The Hartford 2007 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169

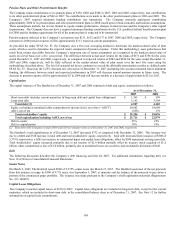

Consumer Notes

Institutional Solutions Group began issuing Consumer Notes through its Retail Investor Notes Program in September 2006. A

Consumer Note is an investment product distributed through broker-dealers directly to retail investors as medium-term, publicly traded

fixed or floating rate, or a combination of fixed and floating rate, notes. In addition, discount notes, amortizing notes and indexed notes

may also be offered and issued. Consumer Notes are part of the Company’s spread-based business and proceeds are used to purchase

investment products, primarily fixed rate bonds. Proceeds are not used for general operating purposes. Consumer Notes are offered

weekly with maturities up to 30 years and varying interest rates and may include a call provision. Certain Consumer Notes may be

redeemed by the holder in the event of death. Redemptions are subject to certain limitations, including calendar year aggregate and

individual limits equal to the greater of $1 or 1% of the aggregate principal amount of the notes and $250 thousand per individual,

respectively. Derivative instruments will be utilized to hedge the Company’s exposure to interest rate risk in accordance with Company

policy.

As of December 31, 2007 and 2006, $809 and $258 of consumer notes had been issued. These notes have interest rates ranging from

4.75% to 6.25% for fixed notes and for variable notes, either consumer price index plus 157 basis points to 267 basis points, or indexed

to the S&P 500, Dow Jones Industrials or the Nikkei 225. The aggregate maturities of consumer notes are as follows: $222 in 2008,

$494 in 2009, $34 in 2010, $19 in 2011 and $40 thereafter. For 2007 and 2006, interest credited to holders of consumer notes was $11

and $2, respectively.

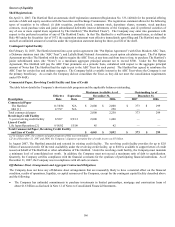

Stockholders’ Equity

Treasury stock acquired — For the year ended December 31, 2007, The Hartford repurchased $1.2 billion of its common stock (12.9

million shares) under its share repurchase program. For additional information regarding the share repurchase program, see the

Liquidity Requirements section above.

Dividends — On February 21, 2008, The Hartford’ s Board of Directors declared a quarterly dividend of $0.53 per share payable on

April 1, 2008 to shareholders of record as of March 3, 2008.

The Hartford declared $643 and paid $636 in dividends to shareholders in 2007 and declared $531 and paid $460 in dividends to

shareholders in 2006.

AOCI – AOCI, net of tax, decreased by $1.0 billion as of December 31, 2007 compared with December 31, 2006. The decrease in

AOCI, net of tax, includes unrealized losses on securities of $1.4 billion, primarily due to widening credit spreads associated with fixed

maturities, partially offset by changes in gains on cash-flow hedging instruments of $94, change in foreign currency translation

adjustments of $146, and pension and other postretirement plan adjustments of $141. Because The Hartford's investment portfolio has a

duration of approximately 5 years, a 100 basis point parallel movement in rates would result in approximately a 5% change in fair value.

Movements in short-term interest rates without corresponding changes in long-term rates will impact the fair value of our fixed

maturities to a lesser extent than parallel interest rate movements.

For additional information on stockholders’ equity, AOCI, net of tax, and pension and other postretirement plans see Notes 15, 16 and

17, respectively, of Notes to Consolidated Financial Statements.

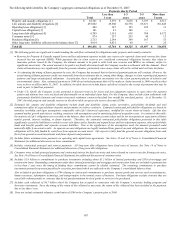

Cash Flow

2007 2006 2005

Net cash provided by operating activities $5,991 $ 5,638 $3,732

Net cash used for investing activities $(6,176) $ (7,410) $(4,860)

Net cash provided by financing activities $499 $ 1,915 $1,280

Cash - end of year $2,011 $ 1,424 $1,273

Year ended December 31, 2007 compared to the year ended December 31, 2006

The increase in cash from operating activities compared to prior year period was primarily the result of premium cash flows in excess of

claim payments, partially offset by increases in taxes paid. Net purchases of available-for-sale securities continue to account for the

majority of cash used for investing activities. Cash from financing activities decreased primarily due to treasury stock acquired and

increases in dividends paid; partially offset by higher net receipts from policyholder’ s accounts related to investment and universal life

contracts, proceeds from consumer notes, and issuance of long-term debt, net of repayments.

Year ended December 31, 2006 compared to the year ended December 31, 2005

The increase in cash from operating activities was primarily the result of premium cash flows in excess of claim payments and increased

net income as compared to prior year period. Net purchases of available-for-sale securities accounted for the majority of cash used for

investing activities. Cash provided by financing activities increased primarily due to higher net receipts from policyholder’ s accounts

related to investment and universal life contracts, proceeds from issuance of consumer notes and proceeds from issuance of shares from

equity unit contracts, less the portion that was used for debt repayments.

Operating cash flows in each of the last three years have been adequate to meet liquidity requirements.