The Hartford 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

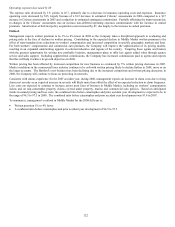

SPECIALTY COMMERCIAL

Specialty Commercial offers a variety of customized insurance products and risk management services. The segment provides standard

commercial insurance products including workers’ compensation, automobile and liability coverages to large-sized companies.

Specialty Commercial also provides professional liability, fidelity and surety, specialty casualty and livestock coverages, as well as core

property and excess and surplus lines coverages not normally written by standard lines insurers. Specialty Commercial provides other

insurance products and services primarily to captive insurance companies, pools and self-insurance groups. In addition, Specialty

Commercial provides third-party administrator services for claims administration, integrated benefits and loss control through Specialty

Risk Services.

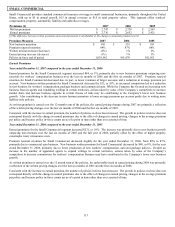

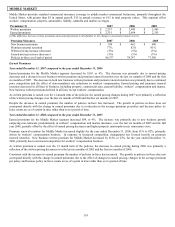

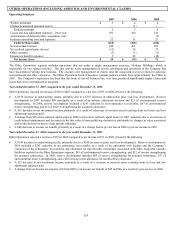

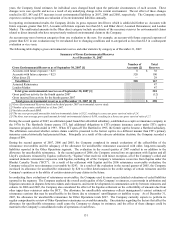

Written Premiums [1] 2007 2006 2005

Property $ 180 $ 212 $ 211

Casualty 534 582 826

Professional liability, fidelity and surety 689 697 613

Other 81 117 167

Total $ 1,484 $ 1,608 $ 1,817

Earned Premiums [1]

Property $ 202 $ 213 $ 245

Casualty 543 579 796

Professional liability, fidelity and surety 685 650 555

Other 85 120 170

Total $ 1,515 $ 1,562 $ 1,766

[1] The difference between written premiums and earned premiums is attributable to the change in unearned premium reserve.

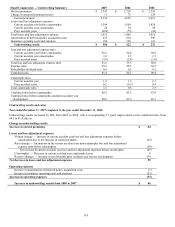

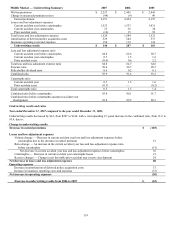

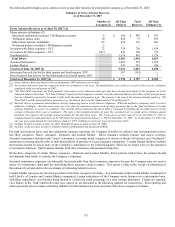

Earned Premiums

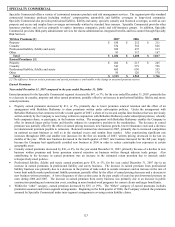

Year ended December 31, 2007 compared to the year ended December 31, 2006

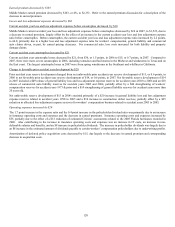

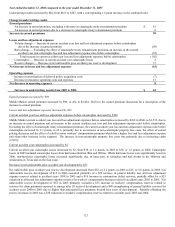

Earned premiums for the Specialty Commercial segment decreased by $47, or 3%, for the year ended December 31, 2007, primarily due

to a decrease in casualty, property and other earned premiums, partially offset by an increase in professional liability, fidelity and surety

earned premiums.

• Property earned premiums decreased by $11, or 5%, primarily due to lower premium renewal retention and the effect of an

arrangement with Berkshire Hathaway to share premiums written under subscription policies. Under the arrangement with

Berkshire Hathaway that commenced in the second quarter of 2007, a share of excess and surplus lines business that was previously

written entirely by the Company is now being written in conjunction with Berkshire Hathaway under subscription policies, whereby

both companies share, or participate, in the business written. The arrangement with Berkshire Hathaway enables the Company to

offer its insureds larger policy limits and thereby enhance its competitive position in the marketplace. The decrease in earned

premium was partially offset by the effect of earned pricing increases, new business growth, lower reinsurance costs and a decrease

in reinstatement premium payable to reinsurers. Renewal retention has decreased in 2007, primarily due to increased competition

on national account business as well as in the standard excess and surplus lines market. After experiencing significant rate

increases throughout 2006 and smaller rate increases for the first six months of 2007, written pricing decreased in the last six

months of the year. While new business decreased in the fourth quarter of 2007, new business increased for the full year, largely

because the Company had significantly curtailed new business in 2006 in order to reduce catastrophe loss exposures in certain

geographic areas.

• Casualty earned premiums decreased by $36, or 6%, for the year ended December 31, 2007, primarily because of a decline in new

business written premium and lower premium renewal retention on business written through industry trade groups. Also

contributing to the decrease in earned premiums was an increase in the estimated return premium due to insureds under

retrospectively-rated policies.

• Professional liability, fidelity and surety earned premium grew $35, or 5%, for the year ended December 31, 2007 due to an

increase in earned premiums in professional liability and surety business. The increase in earned premium from professional

liability business was primarily due to a decrease in the portion of risks ceded to outside reinsurers and an increase in the mix of

lower limit middle market professional liability premium, partially offset by the effect of earned pricing decreases and a decrease in

new business written premium. A lower frequency of class action cases in the past couple of years has put downward pressure on

rates during 2006 and 2007. The increase in earned premium from surety business was primarily due to an increase in public

construction spending and construction costs, resulting in more bonded work programs for current clients and larger bond limits.

• Within the “other” category, earned premium decreased by $35, or 29%. The “Other” category of earned premiums includes

premiums assumed under inter-segment arrangements. Beginning in the third quarter of 2006, the Company reduced the premiums

assumed by Specialty Commercial under inter-segment arrangements covering certain liability claims.