The Hartford 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

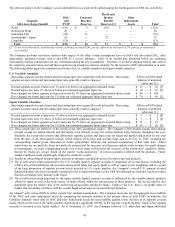

the use of internally developed models, which run a large number of stochastically determined scenarios of separate account fund

performance. Incorporated in each scenario are assumptions with respect to lapse rates, mortality and expenses, based on the Company’ s

most recent assumption study. These scenarios are run for the Company’ s individual variable annuity businesses in the United States

and Japan, the Company’ s Retirement Plans businesses, and for the Company’ s individual variable universal life business and are used

to calculate statistically significant ranges of reasonable EGPs. The statistical ranges produced from the stochastic scenarios are

compared to the present value of EGPs used in the Company’ s models. If EGPs used in the Company’s models fall outside of the

statistical ranges of reasonable EGPs, an “unlock” would be necessary. If EGPs used in the Company’ s models fall inside of the

statistical ranges of reasonable EGPs, the Company will not solely rely on the results of the quantitative analysis to determine the

necessity of an unlock. In addition, the Company considers, on a quarterly basis, other qualitative factors such as market, product,

regulatory and policyholder behavior trends and may also revise EGPs if those trends are expected to be significant and were not or

could not be included in the statistically significant ranges of reasonable EGPs. As of January 31, 2008, separate account returns have

been unfavorable in comparison to expectations from July 31, 2007 to January 31, 2008. Before an unlock was required in the U.S. or

Japan, separate account returns would need to be approximately three times as unfavorable in comparison to expectations as they were at

January 31, 2008.

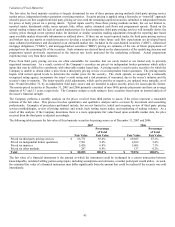

Unlock and Sensitivity Analysis

During the third quarter of 2007 and the fourth quarter of 2006, the Company completed an annual, comprehensive study of

assumptions underlying EGPs, resulting in an “unlock”. The study covered all assumptions, including mortality, lapses, expenses,

hedging costs, and separate account returns, in substantially all product lines. The new best estimate assumptions were applied to the

current in-force to project future gross profits.

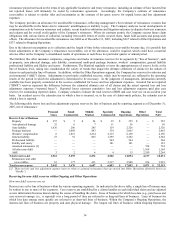

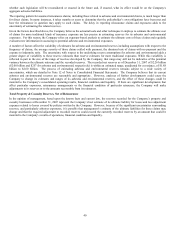

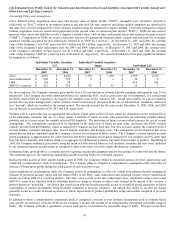

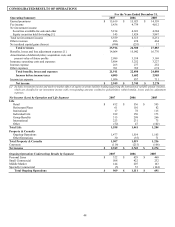

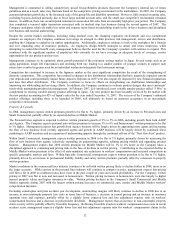

The after-tax impact on the Company’ s assets and liabilities as a result of the unlock during the third quarter of 2007 was as follows:

Segment

After-tax (charge) benefit

DAC

and

PVFP

Unearned

Revenue

Reserves

Death and

Income

Benefit

Reserves [1]

Sales

Inducement

Assets

Total [2]

Retail $ 180 $ (5) $ (4) $ 9 $ 180

Retirement Plans (9) — — — (9)

Institutional 1 — — — 1

Individual Life 24 (8) — — 16

International – Japan 16 — 6 — 22

Corporate 3 — — — 3

Total $ 215 $ (13) $ 2 $ 9 $ 213

[1] As a result of the unlock, death benefit reserves, in Retail, decreased $4, pre-tax, offset by a decrease of $10, pre-tax, in reinsurance

recoverables.

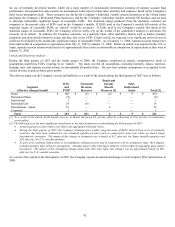

[2] The following were the most significant contributors to the unlock amounts recorded during the third quarter of 2007:

• Actual separate account returns were above our aggregated estimated return.

• During the third quarter of 2007, the Company estimated gross profits using the mean of EGPs derived from a set of stochastic

scenarios that have been calibrated to our estimated separate account return as compared to prior year where we used a single

deterministic estimation. The impact of this change in estimation was a benefit of $13, after-tax, for Japan variable annuities and

$20, after-tax, for U.S. variable annuities.

• As part of its continual enhancement to its assumption setting processes and in connection with its assumption study, the Company

included dynamic lapse behavior assumptions. Dynamic lapses reflect that lapse behavior will be different depending upon market

movements. The impact of this assumption change along with other base lapse rate changes was an approximate benefit of $40,

after-tax, for U.S. variable annuities.

As a result of the unlock in the third quarter of 2007, the Company expects an immaterial change to total Company DAC amortization in

2008.