The Hartford 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

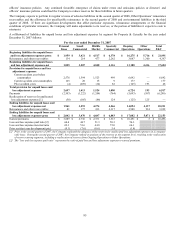

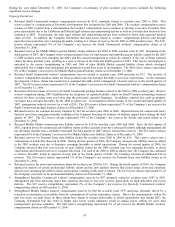

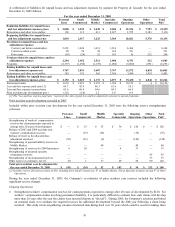

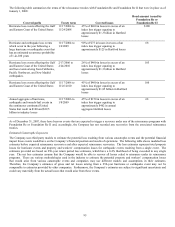

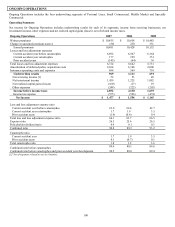

A rollforward of liabilities for unpaid losses and loss adjustment expenses by segment for Property & Casualty for the year ended

December 31, 2005 follows:

For the year ended December 31, 2005

Personal

Lines

Small

Commercial

Middle

Market

Specialty

Commercial

Ongoing

Operations

Other

Operations

Total

P&C

Beginning liabilities for unpaid losses

and loss adjustment expenses-gross

$ 2,000 $2,532

$

3,638 $

5,406 $ 13,576 $ 7,753 $ 21,329

Reinsurance and other recoverables 190 115 413 2,037 2,755 2,383 5,138

Beginning liabilities for unpaid losses

and loss adjustment expenses-net

1,810 2,417

3,225

3,369 10,821 5,370 16,191

Provision for unpaid losses and loss

adjustment expenses

Current year before catastrophes 2,291 1,426 1,431 1,216 6,364 — 6,364

Current accident years 98 50 38 165 351 — 351

Prior years (95) (24) 52 103 36 212 248

Total provision for unpaid losses and loss

adjustment expenses

2,294

1,452

1,521

1,484

6,751

212 6,963

Payments (2,337) (1,038) (1,139) (1,086) (5,600) (691) (6,291)

Ending liabilities for unpaid losses and

loss adjustment expenses-net

1,767 2,831

3,607

3,767 11,972 4,891 16,863

Reinsurance and other recoverables 385 192 565 2,306 3,448 1,955 5,403

Ending liabilities for unpaid losses and

loss adjustment expenses-gross

$ 2,152 $3,023

$

4,172 $

6,073 $ 15,420 $ 6,846 $ 22,266

Earned premiums $ 3,610 $2,421 $2,355 $1,766 $ 10,152 $ 4 $ 10,156

Loss and loss expense paid ratio [1] 64.7 42.9 48.3 61.6 55.1

Loss and loss expense incurred ratio 63.6 60.0 64.6 84.1 66.5

Prior accident year development (pts.) (2.6) (1.0) 2.2 5.8 0.4

[1] The “loss and loss expense paid ratio” represents the ratio of paid loss and loss adjustment expenses to earned premiums.

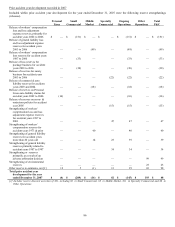

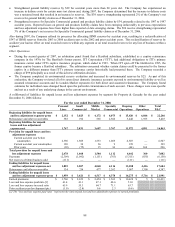

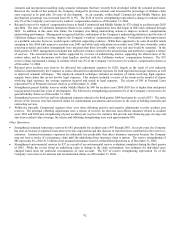

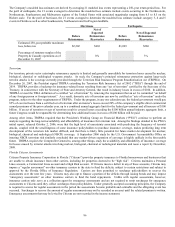

Prior accident year development recorded in 2005

Included within prior accident year development for the year ended December 31, 2005 were the following reserve strengthenings

(releases).

Personal

Lines

Small

Commercial

Middle

Market

Specialty

Commercial

Ongoing

Operations

Other

Operations

Total

P&C

Strengthening of workers’ compensation

reserves for claim payments expected to

emerge after 20 years of development

$

—

$

15

$

35

$

70

$

120

$

—

$

120

Release of 2003 and 2004 accident year

workers’ compensation reserves

—

(37)

(38)

—

(75)

—

(75)

Release of reserves for allocated loss

adjustment expenses

(95)

(23)

(2)

—

(120)

—

(120)

Strengthening of general liability reserves in

Middle Market

—

—

40

—

40

—

40

Strengthening of reserves for 2004 hurricanes 9 20 — 4 33 — 33

Strengthening of assumed casualty

reinsurance reserves

—

—

—

—

—

85

85

Strengthening of environmental reserves — — — — — 37 37

Other reserve re-estimates, net [1] (9) 1 17 29 38 90 128

Total prior accident year development for

the year ended December 31, 2005

$

(95) $

(24) $

52 $

103

$

36

$

212

$

248

[1] Includes reserve discount accretion of $30, including $6 in Small Commercial, $7 in Middle Market, $10 in Specialty Commercial and $7 in Other

Operations.

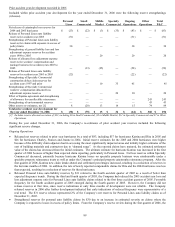

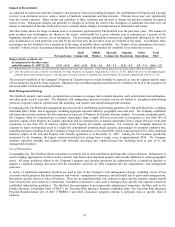

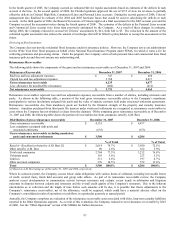

During the year ended December 31, 2005, the Company’ s re-estimates of prior accident year reserves included the following

significant reserve changes.

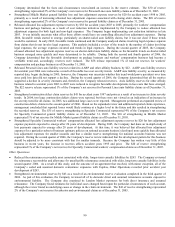

Ongoing Operations

• Strengthened workers’ compensation reserves for claim payments expected to emerge after 20 years of development by $120. For

workers’ compensation claims involving permanent disability, it is particularly difficult to estimate how such claims will develop

more than 20 years after the year the claims were incurred (known as “the tail”). During 2005, the Company’ s actuaries performed

an actuarial study to re-estimate the required reserves for additional development beyond the 20th year following a claim being

incurred. This study involved gathering extensive historical data dating back over 50 years which could be used for making these