The Hartford 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

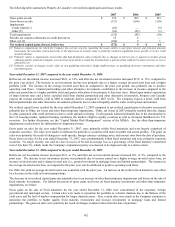

The other-than-temporary impairments reported as Credit related were primarily ABS related to investments backed by aircraft lease

receivables. Impairments resulted from higher than expected maintenance expenses.

2005

For the year ended December 31, 2005, other-than-temporary impairments recorded on corporate securities. Approximately $15

recorded on corporate securities related to three Canadian paper companies. These companies’ operations suffered from high energy

prices and falling demand, in part due to the appreciation of the Canadian dollar in comparison to the U.S. dollar. Also included in the

corporate securities was $9 recorded on securities related to two major automotive manufacturers. The market values of these securities

had fallen due to a downward adjustment in earnings and cash flow guidance primarily due to sluggish sales, rising employee and retiree

benefit costs and an increased debt service burden. Other-than-temporary impairments recorded on equity securities had sustained a

decline in market value for an extended period of time as a result of issuer credit spread widening. During 2005 there were no

significant other-than-temporary impairments (i.e., $15 or greater) recorded on any single security or issuer.

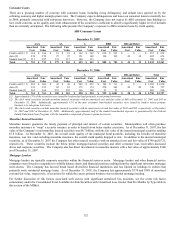

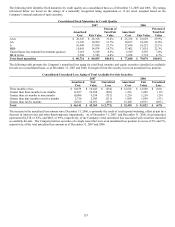

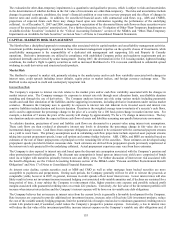

INVESTMENT CREDIT RISK

The Company has established investment credit policies that focus on the credit quality of obligors and counterparties, limit credit

concentrations, encourage diversification and require frequent creditworthiness reviews. Investment activity, including setting of policy

and defining acceptable risk levels, is subject to regular review and approval by senior management and by The Hartford’s Board of

Directors.

The Company invests primarily in securities which are rated investment grade and has established exposure limits, diversification

standards and review procedures for all credit risks including borrower, issuer and counterparty. Creditworthiness of specific obligors is

determined by consideration of external determinants of creditworthiness, typically ratings assigned by nationally recognized ratings

agencies and is supplemented by an internal credit evaluation. Obligor, asset sector and industry concentrations are subject to

established Company limits and are monitored on a regular basis.

The Company is not exposed to any credit concentration risk of a single issuer greater than 10% of the Company’ s stockholders’ equity

other than U.S. government and certain U.S. government agencies. For further discussion of concentration of credit risk, see the

“Concentration of Credit Risk” section in Note 4 of Notes to Consolidated Financial Statements.

Derivative Instruments

The Company’s derivative counterparty exposure policy establishes market-based credit limits, favors long-term financial stability and

creditworthiness and typically requires credit enhancement/credit risk reducing agreements. Credit risk is measured as the amount owed

to the Company based on current market conditions and potential payment obligations between the Company and its counterparties.

Credit exposures are generally quantified daily, netted by counterparty for each legal entity of the Company, and collateral is pledged to

and held by, or on behalf of, the Company to the extent the current value of derivatives exceeds the exposure policy thresholds which do

not exceed $10. The Company also minimizes the credit risk in derivative instruments by entering into transactions with high quality

counterparties rated A2/A or better, which are monitored by the Company’ s internal compliance unit and reviewed frequently by senior

management. In addition, the compliance unit monitors counterparty credit exposure on a monthly basis to ensure compliance with

Company policies and statutory limitations. The Company also maintains a policy of requiring that derivative contracts, other than

exchange traded contracts, currency forward contracts, and certain embedded derivatives, be governed by an International Swaps and

Derivatives Association Master Agreement which is structured by legal entity and by counterparty and permits right of offset. To date,

the Company has not incurred any losses on derivative instruments due to counterparty nonperformance.

In addition to counterparty credit risk, the Company enters into credit derivative instruments to manage credit exposure which includes

assuming credit risk from and reducing credit risk to a single entity, referenced index, or asset pool. Credit derivatives used by the

Company include credit default swaps, credit index swaps, and total return swaps.

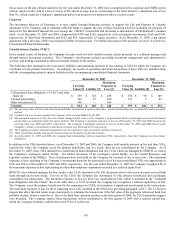

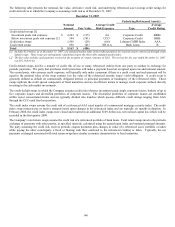

The Company purchases credit protection through credit default swaps to economically hedge and manage credit risk of certain fixed

maturity investments across multiple sectors of the investment portfolio. As of December 31, 2007, the notional and fair value of these

credit default swaps was $5.2 billion and $81, respectively. The average credit quality of the economically hedged securities was

BBB+.