The Hartford 2007 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-42

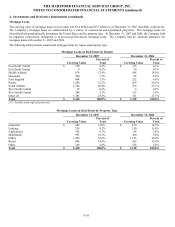

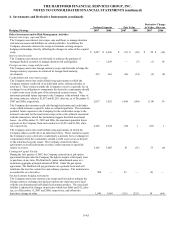

4. Investments and Derivative Instruments (continued)

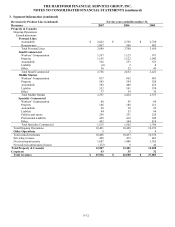

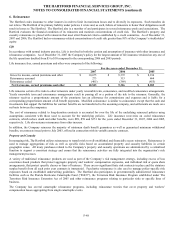

The following table summarizes the derivative instruments used by the Company and the primary hedging strategies to which they

relate. Derivatives in the Company’ s separate accounts are not included because the associated gains and losses accrue directly to

policyholders. The notional value of derivative contracts represents the basis upon which pay or receive amounts are calculated and are

not reflective of credit risk. The fair value amounts of derivative assets and liabilities are presented on a net basis as of December 31,

2007 and 2006. The total ineffectiveness of all cash-flow, fair-value and net investment hedges and total change in value of other

derivative-based strategies which do not qualify for hedge accounting treatment, including periodic derivative net coupon settlements,

are presented below on an after-tax basis for the years ended December 31, 2007 and 2006.

Notional Amount

Fair Value

Hedge

Ineffectiveness,

After-tax

Hedging Strategy 2007 2006 2007 2006 2007 2006

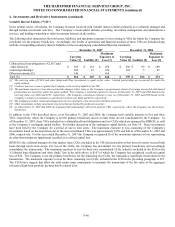

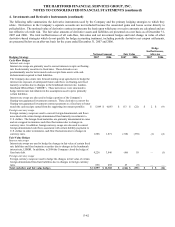

Cash-Flow Hedges

Interest rate swaps

Interest rate swaps are primarily used to convert interest receipts on floating-

rate fixed maturity securities to fixed rates. These derivatives are

predominantly used to better match cash receipts from assets with cash

disbursements required to fund liabilities.

The Company also enters into forward starting swap agreements to hedge the

interest rate exposure of anticipated future cash flows on floating-rate fixed

maturity securities due to changes in the benchmark interest rate, London-

Interbank Offered Rate (“LIBOR”). These derivatives were structured to

hedge interest rate risk inherent in the assumptions used to price primarily

certain liabilities.

Interest rate swaps are also used to hedge a portion of the Company’ s

floating-rate guaranteed investment contracts. These derivatives convert the

floating-rate guaranteed investment contract payments to a fixed rate to better

match the cash receipts earned from the supporting investment portfolio.

$

5,049

$

6,093

$

113

$

(22)

$

2

$

(9)

Foreign currency swaps

Foreign currency swaps are used to convert foreign denominated cash flows

associated with certain foreign denominated fixed maturity investments to

U.S. dollars. The foreign fixed maturities are primarily denominated in euros

and are swapped to minimize cash flow fluctuations due to changes in

currency rates. In addition, foreign currency swaps are also used to convert

foreign denominated cash flows associated with certain liability payments to

U.S. dollars in order to minimize cash flow fluctuations due to changes in

currency rates.

1,588

1,871

(318)

(370)

(1)

(4)

Fair-Value Hedges

Interest rate swaps

Interest rate swaps are used to hedge the changes in fair value of certain fixed

rate liabilities and fixed maturity securities due to changes in the benchmark

interest rate, LIBOR. In addition, in 2006 the Company closed the hedge of

fixed rate debt.

4,226

3,846

(66)

10

—

(1)

Foreign currency swaps

Foreign currency swaps are used to hedge the changes in fair value of certain

foreign denominated fixed rate liabilities due to changes in foreign currency

rates.

696

492

25

(9)

—

—

Total cash-flow and fair-value hedges $ 11,559 $ 12,302 $ (246) $ (391) $ 1 $ (14)