The Hartford 2007 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-43

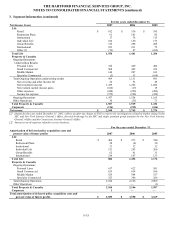

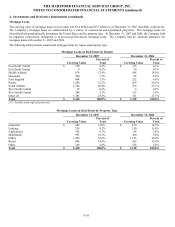

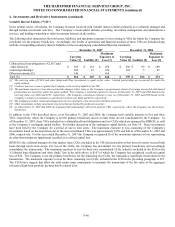

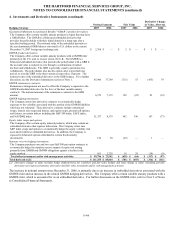

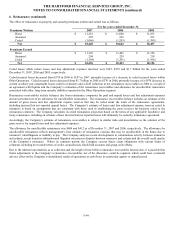

4. Investments and Derivative Instruments (continued)

Notional Amount

Fair Value

Derivative Change

in Value, After-tax

Hedging Strategy 2007 2006 2007 2006 2007 2006

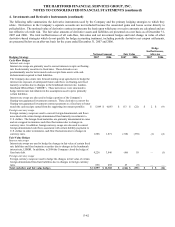

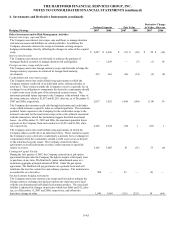

Other Investment and/or Risk Management Activities

Interest rate swaps, caps and floors

The Company uses interest rate swaps, caps and floors to manage duration

risk between assets and liabilities in certain portfolios. In addition, the

Company enters into interest rate swaps to terminate existing swaps in

hedging relationships, thereby offsetting the changes in value of the original

swap.

$

9,287

$

6,560

$

(17)

$

(30)

$

20

$

(34)

Interest rate forwards

The Company uses interest rate forwards to replicate the purchase of

mortgage-backed securities to manage duration risk and liquidity.

—

1,269

—

(7)

(1)

10

Foreign currency swaps and forwards

The Company enters into foreign currency swaps and forwards to hedge the

foreign currency exposures in certain of its foreign fixed maturity

investments.

412

663

(14)

(14)

(9)

(8)

Credit default and total return swaps

The Company enters into credit default swap agreements in which the

Company assumes credit risk of an individual entity, referenced index or

asset pool. These contracts entitle the Company to receive a periodic fee in

exchange for an obligation to compensate the derivative counterparty should

a credit event occur on the part of the referenced security issuers. The

maximum potential future exposure to the Company is the notional value of

the swap contracts, which is $1,857 and $1,203, after-tax, as of December 31,

2007 and 2006, respectively.

2,857

1,852

(416)

(184)

(134)

30

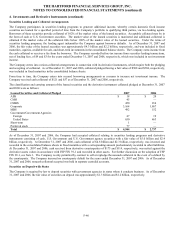

The Company also assumes credit risk through total return and credit index

swaps which reference a specific index or collateral portfolio. The maximum

potential future exposure to the Company for the credit index swaps is the

notional value and for the total return swaps is the cash collateral associated

with the transaction, which has termination triggers that limit investment

losses. As of December 31, 2007 and 2006, the maximum potential future

exposure to the Company from such contracts is $1,013 and $1,386, after-

tax, respectively.

2,306

2,674

(70)

1

(83)

1

The Company enters into credit default swap agreements, in which the

Company reduces credit risk to an individual entity. These contracts require

the Company to pay a derivative counterparty a periodic fee in exchange for

compensation from the counterparty should a credit event occur on the part

of the referenced security issuer. The Company entered into these

agreements as an efficient means to reduce credit exposure to specified

issuers or sectors.

5,166

3,085

81

(11)

55

(6)

Contingent Capital Facility

During the first quarter of 2007, the Company entered into a put option

agreement that provides the Company the right to require a third party trust

to purchase, at any time, The Hartford’ s junior subordinated notes in a

maximum aggregate principal amount of $500. Under the put option

agreement, The Hartford will pay premiums on a periodic basis and will

reimburse the trust for certain fees and ordinary expenses. The instrument is

accounted for as a derivative.

500

—

43

—

(2)

—

Yen fixed annuity hedging instruments

The Company enters into currency rate swaps and forwards to mitigate the

foreign currency exchange rate and yen interest rate exposures associated

with the yen denominated individual fixed annuity product. The associated

liability is adjusted for changes in spot rates which was $(66) and $12, after-

tax, as of December 31, 2007 and 2006, respectively, and offsets the

derivative change in value.

1,849

1,869

(115)

(225)

34

(64)