The Hartford 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

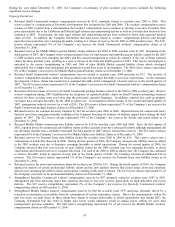

• Strengthened general liability reserves by $39 for accident years more than 20 years old. The Company has experienced an

increase in defense costs for certain mass tort claims and, during 2007, the Company determined that the increase in defense costs

was a sustained trend that resulted in an increase in reserves. The $39 reserve strengthening represented 2% of the Company’ s net

reserves for general liability claims as of December 31, 2006.

• Strengthened reserves for Specialty Commercial general and products liability claims by $34, primarily related to the 1987 to 1997

accident years. Reported losses on general and products liability claims have been emerging unfavorably to previous expectations

and loss adjustment expenses have been higher than expected on late emerging claims. The $34 reserve strengthening represented

3% of the Company’s net reserves for Specialty Commercial general liability claims as of December 31, 2006.

Also during 2007, the Company refined its processes for allocating IBNR reserves by accident year, resulting in a reclassification of

$347 of IBNR reserves from the 2003 to 2006 accident years to the 2002 and prior accident years. This reclassification of reserves by

accident year had no effect on total recorded reserves within any segment or on total recorded reserves for any line of business within a

segment.

Other Operations

• During the second quarter of 2007, an arbitration panel found that a Hartford subsidiary, established as a captive reinsurance

company in the 1970s by The Hartford's former parent, ITT Corporation (“ITT”), had additional obligations to ITT's primary

insurance carrier under ITT's captive insurance program, which ended in 1993. When ITT spun off The Hartford in 1995, the

former captive became a Hartford subsidiary. The arbitration concerned whether certain claims could be presented to the former

captive in a different manner than ITT’ s primary insurance carrier historically had presented them. The Company recorded a

charge of $99 principally as a result of this adverse arbitration decision.

• The Company completed its environmental reserve evaluation and increased its environmental reserves by $25. As part of this

evaluation, the Company reviewed all of its open direct domestic insurance accounts exposed to environmental liability as well as

assumed reinsurance accounts and its London Market exposures for both direct and assumed reinsurance. The Company found

estimates for individual cases changed based upon the particular circumstances of each account. These changes were case specific

and not as a result of any underlying change in the current environment.

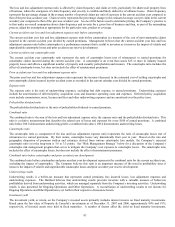

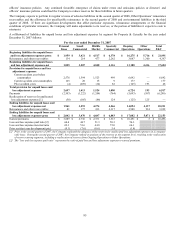

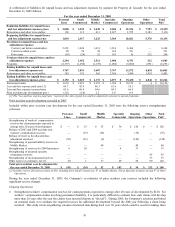

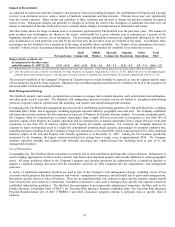

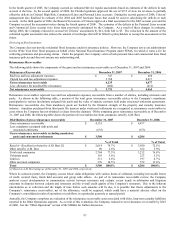

A rollforward of liabilities for unpaid losses and loss adjustment expenses by segment for Property & Casualty for the year ended

December 31, 2006 follows:

For the year ended December 31, 2006

Personal

Lines

Small

Commercial

Middle

Market

Specialty

Commercial

Ongoing

Operations

Other

Operations

Total

P&C

Beginning liabilities for unpaid losses

and loss adjustment expenses-gross

$

2,152

$

3,023

$

4,172

$

6,073 $

15,420

$

6,846

$ 22,266

Reinsurance and other recoverables 385 192 565 2,306 3,448 1,955 5,403

Beginning liabilities for unpaid

losses and loss adjustment

expenses-net

1,767 2,831

3,607 3,767 11,972 4,891 16,863

Provision for unpaid losses and loss

adjustment expenses

Current accident year before

catastrophes

2,396

1,509

1,533

1,069

6,507

—

6,507

Current accident year catastrophes 120 34 36 9 199 — 199

Prior years (38) (75) 15 34 (64) 360 296

Total provision for unpaid losses and

loss adjustment expenses

2,478

1,468

1,584

1,112

6,642

360

7,002

Payments (2,309) (1,092) (1,151) (763) (5,315) (835) (6,150)

Net reserves of Omni business sold (111) — — — (111) — (111)

Ending liabilities for unpaid losses

and loss adjustment expenses-net

1,825 3,207

4,040 4,116 13,188 4,416 17,604

Reinsurance and other recoverables 134 214 477 2,262 3,087 1,300 4,387

Ending liabilities for unpaid losses

and loss adjustment expenses-gross

$

1,959

$

3,421

$

4,517

$

6,378 $

16,275

$

5,716

$

21,991

Earned premiums $ 3,760 $2,652 $ 2,454 $ 1,562 $ 10,428 $ 5 $ 10,433

Loss and loss expense paid ratio [1] 61.4 41.1 47.1 48.6 51.0

Loss and loss expense incurred ratio 65.9 55.3 64.7 71.1 63.7

Prior accident year development (pts.) (1.0) (2.8) 0.6 2.3 (0.6)

[1] The “loss and loss expense paid ratio” represents the ratio of paid loss and loss adjustment expenses to earned premiums.