The Hartford 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

Company to currency risk. The Company manages this currency risk associated with the yen fixed annuities primarily with pay variable

U.S. dollar and receive fixed yen currency swaps. As of December 31, 2007 and 2006, the notional value and fair value of the currency

swaps were $1.8 billion and $1.9 billion, respectively, and $(115) and $(225), respectively. Although economically an effective hedge,

a divergence between the yen denominated fixed annuity product liability and the currency swaps exists primarily due to the difference

in the basis of accounting between the liability and the derivative instruments (i.e. historical cost versus fair value). The yen

denominated fixed annuity product liabilities are recorded on a historical cost basis and are only adjusted for changes in foreign spot

rates and accrued income. The currency swaps are recorded at fair value, incorporating changes in value due to changes in forward

foreign exchange rates, interest rates and accrued income. An after-tax net gain (loss) of $12 and $(11) for the years ended December

31, 2007 and 2006, respectively, which includes the changes in value of the currency swaps, excluding net periodic coupon settlements,

and the yen fixed annuity contract remeasurement, was recorded in net realized capital gains and losses.

Based on the fair values of Life’ s non-U.S. dollar denominated investments and derivative instruments (including its yen based

individual fixed annuity product) as of December 31, 2007 and 2006, management estimates that a 10% unfavorable change in exchange

rates would decrease the fair values by an after-tax total of $1 and $3, respectively. The estimated impact was based upon a 10% change

in December 31 spot rates. The selection of the 10% unfavorable change was made only for illustration of the potential hypothetical

impact of such an event and should not be construed as a prediction of future market events. Actual results could differ materially from

those illustrated above due to the nature of the estimates and assumptions used in the above analysis.

Property & Casualty

Property & Casualty attempts to maximize economic value while generating appropriate after-tax income and sufficient liquidity to

meet policyholder and corporate obligations. Property & Casualty’ s investment portfolio has material exposure to interest rates. The

Company continually monitors these exposures and makes portfolio adjustments to manage these risks within established limits.

Interest Rate Risk

The primary exposure to interest rate risk in Property & Casualty relates to its fixed maturity securities, including corporate bonds, ABS,

municipal bonds, CMBS and CMOs. The fair value of these investments was $27.2 billion and $26.7 billion at December 31, 2007 and

2006, respectively. The fair value of these and Property & Casualty’ s other invested assets fluctuates depending on the interest rate

environment and other general economic conditions. A variety of derivative instruments, primarily swaps, are used to manage interest

rate risk and had a total notional amount as of December 31, 2007 and 2006 of $1.8 billion and $2.1 billion, respectively, and fair value

of $(15) and $(4), respectively.

One of the measures Property & Casualty uses to quantify its exposure to interest rate risk inherent in its invested assets is duration. The

weighted average duration of the fixed maturity portfolio was 4.9 and 4.5 years as of December 31, 2007 and 2006, respectively.

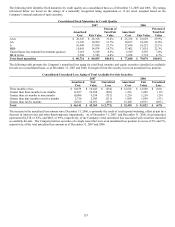

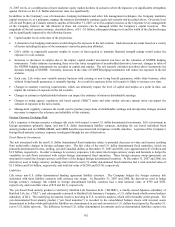

Calculated Interest Rate Sensitivity

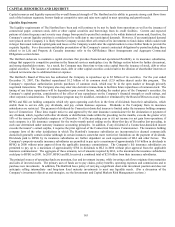

The following table provides an analysis showing the estimated after-tax change in the fair value of Property & Casualty’ s fixed

maturity investments and related derivatives, assuming 100 basis point upward and downward parallel shifts in the yield curve as of

December 31, 2007 and 2006. Certain financial instruments, such as limited partnerships, have been omitted from the analysis due to

the fact that the investments are accounted for under the equity method and generally lack sensitivity to interest rate changes.

Change in Fair Value As of December 31,

2007 2006

Basis point shift - 100 + 100 - 100 + 100

Amount $ 925 $ (894) $ 857 $ (829)

The selection of the 100 basis point parallel shift in the yield curve was made only as an illustration of the potential hypothetical impact

of such an event and should not be construed as a prediction of future market events. Actual results could differ materially from those

illustrated above due to the nature of the estimates and assumptions used in the above analysis. The Company’ s sensitivity analysis

calculation assumes that the composition of invested assets remains materially consistent throughout the year and that the current

relationship between short-term and long-term interest rates will remain constant over time. As a result, these calculations may not fully

capture the impact of portfolio re-allocations or non-parallel changes in interest rates.

Foreign Currency Exchange Risk

Foreign currency exchange risk exists with respect to investments in non-U.S. dollar denominated fixed maturities, primarily euro,

sterling and Canadian dollar denominated securities. The risk associated with these securities relates to potential decreases in value

resulting from unfavorable changes in foreign exchange rates. The fair value of these fixed maturity securities at December 31, 2007

and 2006 was $1.0 billion.

In order to manage its currency exposures, Property & Casualty enters into foreign currency swaps and forward contracts to hedge the

variability in cash flow associated with certain foreign denominated securities. These foreign currency swap agreements are structured

to match the foreign currency cash flows of the hedged foreign denominated securities. At December 31, 2007 and 2006, the derivatives

used to hedge currency exchange risk had a total notional value of $428 and $805, respectively, and total fair value of $(43) and $(45),

respectively.