The Hartford 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

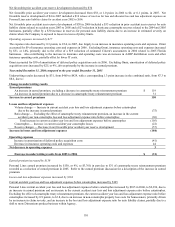

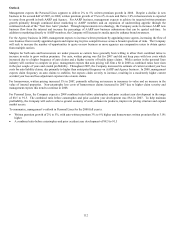

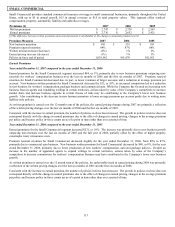

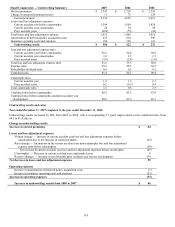

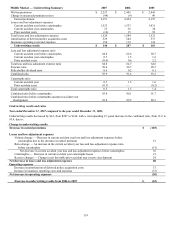

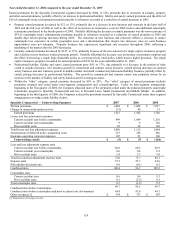

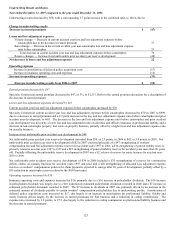

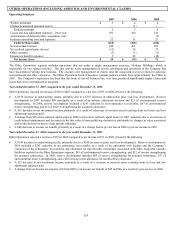

Earned premium decreased by $103

Middle Market earned premium decreased by $103, or 4%, to $2,351. Refer to the earned premium discussion for a description of the

decrease in earned premium.

Losses and loss adjustment expenses decreased by $60

Current accident year loss and loss adjustment expenses before catastrophes decreased by $10

Middle Market current accident year loss and loss adjustment expenses before catastrophes decreased by $10 in 2007, to $1,523, due to

a decrease in earned premium, largely offset by the effect of an increase in the current accident year loss and loss adjustment expense

ratio before catastrophes. Before catastrophes, the current accident year loss and loss adjustment expense ratio increased by 2.2 points,

to 64.8, primarily due to a higher loss and loss adjustment expense ratio for workers’ compensation, general liability and commercial

auto claims driven, in part, by earned pricing decreases. For commercial auto, loss costs increased for both liability and property

damage claims.

Current accident year catastrophes decreased by $21

Current accident year catastrophe losses decreased by $21, from $36, or 1.5 points, in 2006 to $15, or 0.7 points, in 2007. Compared to

2007, there were more severe catastrophes in 2006, including tornadoes and hail storms in the Midwest and windstorms in Texas and on

the East coast. The largest catastrophe losses in 2007 were from spring windstorms in the Southeast and wildfires in California.

Change to favorable prior accident year development by $29

Prior accident year reserve development changed from net unfavorable prior accident year reserve development of $15, or 0.6 points, in

2006 to net favorable prior accident year reserve development of $14, or 0.6 points, in 2007. Net favorable reserve development of $14

in 2007 included a $49 release of general liability loss and loss adjustment expense reserves for accident years 2003 to 2006 and an $18

release of commercial auto liability reserves for accident years 2003 and 2004, partially offset by a $40 strengthening of workers’

compensation reserves for accident years 1973 & prior and a $14 strengthening of general liability reserves for accident years more than

20 years old.

Net unfavorable reserve development of $15 in 2006 consisted primarily of a $20 increase in general liability loss and loss adjustment

expense reserves related to accident years 1998 to 2005 and a $10 increase in construction defect reserves, partially offset by a $25

reduction in allocated loss adjustment expense reserves for workers’ compensation business related to accident years 2003 to 2005.

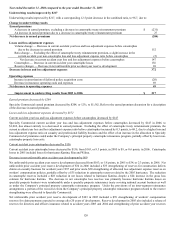

Operating expenses increased by $20

The 1.7 point increase in the expense ratio and the 0.4 point increase in the policyholder dividend ratio was primarily due to an increase

in insurance operating costs and expenses and the decrease in earned premiums. Insurance operating costs and expenses increased by

$35, partially due to the effect of a $12 reduction of estimated Citizens’ assessments related to the 2005 Florida hurricanes recorded in

2006. Also contributing to the increase in insurance operating costs and expenses was an increase in IT costs, an increase in non-

deferrable salaries and benefits, and an $8 increase in policyholder dividends. The increase in policyholder dividends was largely due to

an $8 increase in the estimated amount of dividends payable to certain workers’ compensation policyholders due to underwriting profits.

Amortization of deferred policy acquisition costs decreased by $15, due largely to the decrease in earned premium and corresponding

decrease in acquisition costs.