The Hartford 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

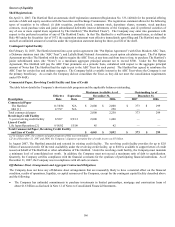

CAPITAL RESOURCES AND LIQUIDITY

Capital resources and liquidity represent the overall financial strength of The Hartford and its ability to generate strong cash flows from

each of the business segments, borrow funds at competitive rates and raise new capital to meet operating and growth needs.

Liquidity Requirements

The liquidity requirements of The Hartford have been and will continue to be met by funds from operations as well as the issuance of

commercial paper, common stock, debt or other capital securities and borrowings from its credit facilities. Current and expected

patterns of claim frequency and severity may change from period to period but continue to be within historical norms and, therefore, the

Company's current liquidity position is considered to be sufficient to meet anticipated demands. However, if an unanticipated demand

were placed on the Company it is likely that the Company would either sell certain of its investments to fund claims which could result

in larger than usual realized capital gains and losses or the Company would enter the capital markets to raise further funds to provide the

requisite liquidity. For a discussion and tabular presentation of the Company's current contractual obligations by period including those

related to its Life and Property & Casualty insurance refer to the Off-Balance Sheet Arrangements and Aggregate Contractual

Obligations section below.

The Hartford endeavors to maintain a capital structure that provides financial and operational flexibility to its insurance subsidiaries,

ratings that support its competitive position in the financial services marketplace (see the Ratings section below for further discussion),

and strong shareholder returns. As a result, the Company may from time to time raise capital from the issuance of stock, debt or other

capital securities. The issuance of common stock, debt or other capital securities could result in the dilution of shareholder interests or

reduced net income due to additional interest expense.

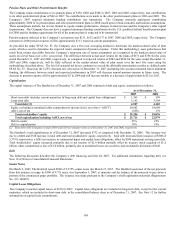

The Hartford’ s Board of Directors has authorized the Company to repurchase up to $2 billion of its securities. For the year ended

December 31, 2007, The Hartford repurchased $1.2 billion of its common stock (12.9 million shares) under this program. The

Company’s repurchase authorization permits purchases of common stock, which may be in the open market or through privately

negotiated transactions. The Company also may enter into derivative transactions to facilitate future repurchases of common stock. The

timing of any future repurchases will be dependent upon several factors, including the market price of the Company’ s securities, the

Company’ s capital position, consideration of the effect of any repurchases on the Company’ s financial strength or credit ratings, and

other corporate considerations. The repurchase program may be modified, extended or terminated by the Board of Directors at any time.

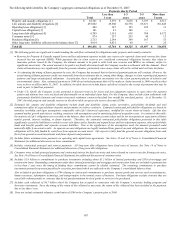

HFSG and HLI are holding companies which rely upon operating cash flow in the form of dividends from their subsidiaries, which

enable them to service debt, pay dividends, and pay certain business expenses. Dividends to the Company from its insurance

subsidiaries are restricted. The payment of dividends by Connecticut-domiciled insurers is limited under the insurance holding company

laws of Connecticut. These laws require notice to and approval by the state insurance commissioner for the declaration or payment of

any dividend, which, together with other dividends or distributions made within the preceding twelve months, exceeds the greater of (i)

10% of the insurer’s policyholder surplus as of December 31 of the preceding year or (ii) net income (or net gain from operations, if

such company is a life insurance company) for the twelve-month period ending on the thirty-first day of December last preceding, in

each case determined under statutory insurance accounting principles. In addition, if any dividend of a Connecticut-domiciled insurer

exceeds the insurer’ s earned surplus, it requires the prior approval of the Connecticut Insurance Commissioner. The insurance holding

company laws of the other jurisdictions in which The Hartford’ s insurance subsidiaries are incorporated (or deemed commercially

domiciled) generally contain similar (although in certain instances somewhat more restrictive) limitations on the payment of dividends.

Dividends paid to HFSG by its insurance subsidiaries are further dependent on cash requirements of HLI and other factors. The

Company’s property-casualty insurance subsidiaries are permitted to pay up to a maximum of approximately $1.6 billion in dividends to

HFSG in 2008 without prior approval from the applicable insurance commissioner. The Company’ s life insurance subsidiaries are

permitted to pay up to a maximum of approximately $784 in dividends to HLI in 2008 without prior approval from the applicable

insurance commissioner. The aggregate of these amounts, net of amounts required by HLI, is the maximum the insurance subsidiaries

could pay to HFSG in 2008. In 2007, HFSG and HLI received a combined total of $2.0 billion from their insurance subsidiaries.

The principal sources of operating funds are premium, fees and investment income, while investing cash flows originate from maturities

and sales of invested assets. The primary uses of funds are to pay claims, policy benefits, operating expenses and commissions and to

purchase new investments. In addition, The Hartford has a policy of carrying a significant short-term investment position and does not

anticipate selling intermediate- and long-term fixed maturity investments to meet any liquidity needs. (For a discussion of the

Company’ s investment objectives and strategies, see the Investments and Capital Markets Risk Management sections.)