The Hartford 2007 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157

Interest rate cap and floor contracts entitle the purchaser to receive from the issuer at specified dates, the amount, if any, by which a

specified market rate exceeds the cap strike interest rate or falls below the floor strike interest rate, applied to a notional principal

amount. A premium payment is made by the purchaser of the contract at its inception and no principal payments are exchanged.

Forward contracts are customized commitments to either purchase or sell designated financial instruments, at a future date, for a

specified price and may be settled in cash or through delivery of the underlying instrument.

Financial futures are standardized commitments to either purchase or sell designated financial instruments, at a future date, for a

specified price and may be settled in cash or through delivery of the underlying instrument. Futures contracts trade on organized

exchanges. Margin requirements for futures are met by pledging securities, and changes in the futures’ contract values are settled daily

in cash.

Option contracts grant the purchaser, for a premium payment, the right to either purchase from or sell to the issuer a financial instrument

at a specified price, within a specified period or on a stated date.

Foreign currency swaps exchange an initial principal amount in two currencies, agreeing to re-exchange the currencies at a future date,

at an agreed upon exchange rate. There may also be a periodic exchange of payments at specified intervals calculated using the agreed

upon rates and exchanged principal amounts.

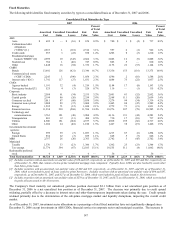

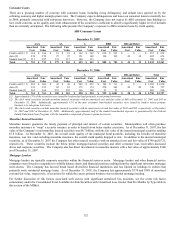

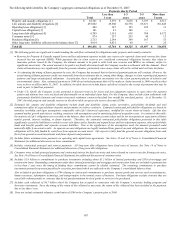

Derivative activities are monitored by an internal compliance unit and reviewed frequently by senior management. The notional

amounts of derivative contracts represent the basis upon which pay or receive amounts are calculated and are not reflective of credit

risk. Notional amounts pertaining to derivative instruments used in the management of market risk, excluding the credit derivatives as

discussed in the “Investment Credit Risk” section, at December 31, 2007 and 2006, were $101.0 billion and $78.2 billion, respectively.

The increase in the derivative notional amount during 2007 was primarily due to the derivatives associated with the GMWB product

feature. For further information, see Note 4 of Notes to Consolidated Financial Statements. For further discussion on credit derivatives,

see the “Investment Credit Risk” section.

The following discussions focus on the key market risk exposures within Life and Property & Casualty portfolios.

Life

Life is responsible for maximizing economic value within acceptable risk parameters, including the management of the interest rate

sensitivity of invested assets, while generating sufficient after-tax income to support policyholder and corporate obligations. Life’ s

fixed maturity portfolios and certain investment contracts and insurance product liabilities have material market exposure to interest rate

risk. In addition, Life’ s operations are significantly influenced by changes in the equity markets. Life’ s profitability depends largely on

the amount of assets under management, which is primarily driven by the level of sales, equity market appreciation and depreciation and

the persistency of the in-force block of business. Life’ s foreign currency exposure is primarily related to non-U.S. dollar denominated

fixed income securities, non-U.S. dollar denominated liability contracts, the investment in and net income of the Japanese Life operation

and certain foreign currency based individual fixed annuity contracts, and its GMDB, GMAB, and GMIB benefits associated with its

Japanese variable annuities.

Interest Rate Risk

Life’ s exposure to interest rate risk relates to the market price and/or cash flow variability associated with changes in market interest

rates. As stated above, changes in interest rates can potentially impact Life’ s profitability. In certain scenarios where interest rates are

volatile, Life could be exposed to disintermediation risk and a reduction in net interest rate spread or profit margins. The investments

and liabilities primarily associated with interest rate risk are included in the following discussion. Certain product liabilities, including

those containing GMWB, GMAB, or GMDB, expose the Company to interest rate risk but also have significant equity risk. These

liabilities are discussed as part of the Equity Risk section below.

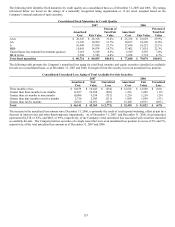

Fixed Maturity Investments

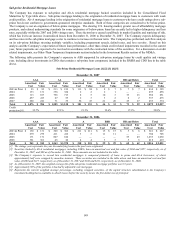

Life’ s investment portfolios primarily consist of investment grade fixed maturity securities, including corporate bonds, ABS, CMBS,

tax-exempt municipal securities and CMOs. The fair value of Life’ s fixed maturities was $52.5 billion and $52.1 billion at December

31, 2007 and 2006, respectively. The fair value of Life’ s fixed maturities and other invested assets fluctuates depending on the interest

rate environment and other general economic conditions. The weighted average duration of the fixed maturity portfolio was

approximately 4.6 and 5.1 years as of December 31, 2007 and 2006, respectively.

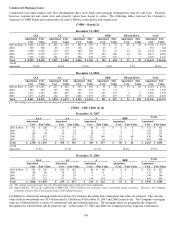

Liabilities

Life’ s investment contracts and certain insurance product liabilities, other than non-guaranteed separate accounts, include asset

accumulation vehicles such as fixed annuities, guaranteed investment contracts, other investment and universal life-type contracts and

certain insurance products such as long-term disability.

Asset accumulation vehicles primarily require a fixed rate payment, often for a specified period of time. Product examples include fixed

rate annuities with a market value adjustment feature and fixed rate guaranteed investment contracts. The duration of these contracts

generally range from less than one year to ten years. In addition, certain products such as universal life contracts and the general

account portion of Life’ s variable annuity products, credit interest to policyholders subject to market conditions and minimum interest

rate guarantees. The duration of these products is short-term to intermediate-term.