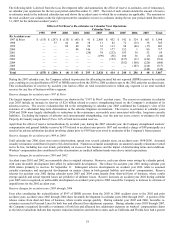

The Hartford 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

commissions to the broker defendants to steer business to the insurance company defendants. The district court has dismissed the

Sherman Act and RICO claims in both complaints for failure to state a claim and has granted the defendants’ motions for summary

judgment on the ERISA claims in the group-benefits products complaint. The district court further has declined to exercise

supplemental jurisdiction over the state law claims, has dismissed those state law claims without prejudice, and has closed both cases.

The plaintiffs have appealed the dismissal of the Sherman Act, RICO and ERISA claims.

The Company is also a defendant in two consolidated securities actions and two consolidated derivative actions filed in the United

States District Court for the District of Connecticut. The consolidated securities actions assert claims on behalf of a putative class of

shareholders alleging that the Company and certain of its executive officers violated Section 10(b) of the Securities Exchange Act of

1934 and Rule 10b-5 by failing to disclose to the investing public that The Hartford’ s business and growth was predicated on the

unlawful activity alleged in the New York Attorney General’ s complaint against Marsh. The consolidated derivative actions, brought

by shareholders on behalf of the Company against its directors and an additional executive officer, allege that the defendants knew

adverse non-public information about the activities alleged in the Marsh complaint and concealed and misappropriated that information

to make profitable stock trades in violation of their duties to the Company. In July 2006, the district court granted defendants’ motion

to dismiss the consolidated securities actions. The plaintiffs have appealed that decision. Defendants filed a motion to dismiss the

consolidated derivative actions in May 2005, and the plaintiffs have agreed to stay further proceedings until after the resolution of the

appeal from the dismissal of the securities action.

In September 2007, the Ohio Attorney General filed a civil action in Ohio state court alleging that certain insurance companies,

including The Hartford, conspired with Marsh in violation of Ohio’ s antitrust statute. The Company has moved to dismiss the case.

Fair Credit Reporting Act Class Action – In February 2007, the United States District Court for the District of Oregon gave final

approval of the Company’ s settlement of a lawsuit brought on behalf of a class of homeowners and automobile policy holders alleging

that the Company willfully violated the Fair Credit Reporting Act by failing to send appropriate notices to new customers whose initial

rates were higher than they would have been had the customer had a more favorable credit report. The settlement was made on a claim-

in, nationwide-class basis and required eligible class members to return valid claim forms postmarked no later than June 28, 2007. The

Company has paid $86.5 to eligible claimants in connection with the settlement. Some additional payments to claimants may be

required to fully satisfy the Company’ s obligations under the settlement, but management estimates that any such payments will not

exceed $1. The Company has sought reimbursement from the Company’ s Excess Professional Liability Insurance Program for the

portion of the settlement in excess of the Company’ s $10 self-insured retention. Certain insurance carriers participating in that program

have disputed coverage for the settlement, and one of the excess insurers has commenced an arbitration to resolve the dispute.

Management believes it is probable that the Company’ s coverage position ultimately will be sustained. In 2006, the Company accrued

$10, the amount of the self-insured retention, which reflects the amount that management believes to be the Company’ s ultimate

liability under the settlement net of insurance.

Call-Center Patent Litigation – In June 2007, the holder of twenty-one patents related to automated call flow processes, Ronald A. Katz

Technology Licensing, LP (“Katz”), brought an action against the Company and various of its subsidiaries in the United States District

Court for the Southern District of New York. The action alleges that the Company’ s call centers use automated processes that willfully

infringe the Katz patents. Katz previously has brought similar patent-infringement actions against a wide range of other companies,

none of which has reached a final adjudication of the merits of the plaintiff’s claims, but many of which have resulted in settlements

under which the defendants agreed to pay licensing fees. The case has been transferred to a multidistrict litigation in the United States

District Court for the Central District of California, which is currently presiding over other Katz patent cases. The Company disputes

the allegations and intends to defend this action vigorously.

Asbestos and Environmental Claims – As discussed in Item 7, Management’ s Discussion and Analysis of Financial Condition and

Results of Operations under the caption “Other Operations (Including Asbestos and Environmental Claims)”, The Hartford continues

to receive asbestos and environmental claims that involve significant uncertainty regarding policy coverage issues. Regarding these

claims, The Hartford continually reviews its overall reserve levels and reinsurance coverages, as well as the methodologies it uses to

estimate its exposures. Because of the significant uncertainties that limit the ability of insurers and reinsurers to estimate the ultimate

reserves necessary for unpaid losses and related expenses, particularly those related to asbestos, the ultimate liabilities may exceed the

currently recorded reserves. Any such additional liability cannot be reasonably estimated now but could be material to The Hartford’ s

consolidated operating results, financial condition and liquidity.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of security holders of The Hartford Financial Services Group, Inc. during the fourth quarter of 2007.