The Hartford 2007 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-56

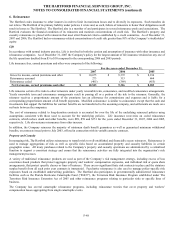

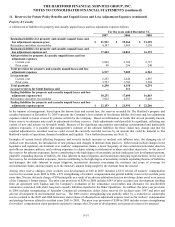

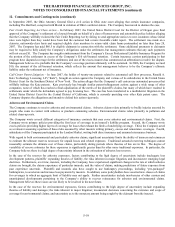

11. Reserves for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses

As described in Note 1, The Hartford establishes reserves for unpaid losses and loss adjustment expenses on reported and unreported

claims. These reserve estimates are based on known facts and interpretations of circumstances, and consideration of various internal

factors including The Hartford’ s experience with similar cases, historical trends involving claim payment patterns, loss payments,

pending levels of unpaid claims, loss control programs and product mix. In addition, the reserve estimates are influenced by

consideration of various external factors including court decisions, economic conditions and public attitudes. The effects of inflation

are implicitly considered in the reserving process.

The establishment of appropriate reserves, including reserves for catastrophes and asbestos and environmental claims, is inherently

uncertain. The Hartford regularly updates its reserve estimates as new information becomes available and events unfold that may have

an impact on unsettled claims. Changes in prior year reserve estimates, which may be material, are reflected in the results of operations

in the period such changes are determined to be necessary. For further discussion of asbestos and environmental claims, see Note 12.

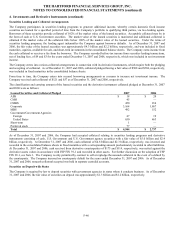

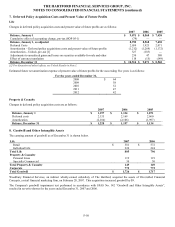

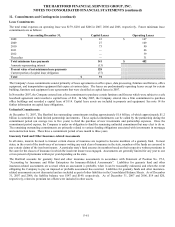

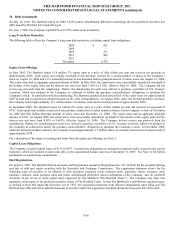

Life

The following table displays the development of the loss reserves (included in reserve for future policy benefits and unpaid losses and

loss adjustment expenses in the Consolidated Balance Sheets) resulting primarily from group disability products.

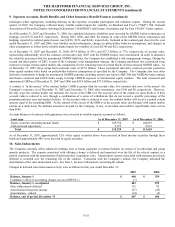

For the years ended December 31,

2007 2006 2005

Beginning liabilities for life unpaid losses and loss adjustment expenses-gross $4,985 $ 4,832 $ 4,714

Reinsurance recoverables 233 238 297

Beginning liabilities for life unpaid losses and loss adjustment expenses 4,752 4,594 4,417

Add provision for life unpaid losses and loss adjustment expenses

Current year 2,127 2,140 1,994

Prior years (65) (128) (112)

Total provision for life unpaid losses and loss adjustment expenses 2,062 2,012 1,882

Less payments

Current year 758 724 645

Prior years 1,221 1,130 1,060

Total payments 1,979 1,854 1,705

Ending liabilities for life unpaid losses and loss adjustment expenses 4,835 4,752 4,594

Reinsurance recoverables 257 233 238

Ending liabilities for life unpaid losses and loss adjustment expenses-gross $5,092 $ 4,985 $ 4,832

The favorable prior year claim development in 2007 and 2006 is principally due to continued strong disability claims management as

well as favorable development on the experience rated financial institutions block. The favorable loss experience on the financial

institutions block inversely impacts the commission expenses incurred.

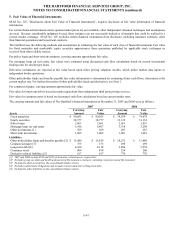

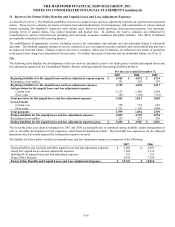

The liability for future policy benefits and unpaid losses and loss adjustment expenses is comprised of the following:

2007 2006

Group Disability and Accident and Other unpaid losses and loss adjustment expenses $ 5,092 $ 4,985

Group Life unpaid losses and loss adjustment expenses 1,205 1,132

Individual Life unpaid losses and loss adjustment expenses 121 110

Future Policy Benefits 8,913 7,789

Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses $ 15,331 $ 14,016