The Hartford 2007 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-14

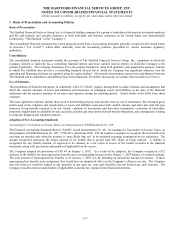

1. Basis of Presentation and Accounting Policies (continued)

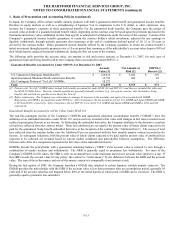

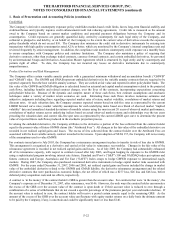

The following table provides the account value, SFAS 133 fair value and GRB at December 31, 2007, for each type of guaranteed

living benefit liability sold by the Company that is accounted for under SFAS 133:

Account

Value [1]

SFAS 133

Fair Value[2]

of the

Liability (Asset)

Guaranteed

Remaining

Balance

U.S. Guaranteed Minimum Withdrawal Benefits $ 46,088 $ 553 $ 34,622

Non-Life Contingent Portion of “for Life”

Guaranteed Minimum Withdrawal Benefits

U.S. Products 10,272 154 10,230

International Products 1,038 8 1,048

Total 11,310 162 11,278

International Guaranteed Minimum

Accumulation Benefits

2,734

(2)

2,768

Total $ 60,132 $ 713 $ 48,668

[1] “For life” GMWB policies, and their related account values, include both benefits accounted for under SFAS 133 and SOP 03-1 and thus are

included in this SFAS 133 table and the SOP 03-1 table above. However, benefits payable are generally mutually exclusive (e.g., for a given

contract, only the death or living benefits, but not both are payable at one time).

[2] The magnitude of the SFAS 133 fair value, at December 31, 2007, was highly dependent upon the size of the block of business for guaranteed

living benefits that are required to be fair valued, and the market conditions at the date of valuation, in particular high implied volatilities and

low risk-free interest rates. If implied volatilities were lower and risk-free interest rates were higher at December 31, 2007, the SFAS 133 fair

value would have been lower and vice versa.

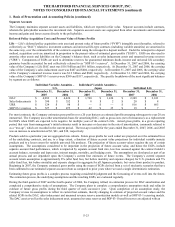

Derivatives That Hedge Capital Markets Risk for Guaranteed Minimum Benefit Accounted for as Derivatives

Changes in capital markets or policyholder behavior may increase or decrease the Company’ s exposure to benefits under the

guarantees. The Company uses derivative transactions, including GMWB reinsurance (described below) which meets the definition of

a derivative under SFAS 133 and customized derivative transactions, to mitigate some of that exposure. Derivatives are recorded at fair

value with changes in fair value recorded in net realized capital gains (losses) in net income.

GMWB Reinsurance

For all U.S. GMWB contracts in effect through July 2003, the Company entered into a reinsurance arrangement to offset its exposure to

the GMWB for the remaining lives of those contracts. Substantially all of the Company’ s reinsurance capacity was utilized as of the

third quarter of 2003. Substantially all U.S. GMWB riders sold since July 2003, are not covered by reinsurance.

Customized Derivatives

In June and July of 2007, the Company entered into two customized swap contracts to hedge certain risk components for the remaining

term of certain blocks of non-reinsured GMWB riders. These customized derivative contracts provide protection from capital markets

risks based on policyholder behavior assumptions as specified by the Company at the inception of the derivative transactions. Due to

the significance of the non-observable inputs associated with pricing these derivatives, the initial difference between the transaction

price and modeled value was deferred in accordance with EITF No. 02-3 “Issues Involved in Accounting for Derivative Contracts Held

for Trading Purposes and Contracts Involved in Energy Trading and Risk Management Activities” (“EITF 02-3”) and included in other

assets in the Consolidated Balance Sheets.

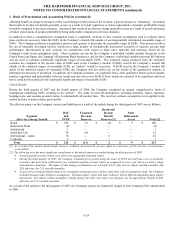

Other Derivative Instruments

The Company uses other hedging instruments to hedge its unreinsured GMWB exposure. These instruments include interest rate

futures and swaps, variance swaps, S&P 500 and NASDAQ index put options and futures contracts. The Company also uses EAFE

Index swaps to hedge GMWB exposure to international equity markets.