical Accounting Estimates 33 Ongoing Operations 100

Consolidated Results of Operations 48 Personal Lines 106

Life 54 Small Commercial 113

Retail 63 Middle Market 118

Retirement Plans 65 Specialty Commercial 123

Institutional 67 Other Operations (Including Asbestos and

Individual Life 69 Environmental Claims) 128

Group Benefits 71 Investments 136

International 73 Investment Credit Risk 145

Other 75 Capital Markets Risk Management 155

Property & Casualty 76 Capital Resources and Liquidity 165

Impact of New Accounting Standards 171

OVERVIEW

The Hartford is a diversified insurance and financial services company with operations dating back to 1810. The Company is

headquartered in Connecticut and is organized into two major operations: Life and Property & Casualty, each containing reporting

segments. Within the Life and Property & Casualty operations, The Hartford conducts business principally in eleven reporting

segments. Corporate primarily includes the Company’ s debt financing and related interest expense, as well as other capital raising

activities and purchase accounting adjustments.

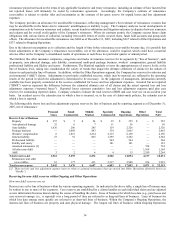

Life is organized into six reporting segments: Retail Products Group (“Retail”), Retirement Plans, Institutional Solutions Group

(“Institutional”), Individual Life, Group Benefits and International. Through Life the Company provides retail and institutional

investment products such as variable and fixed annuities, mutual funds, private placement life insurance and retirement plan services,

individual life insurance products including variable universal life, universal life, interest sensitive whole life and term life; and group

benefit products, such as group life and group disability insurance. In 2007, Life changed its reporting for realized gains and losses, as