The Hartford 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

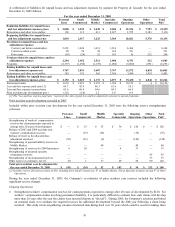

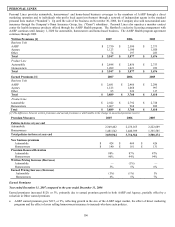

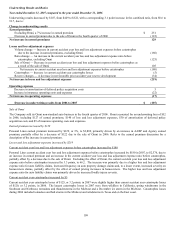

Year ended December 31, 2007 compared to the year ended December 31, 2006

Net income

Net income decreased by $77, or 5%, due primarily to a decrease in underwriting results and an increase in net realized capital losses,

partially offset by an increase in net investment income.

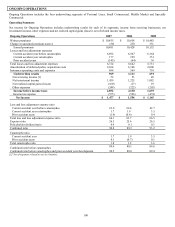

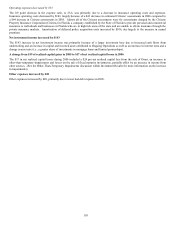

Underwriting results decreased by $142

Underwriting results decreased by $142, from $1,111 to $969, with a corresponding 1.5 point increase in the combined ratio, from 89.3

to 90.8, due to:

Change in underwriting results

Earned premiums

Excluding Omni, a 2% increase in earned premium $ 185

Decrease in earned premium due to the sale of Omni in the fourth quarter of 2006 (122)

Net increase in earned premiums 63

Losses and loss adjustment expenses

Ratio change — An increase in the current accident year loss and loss adjustment expense ratio before

catastrophes, excluding Omni

(176)

Volume change — Increase in current accident year loss and loss adjustment expenses before catastrophes

due to the increase in earned premium, excluding Omni

(114)

Sale of Omni — Decrease in current accident year loss and loss adjustment expenses before catastrophes as

a result of the sale of Omni

105

Net increase in current accident year loss and loss adjustment expenses before catastrophes (185)

Catastrophes — Decrease in current accident year catastrophe losses 22

Reserve changes — Increase in net favorable prior accident year reserve development 81

Net increase in losses and loss adjustment expenses (82)

Operating expenses

Decrease in amortization of deferred policy acquisition costs 2

Increase in insurance operating costs and expenses (125)

Net increase in operating expenses (123)

Decrease in underwriting results from 2006 to 2007 $

(142)

Sale of Omni

The Company sold its Omni non-standard auto business in the fourth quarter of 2006. Omni accounted for an underwriting loss of $52

in 2006, including $127 of earned premiums, $140 of loss and loss adjustment expenses, $30 of amortization of deferred policy

acquisition costs and $9 of insurance operating costs and expenses.

Earned premium increased by $63

Ongoing Operations’ earned premium increased by $63, or 1%, to $10,491, driven by a 3% increase in both Personal Lines and Small

Commercial, partially offset by a 4% decrease in Middle Market and a 3% decrease in Specialty Commercial. Excluding Omni, earned

premium increased by $185, or 2%. Refer to the earned premium discussion in the Executive Overview section of the Property &

Casualty MD&A for further discussion of the increase in earned premium.

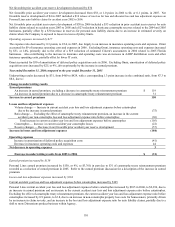

Losses and loss adjustment expenses increased by $82

Current accident year loss and loss adjustment expenses before catastrophes increased by $185

Ongoing Operations’ current accident year loss and loss adjustment expenses before catastrophes increased by $185 in 2007, to $6,692,

due largely to an increase in the current accident year loss and loss adjustment expense ratio and an increase in earned premium,

partially offset by a decrease due to the sale of Omni. Excluding Omni, the current accident year loss and loss adjustment expense ratio

before catastrophes increased by 1.7 points, to 63.8, due to an increase in the current accident year loss and loss adjustment expense

ratio before catastrophes of 3.3 points in Personal Lines, 1.4 points in Small Commercial and 2.2 points in Middle Market, partially

offset by a decrease in the current accident year loss and loss adjustment expense ratio before catastrophes of 2.2 points in Specialty

Commercial.