The Hartford 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

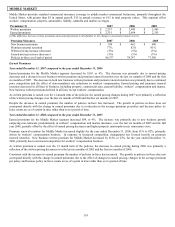

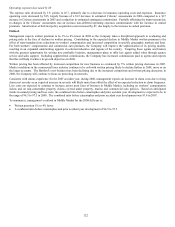

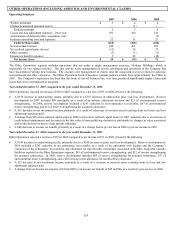

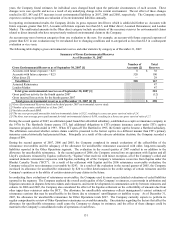

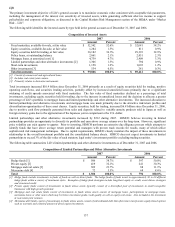

OTHER OPERATIONS (INCLUDING ASBESTOS AND ENVIRONMENTAL CLAIMS)

Operating Summary

2007 2006 2005

Written premiums $5 $ 4 $ 4

Change in unearned premium reserve — (1) —

Earned premiums 5 5 4

Losses and loss adjustment expenses – prior year 193 360 212

Amortization of deferred policy acquisition costs — — (3)

Insurance operating costs and expenses 22 11 21

Underwriting results (210) (366) (226)

Net investment income 248 261 283

Net realized capital gains (losses) (12) 26 25

Other expenses (1) (1) (1)

Income tax benefit (expense) 5 45 (10)

Net income (loss) $30 $ (35) $ 71

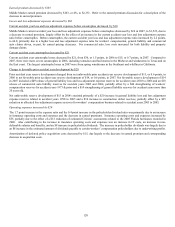

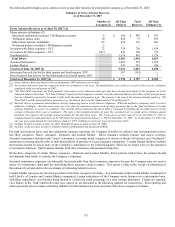

The Other Operations segment includes operations that are under a single management structure, Heritage Holdings, which is

responsible for two related activities. The first activity is the management of certain subsidiaries and operations of the Company that

have discontinued writing new business. The second is the management of claims (and the associated reserves) related to asbestos,

environmental and other exposures. The Other Operations book of business contains policies written from approximately the 1940s to

2003. The Company’ s experience has been that this book of run-off business has, over time, produced significantly higher claims and

losses than were contemplated at inception.

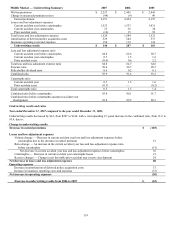

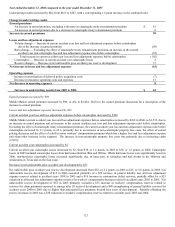

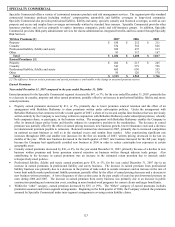

Year ended December 31, 2007 compared to the year ended December 31, 2006

Other Operations reported net income of $30 in 2007 compared to a net loss of $35 in 2006, driven by the following:

• A $156 increase in underwriting results, primarily due to a $167 decrease in unfavorable prior year loss development. Reserve

development in 2007 included $99 principally as a result of an adverse arbitration decision and $25 of environmental reserve

strengthening. In 2006, reserve development included a $243 reduction in net reinsurance recoverables, $43 of environmental

reserve strengthening and $12 of reserve strengthening for assumed reinsurance.

• A $13 decrease in net investment income, primarily as a result of a decrease in invested assets resulting from net losses and loss

adjustment expenses paid.

• A change from $26 of net realized capital gains in 2006 to $12 of net realized capital losses in 2007, primarily due to an increase in

credit-related impairments and decreases in the fair value of non-qualifying derivatives attributable to changes in value associated

with credit derivatives due to credit spreads widening.

• A $40 decrease in income tax benefit, primarily as a result of a change from a pre-tax loss in 2006 to pre-tax income in 2007.

Year ended December 31, 2006 compared to the year ended December 31, 2005

Other Operations reported a net loss of $35 in 2006 compared to net income of $71 in 2005, driven by the following:

• A $140 decrease in underwriting results, primarily due to a $148 increase in prior year loss development. Reserve development in

2006 included a $243 reduction in net reinsurance recoverables as a result of the agreement with Equitas and the Company’ s

evaluation of the reinsurance recoverables and allowance for uncollectible reinsurance associated with older, long-term casualty

liabilities reported in the Other Operations segment, $43 of environmental reserve strengthening, and $12 of reserve strengthening

for assumed reinsurance. In 2005, reserve development included $85 of reserve strengthening for assumed reinsurance, $37 of

environmental reserve strengthening, and a $20 increase in the allowance for uncollectible reinsurance.

• A $22 decrease in net investment income, primarily as a result of a decrease in invested assets resulting from net loss and loss

adjustment expenses paid.

• A change from an income tax expense of $10 in 2005 to an income tax benefit of $45 in 2006, as a result of a pre-tax loss in 2006.