The Hartford 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

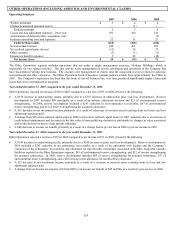

years, the Company found estimates for individual cases changed based upon the particular circumstances of each account. These

changes were case specific and not as a result of any underlying change in the current environment. The net effect of these changes

resulted in $25, $43 and $37 increases in net environmental liabilities in 2007, 2006 and 2005, respectively. The Company currently

expects to continue to perform an evaluation of its environmental liabilities annually.

In reporting environmental results, the Company divides its gross exposure into Direct, which is subdivided further as: Accounts with

future exposure greater than $2.5, Accounts with future exposure less than $2.5, and Other direct; Assumed Reinsurance; and London

Market. The unallocated amounts in the Other direct category include an estimate of the necessary reserves for environmental claims

related to direct insureds who have not previously tendered environmental claims to the Company.

An account may move between categories from one evaluation to the next. For example, an account with future expected exposure of

greater than $2.5 in one evaluation may be reevaluated due to changing conditions and re-categorized as less than $2.5 in a subsequent

evaluation or vice versa.

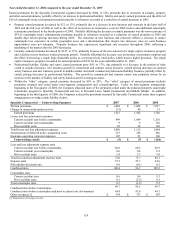

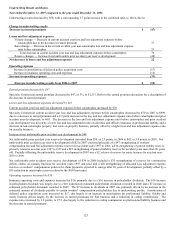

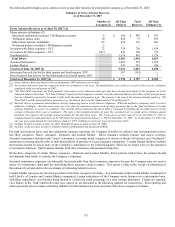

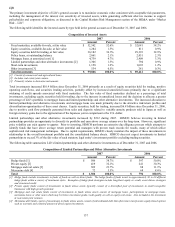

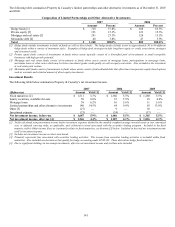

The following table displays gross environmental reserves and other statistics by category as of December 31, 2007.

Summary of Gross Environmental Reserves

As of December 31, 2007

Gross Environmental Reserves as of September 30, 2007 [1]

Number of

Accounts [2]

Total

Reserves

Accounts with future exposure > $2.5 8 $ 38

Accounts with future exposure < $2.5 520 100

Other direct [3] — 29

Total Direct 528 167

Assumed Reinsurance 87

London Market 47

Total gross environmental reserves as of September 30, 2007 [1] 301

Gross paid loss activity for the fourth quarter 2007 (12)

Gross incurred loss activity for the fourth quarter 2007 1

Total gross environmental reserves as of December 31, 2007 [4] [5] $290

[1] Gross Environmental Reserves based on the third quarter 2007 environmental reserve study.

[2] Number of accounts established as of June 2007.

[3] Includes unallocated IBNR.

[4] The one year gross paid amount for total environmental claims is $121, resulting in a one year gross survival ratio of 2.4.

[5] The three year average gross paid amount for total environmental claims is $108, resulting in a three year gross survival ratio of 2.7.

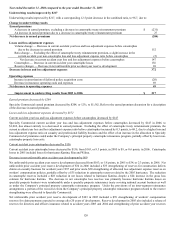

During the second quarter of 2007, an arbitration panel found that a Hartford subsidiary, established as a captive reinsurance company in

the 1970s by The Hartford's former parent, ITT, had additional obligations to ITT's primary insurance carrier under ITT's captive

insurance program, which ended in 1993. When ITT spun-off The Hartford in 1995, the former captive became a Hartford subsidiary.

The arbitration concerned whether certain claims could be presented to the former captive in a different manner than ITT’s primary

insurance carrier historically had presented them. Principally as a result of this adverse arbitration decision, the Company recorded a

charge of $99.

During the second quarters of 2007, 2006 and 2005, the Company completed its annual evaluations of the collectibility of the

reinsurance recoverables and the adequacy of the allowance for uncollectible reinsurance associated with older, long-term casualty

liabilities reported in the Other Operations segment. The evaluation in the second quarter of 2007 resulted in no addition to the

allowance for uncollectible reinsurance. In the second quarter of 2006, the Company entered into an agreement with Equitas and all

Lloyd’ s syndicates reinsured by Equitas (collectively, “Equitas”) that resolved, with minor exception, all of the Company’ s ceded and

assumed domestic reinsurance exposures with Equitas, including all of the Company’ s reinsurance recoveries from Equitas under the

Blanket Casualty Treaty (“BCT”). As a result of the settlement with Equitas and the 2006 reinsurance recoverable evaluation, the

Company reduced its net reinsurance recoverable by $243. As a result of the evaluation in the second quarter of 2005, the Company

increased its allowance for uncollectible reinsurance by $20 to reflect deterioration in the credit ratings of certain reinsurers and the

Company’ s opinion as to the ability of certain reinsurers to pay claims in the future.

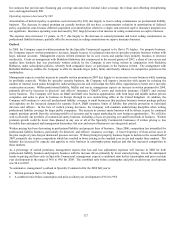

In conducting these evaluations of reinsurance recoverables, the Company used its most recent detailed evaluations of ceded liabilities

reported in the segment. The Company analyzed the overall credit quality of the Company’ s reinsurers, recent trends in arbitration and

litigation outcomes in disputes between cedants and reinsurers, and recent developments in commutation activity between reinsurers and

cedants. In 2006 and 2007, the Company also considered the effect of the Equitas settlement on the collectibility of amounts due from

other upper-layer reinsurers under the BCT. The allowance for uncollectible reinsurance reflects management’s current estimate of

reinsurance cessions that may be uncollectible in the future due to reinsurers’ unwillingness or inability to pay. As of December 31,

2007, the allowance for uncollectible reinsurance for Other Operations totals $267. The Company currently expects to perform its

regular comprehensive review of Other Operations reinsurance recoverables annually. Uncertainties regarding the factors that affect the

allowance for uncollectible reinsurance could cause the Company to change its estimates, and the effect of these changes could be

material to the Company’ s consolidated results of operations or cash flows.