The Hartford 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

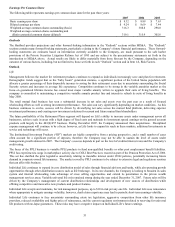

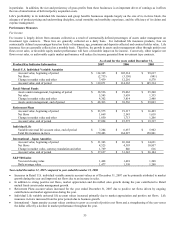

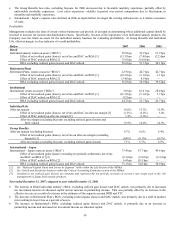

Earnings Per Common Share

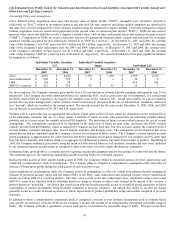

The following table represents earnings per common share data for the past three years:

2007 2006 2005

Basic earnings per share $9.32 $ 8.89 $ 7.63

Diluted earnings per share $9.24 $ 8.69 $ 7.44

Weighted average common shares outstanding (basic) 316.3 308.8 298.0

Weighted average common shares outstanding and

dilutive potential common shares (diluted)

319.1

315.9

305.6

Outlooks

The Hartford provides projections and other forward-looking information in the “Outlook” sections within MD&A. The “Outlook”

sections contain many forward-looking statements, particularly relating to the Company’s future financial performance. These forward-

looking statements are estimates based on information currently available to the Company, are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995 and are subject to the precautionary statements set forth in the

introduction to MD&A above. Actual results are likely to differ materially from those forecast by the Company, depending on the

outcome of various factors, including, but not limited to, those set forth in each “Outlook” section and in Item 1A, Risk Factors.

Outlook

Life

Management believes the market for retirement products continues to expand as individuals increasingly save and plan for retirement.

Demographic trends suggest that as the “baby boom” generation matures, a significant portion of the United States population will

allocate a greater percentage of their disposable incomes to saving for their retirement years due to uncertainty surrounding the Social

Security system and increases in average life expectancy. Competition continues to be strong in the variable annuities market as the

focus on guaranteed lifetime income has caused most major variable annuity writers to upgrade their suite of living benefits. The

company is committed to maintaining a competitive variable annuity product line and intends to refresh its suite of living benefits in

May 2008.

The retail mutual fund business has seen a substantial increase in net sales and assets over the past year as a result of focused

wholesaling efforts as well as strong investment performance. Net sales can vary significantly depending on market conditions. As this

business continues to evolve, success will be driven by diversifying net sales across the mutual fund platform, delivering superior

investment performance and creating new investment solutions for current and future mutual fund shareholders.

The future profitability of the Retirement Plans segment will depend on Life’ s ability to increase assets under management across all

businesses, achieve scale in areas with a high degree of fixed costs and maintain its investment spread earnings on the general account

products sold largely in the 403(b)/457 business. During December 2007, the Company announced three acquisitions. Disciplined

expense management will continue to be a focus; however, as Life looks to expand its reach in these markets, additional investments in

service and technology will occur.

The Institutional Investment Products (“IIP”) markets are highly competitive from a pricing perspective, and a small number of cases

often account for a significant portion of deposits, therefore the Company may not be able to sustain the level of assets under

management growth attained in 2007. The Company’ s success depends in part on the level of credited interest rates and the Company’ s

credit rating.

The focus of the PPLI business is variable PPLI products to fund non-qualified benefits or other post employment benefit liabilities.

PPLI has experienced a surge in marketplace activity due to COLI Best Practices enacted as part of the Pension Protection Act of 2006.

This act has clarified the prior legislative uncertainty relating to insurable interest under COLI policies, potentially increasing future

demand in corporate owned life insurance. The market served by PPLI continues to be subject to extensive legal and regulatory scrutiny

that can affect this business.

Individual Life continues to expand its core distribution model of sales through financial advisors and banks, while also pursuing growth

opportunities through other distribution sources such as life brokerage. In its core channels, the Company is looking to broaden its sales

system and internal wholesaling, take advantage of cross selling opportunities and extend its penetration in the private wealth

management services areas. Variable universal life mix remained strong during the year ended December 31, 2007. Future sales will be

driven by the Company’ s management of current distribution relationships and development of new sources of distribution while

offering competitive and innovative new products and product features.

Individual Life accepts and maintains, for risk management purposes, up to $10 in risk per any one life. Individual Life uses reinsurance

where appropriate to mitigate earnings volatility; however, death claim experience may lead to periodic short-term earnings volatility.

Individual Life continues to face uncertainty surrounding estate tax legislation, aggressive competition from other life insurance

providers, reduced availability and higher price of reinsurance, and the current regulatory environment related to reserving for universal

life products with no-lapse guarantees. These risks may have a negative impact on Individual Life’ s future earnings.