The Hartford 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

agents are seeking competitive quotes for renewals more frequently, particularly for larger accounts within small commercial. Many

companies in the industry are trying to increase sales by appointing more agents or by expanding business with existing agents.

The Hartford is the sixth largest commercial lines insurer in the United States based on direct written premiums for the year ended

December 31, 2006 according to A.M. Best. The relatively large size and underwriting capacity of The Hartford provide opportunities

not available to smaller insurers

Middle Market

Middle Market provides standard commercial insurance coverage to middle market commercial businesses primarily throughout the

United States. Middle market businesses generally represent companies with greater than $5 in annual payroll, $15 in annual revenues

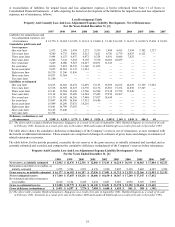

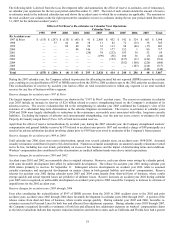

or $15 in total property values. Earned premiums for 2007, 2006 and 2005 were $2.4 billion, $2.5 billion and $2.4 billion, respectively.

The segment had underwriting income of $144, $207 and $163 in 2007, 2006 and 2005, respectively.

Principal Products

Middle Market offers workers’ compensation, property, automobile, liability, umbrella and marine coverages under several different

products. Workers’ compensation insurance accounts for the largest share of the written premium in the Middle Market segment.

Marketing and Distribution

Middle Market provides insurance products and services through its home office located in Hartford, Connecticut, and multiple

domestic regional office locations and insurance centers. The segment markets its products nationwide utilizing brokers and

independent agents. Brokers and independent agents are not employees of The Hartford.

Competition

The middle market commercial insurance marketplace is a highly competitive environment regarding product, price and service. The

Hartford competes against a number of large, national carriers as well as regional insurers in certain territories. Competitors include

other stock companies, mutual companies and alternative risk sharing groups. These competitors sell primarily through independent

agents and brokers across a broad array of product lines, and with a high level of variation regarding geographic, marketing and

customer segmentation.

Middle Market business is characterized as "high touch" with case-by-case underwriting and pricing decisions. As such, compared to

Small Commercial, the pricing of Middle Market accounts is prone to more significant variation or cyclicality from year to year.

Legislative reforms in a number of states in recent years have helped to control indemnity costs on workers' compensation claims, but

this have also led to rate reductions in many states. In addition, companies writing middle market business will likely continue to

experience a reduction in average premium size due to continued price competition.

Soft market conditions, characterized by highly competitive pricing on new business, have lessened the number of new business

opportunities as carriers look to secure their renewals early. In the soft market, we are seeing an increase in industry specialization by

agents and brokers which has placed even greater importance on the carrier’s need to demonstrate industry expertise to win new

business. To win new business, some companies sought to differentiate themselves in the marketplace in 2007 by paying higher

commissions to agents and management expects this trend to continue in 2008. To manage their exposure to catastrophe losses, a

number of companies have been reducing their property catastrophe-exposed business in certain states.

The Hartford is the sixth largest commercial lines insurer in the United States based on direct written premiums for the year ended

December 31, 2006 according to A.M. Best. The relatively large size and underwriting capacity of The Hartford provide opportunities

not available to smaller companies.

Specialty Commercial

Specialty Commercial provides a wide variety of property and casualty insurance products and services to large commercial clients

requiring specialized coverages. Excess and surplus lines coverages not normally written by standard line insurers are also provided,

primarily through wholesale brokers. Specialty Commercial had earned premiums of $1.5 billion, $1.6 billion and $1.8 billion in 2007,

2006 and 2005, respectively. Underwriting income (loss) was $(5), $53 and $(164) in 2007, 2006 and 2005, respectively.

Principal Products

Specialty Commercial offers a variety of customized insurance products and risk management services. Specialty Commercial

provides standard commercial insurance products including workers’ compensation, automobile and liability coverages to large-sized

companies. Specialty Commercial also provides fidelity, surety, professional liability, specialty casualty and livestock coverages as

well as property excess and surplus lines coverages not normally written by standard lines insurers. A significant portion of specialty

casualty business, including workers’ compensation business, is written through large deductible programs where the insured typically

provides collateral to support loss payments made within their deductible. The specialty casualty business also provides

retrospectively-rated programs where the premiums are adjustable based on loss experience. Alternative markets, within Specialty

Commercial, provides insurance products and services primarily to captive insurance companies, pools and self-insurance groups. In

addition, Specialty Commercial provides third-party administrator services for claims administration, integrated benefits and loss

control through Specialty Risk Services, LLC, a subsidiary of the Company.