The Hartford 2007 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-65

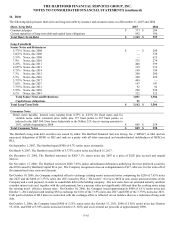

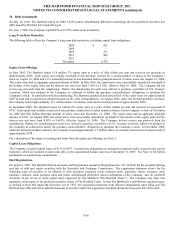

14. Debt

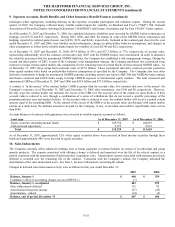

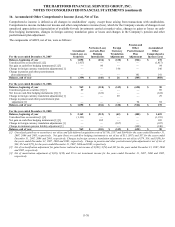

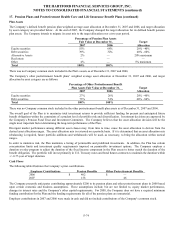

The following table presents short-term and long-term debt by issuance and consumer notes as of December 31, 2007 and 2006.

Short-Term Debt 2007 2006

Commercial paper $ 373 $ 299

Current maturities of long-term debt and capital lease obligations 992 300

Total Short-Term Debt $ 1,365 $ 599

Long-Term Debt

Senior Notes and Debentures

6.375% Notes, due 2008 $ — $ 200

5.663% Notes, due 2008 — 330

5.55% Notes, due 2008 — 425

7.9% Notes, due 2010 275 274

5.25% Notes, due 2011 400 399

4.625% Notes, due 2013 319 319

4.75% Notes, due 2014 199 199

7.3% Notes, due 2015 200 200

5.5% Notes, due 2016 300 299

5.375% Notes, due 2017 499 —

7.65% Notes, due 2027 147 147

7.375% Notes, due 2031 92 92

5.95% Notes, due 2036 298 298

6.1% Notes, due 2041 322 322

Total Senior Notes and Debentures 3,051 3,504

Capital lease obligations

91

—

Total Long-Term Debt $ 3,142 $ 3,504

Consumer Notes

Retail notes payable, interest rates ranging from 4.75% to 6.25% for fixed notes and for

variable notes, either consumer price index plus 157 basis points to 267 basis points, or

indexed to the S&P 500, Dow Jones Industrials or the Nikkei 225, due in varying amounts to

2031, callable beginning in 2008

$

809

$

258

Total Consumer Notes $ 809 $ 258

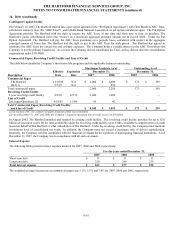

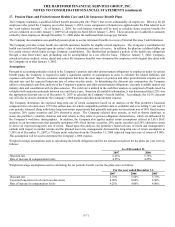

The Hartford’ s long-term debt securities are issued by either The Hartford Financial Services Group, Inc. (“HFSG”) or HLI and are

unsecured obligations of HFSG or HLI and rank on a parity with all other unsecured and unsubordinated indebtedness of HFSG or

HLI.

On September 1, 2007, The Hartford repaid $300 of 4.7% senior notes at maturity.

On March 9, 2007, The Hartford issued $500 of 5.375% senior notes due March 15, 2017.

On December 15, 2006, The Hartford redeemed its $200 7.1% senior notes due 2007 at a price of $202 plus accrued and unpaid

interest.

On November 17, 2006, The Hartford retired its $500 7.45% junior subordinated debentures underlying the trust preferred securities

due 2050 issued by Hartford Capital III at par. The Company recognized a loss on extinguishment of $17, after-tax, for the write-off of

the unamortized issue costs and discount.

On October 10, 2006, the Company completed offers to exchange existing senior unsecured notes comprising the $250 of 7.65% notes

due 2027 and the $400 of 7.375% notes due 2031 issued by HLI (‘‘HLI notes’ ’ ) for up to $650 in new senior unsecured notes of the

Company and a cash payment, in order to consolidate debt at the holding company. The new notes have an extended maturity and bear

a market interest rate and, together with the cash payment, have a present value not significantly different than the existing notes using

the existing notes’ effective interest rates. On October 10, 2006, the Company issued approximately $409 of 6.1% senior notes due

October 1, 2041 and paid cash totaling $85 in exchange for $101 of the 7.65% notes due 2027 and $308 of the 7.375% notes due 2031.

Cash paid to holders of HLI notes in connection with the exchange offers is reflected on our balance sheet as a reduction of long-term

debt.

On October 3, 2006, the Company issued $400 of 5.25% senior notes due October 15, 2011, $300 of 5.50% senior notes due October

15, 2016, and $300 of 5.95% senior notes due October 15, 2036, and received total net proceeds of approximately $990.