The Hartford 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

management or financial condition of the insurers within the system. All transactions within a holding company system affecting

insurers must be fair and equitable. Notice to the insurance departments is required prior to the consummation of transactions affecting

the ownership or control of an insurer and of certain material transactions between an insurer and any entity in its holding company

system. In addition, certain of such transactions cannot be consummated without the applicable insurance department’ s prior approval.

In the jurisdictions in which the Company’ s insurance company subsidiaries are domiciled, the acquisition of more than 10% of The

Hartford’s outstanding common stock would require the acquiring party to make various regulatory filings.

The extent of insurance regulation on business outside the United States varies significantly among the countries in which The Hartford

operates. Some countries have minimal regulatory requirements, while others regulate insurers extensively. Foreign insurers in many

countries are faced with greater restrictions than domestic competitors domiciled in that particular jurisdiction. The Hartford’ s

international operations are comprised of insurers licensed in their respective countries.

Intellectual Property

We rely on a combination of contractual rights and copyright, trademark, patent and trade secret laws to establish and protect our

intellectual property.

We have a worldwide trademark portfolio that we consider important in the marketing of our products and services, including, among

others, the trademarks of The Hartford name, the Stag Logo and the combination of these two marks. The duration of trademark

registrations varies from country to country and may be renewed indefinitely subject to country-specific use and registration

requirements. We regard our trademarks as extremely valuable assets in marketing our products and services and vigorously seek to

protect them against infringement.

Employees

The Hartford had approximately 31,000 employees as of December 31, 2007.

Available Information

The Hartford makes available, free of charge, on or through its Internet website (http://www.thehartford.com) The Hartford’s annual

report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished

pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after The Hartford electronically files such material

with, or furnishes it to, the SEC.

Item 1A. RISK FACTORS

Investing in The Hartford involves risk. In deciding whether to invest in The Hartford, you should carefully consider the following risk

factors, any of which could have a significant or material adverse effect on the business, financial condition, operating results or

liquidity of The Hartford. This information should be considered carefully together with the other information contained in this report

and the other reports and materials filed by The Hartford with the Securities and Exchange Commission.

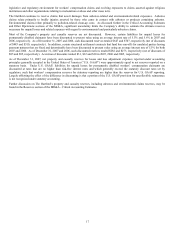

It is difficult for us to predict our potential exposure for asbestos and environmental claims, and our ultimate liability may exceed our

currently recorded reserves, which may have a material adverse effect on our operating results, financial condition and liquidity.

We continue to receive asbestos and environmental claims. Significant uncertainty limits the ability of insurers and reinsurers to

estimate the ultimate reserves necessary for unpaid losses and related expenses for both environmental and particularly asbestos claims.

We believe that the actuarial tools and other techniques we employ to estimate the ultimate cost of claims for more traditional kinds of

insurance exposure are less precise in estimating reserves for our asbestos and environmental exposures. Traditional actuarial reserving

techniques cannot reasonably estimate the ultimate cost of these claims, particularly during periods where theories of law are in flux.

Accordingly, the degree of variability of reserve estimates for these exposures is significantly greater than for other more traditional

exposures. It is also not possible to predict changes in the legal and legislative environment and their effect on the future development

of asbestos and environmental claims. Although potential Federal asbestos-related legislation has been considered in the Senate, it is

uncertain whether such legislation will be reconsidered or enacted in the future and, if so, what its effect would be on our aggregate

asbestos liabilities. Because of the significant uncertainties that limit the ability of insurers and reinsurers to estimate the ultimate

reserves necessary for unpaid losses and related expenses for both environmental and particularly asbestos claims, the ultimate

liabilities may exceed the currently recorded reserves. Any such additional liability cannot be reasonably estimated now but could have

a material adverse effect on our consolidated operating results, financial condition and liquidity.

The occurrence of one or more terrorist attacks in the geographic areas we serve or the threat of terrorism in general may have a

material adverse effect on our business, consolidated operating results, financial condition or liquidity.

The occurrence of one or more terrorist attacks in the geographic areas we serve could result in substantially higher claims under our

insurance policies than we have anticipated. Private sector catastrophe reinsurance is extremely limited and generally unavailable for

terrorism losses caused by attacks with nuclear, biological, chemical or radiological weapons. Reinsurance coverage from the federal

government under the Terrorism Risk Insurance Program Reauthorization Act of 2007 is also limited. Accordingly, the effects of a

terrorist attack in the geographic areas we serve may result in claims and related losses for which we do not have adequate reinsurance.

This would likely cause us to increase our reserves, adversely affect our earnings during the period or periods affected and, if

significant enough, could adversely affect our liquidity and financial condition. Further, the continued threat of terrorism and the

occurrence of terrorist attacks, as well as heightened security measures and military action in response to these threats and attacks, may