The Hartford 2007 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-46

4. Investments and Derivative Instruments (continued)

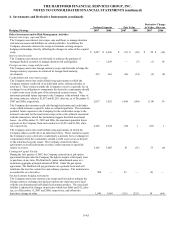

Securities Lending and Collateral Arrangements

The Company participates in securities lending programs to generate additional income, whereby certain domestic fixed income

securities are loaned for a specified period of time from the Company’ s portfolio to qualifying third parties, via two lending agents.

Borrowers of these securities provide collateral of 102% of the market value of the loaned securities. Acceptable collateral may be in

the form of cash or U.S. Government securities. The market value of the loaned securities is monitored and additional collateral is

obtained if the market value of the collateral falls below 100% of the market value of the loaned securities. Under the terms of

securities lending programs, the lending agent indemnifies the Company against borrower defaults. As of December 31, 2007 and

2006, the fair value of the loaned securities was approximately $4.3 billion and $2.2 billion, respectively, and was included in fixed

maturities, equities, available for sale, and short-term investments in the consolidated balance sheets. The Company earns income from

the cash collateral or receives a fee from the borrower. The Company recorded before-tax income from securities lending transactions,

net of lending fees, of $9 and $3 for the years ended December 31, 2007 and 2006, respectively, which was included in net investment

income.

The Company enters into various collateral arrangements in connection with its derivative instruments, which require both the pledging

and accepting of collateral. As of December 31, 2007 and 2006, collateral pledged having a fair value of $508 and $504, respectively,

was included in fixed maturities in the consolidated balance sheets.

From time to time, the Company enters into secured borrowing arrangements as a means to increase net investment income. The

Company received cash collateral of $121 and $57 as of December 31, 2007 and 2006, respectively.

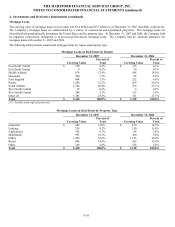

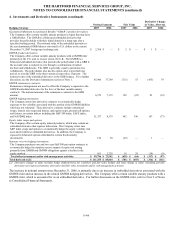

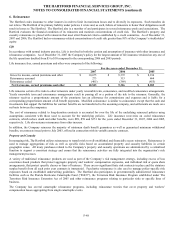

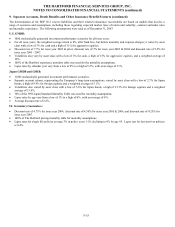

The classification and carrying amount of the loaned securities and the derivative instrument collateral pledged at December 31, 2007

and 2006 were as follows:

Loaned Securities and Collateral Pledged 2007 2006

ABS $ 18 $ 20

CMO 45 —

CMBS 450 216

Corporate 3,164 1,867

MBS 492 152

Government/Government Agencies

Foreign 47 19

United States 650 463

Short-term 1 —

Preferred stock 77 —

Total $4,944 $2,737

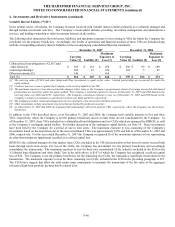

As of December 31, 2007 and 2006, the Company had accepted collateral relating to securities lending programs and derivative

instruments consisting of cash, U.S. Government and U.S. Government agency securities with a fair value of $5.0 billion and $2.4

billion, respectively. At December 31, 2007 and 2006, cash collateral of $4.8 billion and $2.3 billion, respectively, was invested and

recorded in the consolidated balance sheets in fixed maturities with a corresponding amount predominately recorded in other liabilities.

At December 31, 2007 and 2006, cash received from derivative counterparties of $175 and $114, respectively, was netted against the

derivative assets values in accordance with FSP FIN 39-1 and recorded in other assets. For further discussion on the adoption of FSP

FIN 39-1, see Note 1. The Company is only permitted by contract to sell or repledge the noncash collateral in the event of a default by

the counterparty. The Company incurred no counterparty default for the years ended December 31, 2007 and 2006. As of December

31, 2007 and 2006, noncash collateral accepted was held in separate custodial accounts.

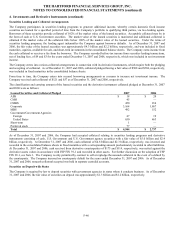

Securities on Deposit with States

The Company is required by law to deposit securities with government agencies in states where it conducts business. As of December

31, 2007 and 2006, the fair value of securities on deposit was approximately $1.3 billion and $1.2 billion, respectively.