The Hartford 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 52

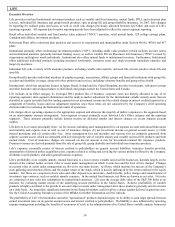

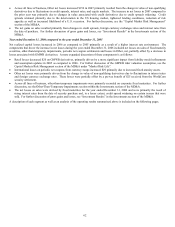

Management is committed to selling competitively priced Group Benefits products that meet the Company’ s internal rate of return

guidelines and as a result, sales may fluctuate based on the competitive pricing environment in the marketplace. In 2007, the Company

generated premium growth due to the increased scale of the group life and disability operations. However, fully insured on-going sales,

excluding buyouts declined primarily due to fewer large national account sales, and the small case competitive environment remained

intense. In addition, there was an anticipated reduction in association life sales from an unusually high prior year period. The Company

also completed a renewal rights transaction associated with its medical stop loss business during the second quarter of 2007. The

Company anticipates relatively stable loss ratios and expense ratios based on underlying trends in the in-force business and disciplined

new business and renewal underwriting.

Despite the current market conditions, including rising medical costs, the changing regulatory environment and cost containment

pressure on employers, the Company continues to leverage its strength in claim practices risk management, service and distribution,

enabling the Company to capitalize on market opportunities. Additionally, employees continue to look to the workplace for a broader

and ever expanding array of insurance products. As employers design benefit strategies to attract and retain employees, while

attempting to control their benefit costs, management believes that the need for the Company’ s products will continue to expand. This

combined with the significant number of employees who currently do not have coverage or adequate levels of coverage, creates

opportunities for our products and services.

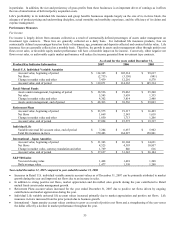

Management continues to be optimistic about growth potential of the retirement savings market in Japan. Several trends such as an

aging population, longer life expectancies and declining birth rate leading to a smaller number of younger workers to support each

retiree have resulted in greater need for an individual to plan and adequately fund retirement savings.

Competition has continued to increase in the Japanese market as the most significant competition the result of the strengthening of

domestic competitors. This competition has resulted in changes in key distribution relationships that have negatively impacted current

year deposits and could potentially impact future deposits. Deposits in 2007 were also negatively impacted by new financial regulations

and laws that affect distribution. The Company continues to focus its efforts on strengthening our distribution relationships and

improving our wholesaling and servicing efforts. In addition, the Company continues to evaluate product designs that meet customers’

needs while maintaining prudent risk management. In February 2007, Life introduced a new variable annuity product called “3 Win” to

complement its existing variable annuity product offerings in Japan. The new product has been favorably received by the market with

the new product accounting for 42% of Japan’ s sales for the year ended December 31, 2007. The success of the Company’ s enhanced

product offerings, including those to be launched in 2008, will ultimately be based on customer acceptance in an increasingly

competitive environment.

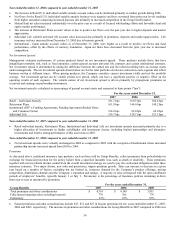

Property & Casualty

In 2008, management expects written premium growth to be flat to 3% higher, primarily driven by an increase in Personal Lines and

Small Commercial, partially offset by an expected decline in Middle Market.

The Personal Lines segment is expected to deliver written premium growth of 2% to 5% in 2008, including growth from both AARP

and Agency. The Company expects personal auto written premium to increase 3% to 6% and homeowners’ written premium to be flat

to 3% higher. Management expects that growth from Agency business will be largely driven by appointing more agents and increasing

the flow of new business from recently appointed agents and growth in AARP business will be largely driven by continued direct

marketing to AARP members and an expansion of underwriting appetite through the continued roll-out of the “Next Gen Auto” product.

Within Small Commercial, management expects written premium in 2008 to be flat to 3% higher, primarily driven by increasing the

flow of new business from agents, selectively expanding its underwriting appetite, refining pricing models and upgrading product

features. Management expects that 2008 written premium for Middle Market will be 1% to 4% lower as the Company takes a

disciplined approach to evaluating and pricing risks in the face of declines in written pricing. Contributing to the expected decline in

Middle Market written premium is the effect of state-mandated rate reductions in workers' compensation and increased competition in

specific geographic markets and lines. Within Specialty Commercial, management expects written premium to be flat to 3% higher,

primarily driven by an increase in professional liability, fidelity and surety written premium, partially offset by a decrease in property

written premium.

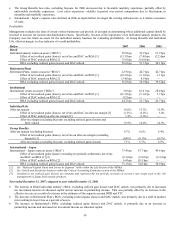

Market conditions in the commercial lines industry continue to be soft with written pricing likely to decline further in 2008, more so on

the larger accounts. While carriers in the personal lines industry will continue to compete on price, management expects that pricing

will firm a bit in 2008 as combined ratios have risen in the past couple of years and eroded profitability. For the Company, written

pricing in 2007 was flat in auto and increased in homeowners. Written pricing increases in homeowners were due largely to higher

insured property values and higher insurance-to-value. Written pricing declined in the Company’ s Small Commercial and Middle

Market segments during 2007 with the largest written pricing decreases on commercial auto, marine and Middle Market workers’

compensation insurance.

Excluding catastrophes and prior accident year development, underwriting margins will likely continue to decline in 2008 due to an

increase in non-catastrophe property loss costs in some lines of business, a decrease in earned pricing and an increase in insurance

operating costs and expenses, partially offset by a slightly lower expected loss and loss adjustment expense ratio on workers’

compensation business and a decrease in policyholder dividends. Management expects that an increase in non-catastrophe property

claim severity will be partially offset by favorable frequency. Reflecting favorable trends in workers’ compensation loss costs in recent

accident years, management expects a slightly lower loss and loss adjustment expense ratio for workers’ compensation claims in the