The Hartford 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

carriers. There has been some activity with competitors returning to the market after the Pension Protection Act (PPA) was

implemented in 2007 clarifying best practices. However, there are several barriers to entry which include scale, expertise and

administrative capability that make it difficult for new entrants to enter the business.

Individual Life

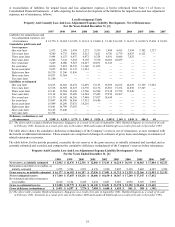

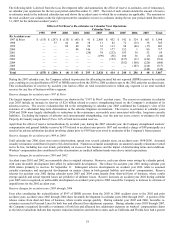

The Individual Life segment provides life insurance strategies to a wide array of business intermediaries and partners to solve the

wealth protection, accumulation and transfer needs of its affluent, emerging affluent and business life insurance clients. Life insurance

in-force was $179.5 billion, $164.2 billion and $150.8 billion as of December 31, 2007, 2006 and 2005, respectively. Account values

were $12.3 billion, $11.4 billion and $10.3 billion as of December 31, 2007, 2006 and 2005, respectively. Individual Life total assets

were $15.6 billion and $14.2 billion as of December 31, 2007 and 2006, respectively. Revenues were $1.1 billion, $1.1 billion and $1.1

billion in 2007, 2006 and 2005, respectively. Net income in Individual Life was $182, $150 and $173 in 2007, 2006 and 2005,

respectively.

Principal Products

Life holds a significant market share in the variable universal life product market and is a leading seller of variable universal life

insurance according to the Tillinghast VALUE Survey as of September 30, 2007. Sales in the Individual Life segment were $286, $284

and $250 in 2007, 2006 and 2005, respectively.

Variable Universal Life — Variable universal life provides life insurance with an investment return linked to underlying investments as

policyholders are allowed to invest premium dollars among a variety of underlying mutual funds. As the return on the investment

portfolios increase or decrease, the surrender value of the variable universal life policy will increase or decrease, and, under certain

policyholder options or market conditions, the death benefit may also increase or decrease. Life’ s second-to-die products are

distinguished from other products in that two lives are insured rather than one, and the policy proceeds are paid upon the deaths of both

insureds. Second-to-die policies are frequently used in estate planning for a married couple as the policy proceeds are paid out at the

time an estate tax liability is incurred. Variable universal life account values were $7.3 billion, $6.6 billion and $5.9 billion as of

December 31, 2007, 2006 and 2005, respectively.

Universal Life and Interest Sensitive Whole Life — Universal life and interest sensitive whole life insurance coverages provide life

insurance with adjustable rates of return based on current interest rates and on the returns of the underlying investment portfolios.

Universal life provides policyholders with flexibility in the timing and amount of premium payments and the amount of the death

benefit, provided there are sufficient policy funds to cover all policy charges for the coming period, unless guaranteed no-lapse

coverage is in effect. At December 31, 2007 and 2006, guaranteed no-lapse universal life represented approximately 8% and 6% of life

insurance in-force, respectively. Life also sells second-to-die universal life insurance policies.

Marketing and Distribution

Consistent with Life’ s strategy to access multiple distribution outlets, the Individual Life distribution organization has been developed

to penetrate multiple retail sales channels. Life sells both variable and fixed individual life products through a wide distribution

network of national and regional broker-dealer organizations, banks and independent financial advisors. Life is a market leader in

selling individual life insurance through national stockbroker and financial institutions channels. In addition, Life distributes individual

life products through independent life and property-casualty agents and Woodbury Financial Services, an indirect and wholly-owned

subsidiary retail broker-dealer. To wholesale Life’ s products, Life has a group of highly qualified life insurance professionals with

specialized training in sophisticated life insurance sales. These individuals are generally employees of Life who are managed through a

regional sales office system.

Competition

Individual Life competes with other stock and mutual companies in the United States, as well as other financial intermediaries

marketing life insurance products. Competitive factors related to this segment are primarily the breadth and quality of life insurance

products offered, pricing, relationships with third-party distributors, effectiveness of sales support, pricing and availability of

reinsurance, and the quality of underwriting and customer service.

The individual life industry continues to see a move in distribution away from the traditional life insurance sales agents, to the

consultative financial advisor as the place people go to buy their life insurance. In 2007, traditional career agents accounted for just

about thirty percent of sales, while the independent channels, including brokerage, financial institutions and banks, and stockbrokers,

sold the remainder. Companies who distribute products through financial advisors and independent agents have increased commissions

or offered additional incentives to attract new business. Competition is most intense among the largest brokerage general agencies.

Individual Life’ s regional sales office system is a differentiator in the market and allows it to compete effectively across multiple

distribution outlets.

The individual life market has seen a shift in product mix towards universal life products over the past few years, which now represents

42% of life insurance sales as of September 30, 2007 as reported through LIMRA. Both consumers and producers have been

demanding fixed products and more guarantees, which can be demonstrated by the shift in the mix of products being sold. Due to this

shifting market demand, enhanced product features are becoming an increasingly important factor in competition. The Company has

updated its universal life product set and sales of universal life have increased. The Company remains a leader in variable universal life

sales and rank number one in total variable life sales according to LIMRA as of September 30, 2007.