The Hartford 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

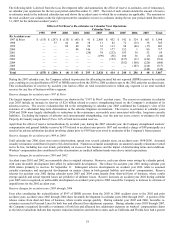

As of September 30, 2007 The Hartford is ranked number four in total premium sales of life insurance and number thirteen in

annualized premium according to LIMRA’ s quarterly U.S. Individual Life Insurance Sales Survey.

Group Benefits

The Group Benefits segment provides individual members of employer groups, associations, affinity groups and financial institutions

with group life, accident and disability coverage, along with other products and services, including voluntary benefits, and group retiree

health. Life ranks number two in fully-insured group disability premium and moved up to number three in fully-insured life premium

of U.S. group carriers (according to LIMRA data as of June 30, 2007). The Company also offers disability underwriting,

administration, claims processing services and reinsurance to other insurers and self-funded employer plans. Generally, policies sold in

this segment are term insurance. This allows the Company to adjust the rates or terms of its policies in order to minimize the adverse

effect of various market trends, including declining interest rates and other factors. Typically policies are sold with one-, two- or three-

year rate guarantees depending upon the product. In the disability market, the Company focuses on its risk management expertise and

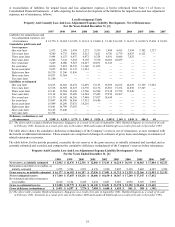

on efficiencies and economies of scale to derive a competitive advantage. Group Benefits generated fully insured ongoing premiums of

$4.2 billion, $4.1 billion and $3.7 billion in 2007, 2006 and 2005, respectively, of which group disability insurance accounted for $1.9

billion, $1.8 billion and $1.7 billion in 2007, 2006 and 2005, respectively, and group life insurance accounted for $1.9 billion, $1.8

billion and $1.6 billion for the year ended December 31, 2007, 2006 and 2005, respectively. The Company held group disability

reserves of $4.6 billion, $4.5 billion and $4.4 billion and group life reserves of $1.3 billion, $1.3 billion and $1.3 billion as of December

31, 2007, 2006 and 2005, respectively. Total assets for Group Benefits were $9.3 billion and $9.0 billion as of December 31, 2007 and

2006, respectively. Total revenues in Group Benefits was $4.7 billion, $4.6 billion and $4.2 billion, during 2007, 2006 and 2005,

respectively. Net income in Group Benefits was $315, $298 and $266 in 2007, 2006 and 2005, respectively.

Principal Products

Group Disability — Life is one of the largest carriers in the “large case” market of the group disability insurance business. Life’ s

strong market presence in the group disability markets is the result of its well known brand recognition and reputation, financial

strength and stability and Life’ s approach to claims management. Life also offers voluntary, or employee-paid, short-term and long-

term disability group benefits. Life’ s efforts in the group disability market focus on early intervention, return-to-work programs and

successful rehabilitation, offering the support to help claimants return to an active, productive life after a disability. Life also works

with disability claimants to improve their approval rate for Social Security Assistance (i.e., reducing payment of benefits by the amount

of Social Security payments received).

Life’ s short-term disability benefit plans provide a weekly benefit amount (typically 60% to 70% of the insured’ s earned income up to a

specified maximum benefit) to insureds when they are unable to work due to an accident or illness. Long-term disability insurance

provides a monthly benefit for those extended periods of time not covered by a short-term disability benefit plan when insureds are

unable to work due to disability. Insureds may receive total or partial disability benefits. Most of these policies begin providing

benefits following a 90- or 180-day waiting period and generally continue providing benefits until the insured reaches age 65. Long-

term disability benefits are paid monthly and are limited to a portion, generally 50-70%, of the insured’ s earned income up to a

specified maximum benefit.

Group Life and Accident — Group term life insurance provides term coverage to employees and members of associations, affinity

groups and financial institutions and their dependents for a specified period and has no accumulation of cash values. Life offers options

for its basic group life insurance coverage, including portability of coverage and a living benefit and critical illness option, whereby

terminally ill policyholders can receive death benefits in advance. Life also offers voluntary, or employee-paid, life group benefits and

accidental death and dismemberment coverage either packaged with life insurance or on a stand-alone basis.

Other — Life offers a host of other products and services, such as Family and Medical Leave Act Administration, group retiree health,

and specialized insurance products for physicians. Life also provides travel accident, hospital indemnity, supplemental health insurance

for military personnel and their families and other coverages to individual members of various associations, affinity groups, financial

institutions and employee groups. Prior to the second quarter of 2007, Life provided excess of loss medical coverage (known as

medical stop loss insurance) to employers who self-fund their medical plans and pay claims using the services of a third party

administrator. In the second quarter of 2007, Life entered into a renewal rights arrangement on its medical stop loss coverage business.

As a result of this transaction, the existing policies in-force will diminish as contracts expire into 2008.

Marketing and Distribution

Life uses an experienced group of Company employees, managed through a regional sales office system, to distribute its group

insurance products and services through a variety of distribution outlets, including brokers, consultants, third-party administrators and

trade associations.

Competition

The Group Benefits business remains highly competitive. Competitive factors primarily affecting Group Benefits are the variety and

quality of products and services offered, the price quoted for coverage and services, Life’ s relationships with its third-party distributors,

and the quality of customer service. In addition, there has been an increase in the length of rate guarantee periods being offered in the

market and top tier carriers are offering on-line and self service capabilities to agents and consumers. Group Benefits competes with

numerous other insurance companies and other financial intermediaries marketing insurance products. However, many of these