The Hartford 2007 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-44

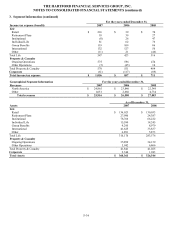

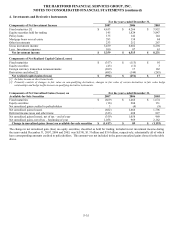

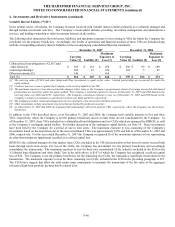

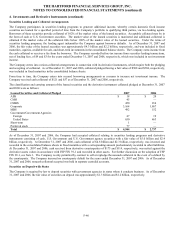

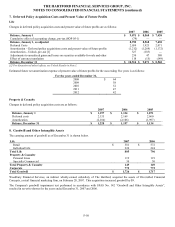

4. Investments and Derivative Instruments (continued)

Notional Amount

Fair Value

Derivative Change

in Value, After-tax

Hedging Strategy 2007 2006 2007 2006 2007 2006

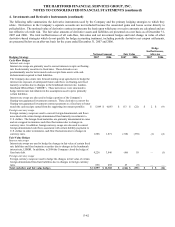

Guaranteed Minimum Accumulation Benefit (“GMAB”) product derivatives

The Company offers certain variable annuity products in Japan that may have

a GMAB rider. The GMAB is a bifurcated embedded derivative that

provides the policyholder with their initial deposit in a lump sum after a

specified waiting period. The notional value of the embedded derivative is

the yen denominated GRB balance converted to U.S. dollars at the current

December 31, 2007 foreign spot exchange rate.

$

2,768

$

—

$

2

$

—

$

1

$

—

GMWB product derivatives

The Company offers certain variable annuity products with a GMWB rider

primarily in the U.S. and, to a lesser extent, the U.K. The GMWB is a

bifurcated embedded derivative that provides the policyholder with a GRB if

the account value is reduced to zero through a combination of market

declines and withdrawals. The GRB is generally equal to premiums less

withdrawals. The policyholder also has the option, after a specified time

period, to reset the GRB to the then-current account value, if greater. The

notional value of the embedded derivative is the GRB balance. For a further

discussion, see the Derivative Instruments section of Note 1.

45,900

37,769

(715)

53

(435)

79

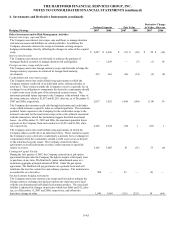

GMWB reinsurance contracts

Reinsurance arrangements are used to offset the Company’ s exposure to the

GMWB embedded derivative for the lives of the host variable annuity

contracts. The notional amount of the reinsurance contracts is the GRB

amount.

6,579

7,172

128

(22)

83

(19)

GMWB hedging instruments

The Company enters into derivative contracts to economically hedge

exposure to the volatility associated with the portion of the GMWB liabilities

which are not reinsured. These derivative contracts include customized

swaps, interest rate swaps and futures, and equity swaps, put and call options,

and futures, on certain indices including the S&P 500 index, EAFE index,

and NASDAQ index.

21,357

8,379

642

346

167

(77)

Equity index swaps and options

The Company offers certain equity indexed products, which may contain an

embedded derivative that requires bifurcation. The Company enters into

S&P index swaps and options to economically hedge the equity volatility risk

associated with these embedded derivatives. In addition, the Company is

exposed to bifurcated options embedded in certain fixed maturity

investments.

154

30

(22)

—

1

—

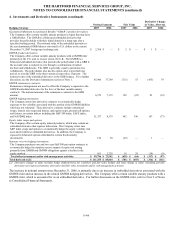

Statutory reserve hedging instruments

The Company purchases one and two year S&P 500 put option contracts to

economically hedge the statutory reserve impact of equity risk arising

primarily from GMDB and GMWB obligations against a decline in the

equity markets.

661

2,220

18

29

(14)

(9)

Total other investment and/or risk management activities $ 99,796 $ 73,542 $ (455) $ (64) $ (317) $ (97)

Total derivatives [1] $ 111,355 $ 85,844 $ (701) $ (455) $ (316) $ (111)

[1] Derivative change in value includes hedge ineffectiveness for cash-flow and fair-value hedges and total change in value, including periodic

derivative net coupon settlements, derivatives held for other investment and/or risk management activities.

The increase in notional amount since December 31, 2006, is primarily due to an increase in embedded derivatives associated with the

GMWB rider and an increase in the related GMWB hedging derivatives. The Company offers certain variable annuity products with a

GMWB rider, which is accounted for as an embedded derivative. For further discussion on the GMWB rider, refer to Note 9 of Notes

to Consolidated Financial Statements.