The Hartford 2007 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-49

6. Reinsurance (continued)

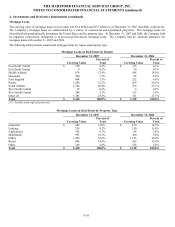

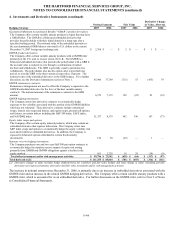

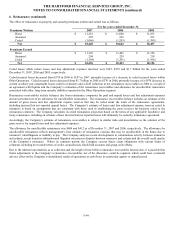

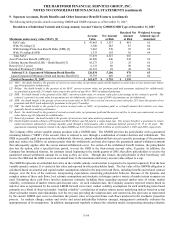

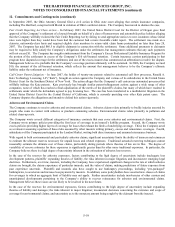

The effect of reinsurance on property and casualty premiums written and earned was as follows:

For the years ended December 31,

Premiums Written 2007 2006 2005

Direct $11,281 $11,600 $ 11,653

Assumed 205 265 233

Ceded (1,046) (1,203) (1,399)

Net $10,440 $10,662 $ 10,487

Premiums Earned

Direct $11,396 $11,465 $ 11,356

Assumed 204 259 218

Ceded (1,104) (1,291) (1,418)

Net $10,496 $10,433 $ 10,156

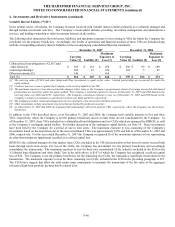

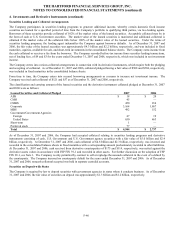

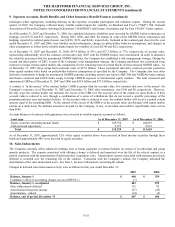

Ceded losses which reduce losses and loss adjustment expenses incurred, were $187, $370 and $1.7 billion for the years ended

December 31, 2007, 2006 and 2005, respectively.

Ceded incurred losses decreased from $370 in 2006 to $187 in 2007, primarily because of a decrease in ceded incurred losses within

Other Operations. Ceded incurred losses decreased from $1.7 billion in 2005 to $370 in 2006, primarily because of a $970 decrease in

current accident year catastrophe losses ceded to reinsurers and a $243 reduction in net reinsurance recoverables in 2006 as a result of

an agreement with Equitas and the Company’ s evaluation of the reinsurance recoverables and allowance for uncollectible reinsurance

associated with older, long-term casualty liabilities reported in the Other Operations segment.

Reinsurance recoverables include balances due from reinsurance companies for paid and unpaid losses and loss adjustment expenses

and are presented net of an allowance for uncollectible reinsurance. The reinsurance recoverables balance includes an estimate of the

amount of gross losses and loss adjustment expense reserves that may be ceded under the terms of the reinsurance agreements,

including incurred but not reported unpaid losses. The Company’ s estimate of losses and loss adjustment expense reserves ceded to

reinsurers is based on assumptions that are consistent with those used in establishing the gross reserves for business ceded to the

reinsurance contracts. The Company calculates its ceded reinsurance projection based on the terms of any applicable facultative and

treaty reinsurance, including an estimate of how incurred but not reported losses will ultimately be ceded by reinsurance agreement.

Accordingly, the Company’ s estimate of reinsurance recoverables is subject to similar risks and uncertainties as the estimate of the

gross reserve for unpaid losses and loss adjustment expenses.

The allowance for uncollectible reinsurance was $404 and $412 as of December 31, 2007 and 2006, respectively. The allowance for

uncollectible reinsurance reflects management’s best estimate of reinsurance cessions that may be uncollectible in the future due to

reinsurers’ unwillingness or inability to pay. The Company analyzes recent developments in commutation activity between reinsurers

and cedants, recent trends in arbitration and litigation outcomes in disputes between reinsurers and cedants and the overall credit quality

of the Company’s reinsurers. Where its contracts permit, the Company secures future claim obligations with various forms of

collateral, including irrevocable letters of credit, secured trusts, funds held accounts and group-wide offsets.

Due to the inherent uncertainties as to collection and the length of time before reinsurance recoverables become due, it is possible that

future adjustments to the Company’ s reinsurance recoverables, net of the allowance, could be required, which could have a material

adverse effect on the Company’s consolidated results of operations or cash flows in a particular quarter or annual period.