The Hartford 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

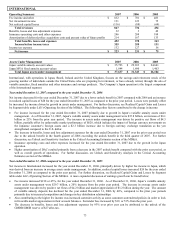

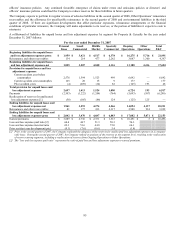

• Middle Market earned premium decreased by $103, or 4%, driven by decreases in all lines, including commercial auto, general

liability, workers’ compensation and property. Earned premium decreases were driven by declines in earned pricing and premium

renewal retention in all lines and a decline in new business premiums in all lines except workers’ compensation.

• Specialty Commercial earned premium decreased by $47, or 3%, primarily driven by a decrease in casualty and property and a

decrease in earned premiums assumed under inter-segment arrangements, partially offset by an increase in professional liability,

fidelity and surety.

Year ended December 31, 2006 compared to the year ended December 31, 2005

• Total Property & Casualty earned premiums grew $277, or 3%, due primarily to growth in Personal Lines, Small Commercial and

Middle Market, partially offset by a decrease in Specialty Commercial. Contributing to the growth in earned premium was a $73

reduction of earned premium in 2005 due to catastrophe treaty reinstatement premium payable to reinsurers as a result of losses

from hurricanes Katrina, Rita and Wilma, including $31 in Personal Lines, $7 in Small Commercial, $8 in Middle Market and $27

in Specialty Commercial. Before catastrophe treaty reinstatement premium, Ongoing Operations’ earned premium grew $203, or

2%, for 2006.

• For the year ended December 31, 2006, earned premiums grew $231, or 10%, in Small Commercial, $150, or 4%, in Personal Lines

and $99, or 4%, in Middle Market. Apart from the effect of catastrophe treaty reinstatement premium in 2005, the growth was

primarily driven by new business premium outpacing non-renewals over the last six months of 2005 and the full year of 2006 and

the effect of earned pricing increases in homeowners, partially offset by the effect of higher property catastrophe treaty reinsurance

costs and earned pricing decreases in Middle Market.

• Specialty Commercial earned premiums decreased by $204, or 12%, primarily driven by a decrease in casualty, property and other

earned premiums, partially offset by an increase in professional liability, fidelity and surety. Casualty earned premiums decreased

by $217, primarily because of the non-renewal of a single captive insurance program. The decrease in property earned premium

was primarily due to a decline in new business, an increase in catastrophe treaty reinsurance costs and a strategic decision not to

renew certain accounts with properties in catastrophe-prone areas.

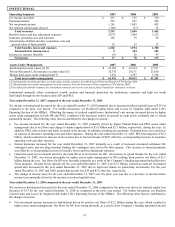

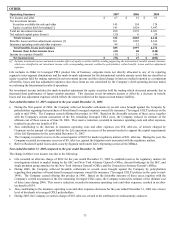

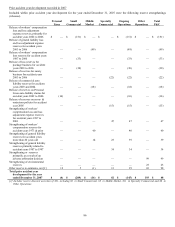

Net income

2007 2006 2005

Underwriting results $ 759 $745 $ 465

Net servicing and other income [1] 52 53 49

Net investment income 1,687 1,486 1,365

Other expenses (249) (223) (203)

Net realized capital gains (losses) (172) 9 44

Income before income taxes 2,077 2,070 1,720

Income tax expense (570) (551) (484)

Net income $ 1,507 $1,519 $ 1,236

[1] Net of expenses related to service business.

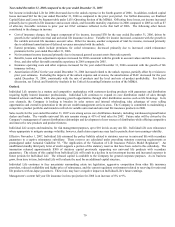

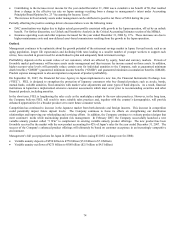

Year ended December 31, 2007 compared to the year ended December 31, 2006

Net income decreased by $12, or 1%, for the year ended December 31, 2007, driven by the following changes:

Income

before

income tax

Net

income

2006 $ 2,070 $ 1,519

Excluding Omni, a decrease in Ongoing Operations’ current accident year underwriting results before

catastrophes

(267) (174)

A change to net realized capital losses (181) (158)

An increase in net investment income 201 139

A decrease in Other Operations’ net unfavorable prior accident year reserve development 167 110

An increase in net favorable prior accident year reserve development in Ongoing Operations 81 52

An increase in other expenses (26) (17)

Benefit from a tax true-up — 20

An increase in current accident year underwriting results due to the sale of the Omni non-standard auto

business, which generated a current accident year underwriting loss before catastrophes in 2006

22

14

A decrease in current accident year catastrophe losses 22 14

Other changes, net (12) (12)

Net change in income for 2007 7 (12)

2007 $ 2,077 $ 1,507