The Hartford 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

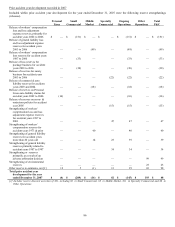

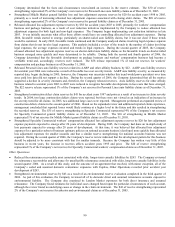

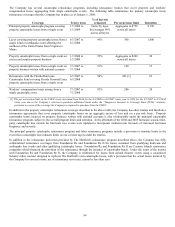

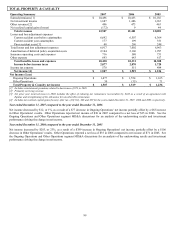

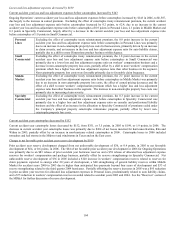

The Company’s modeled loss estimates are derived by averaging 21 modeled loss events representing a 250-year return period loss. For

the peril of earthquake, the 21 events averaged to determine the modeled loss estimate include events occurring in the Northwestern,

Northeastern, Southeastern and Midwestern regions of the United States with associated magnitudes ranging from 6.5 to 8.5 on the

Richter scale. For the peril of hurricane, the 21 events averaged to determine the modeled loss estimate include category 3, 4 and 5

events in Florida as well as other Southeastern, Northeastern and Gulf region landfalls.

Hurricane Earthquake

Before

Reinsurance

Net of

Expected

Reinsurance

Recoveries

Before

Reinsurance

Net of Expected

Reinsurance

Recoveries

Estimated 250-year probable maximum

loss, before-tax

$2,202

$683

$1,099

$286

Percentage of statutory surplus of the

Property & Casualty operations as of

December 31, 2007

8%

3%

Terrorism

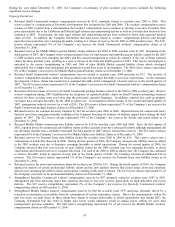

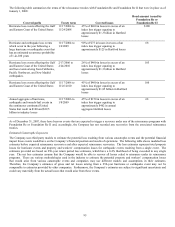

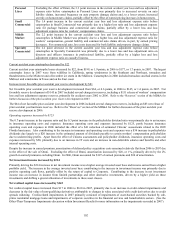

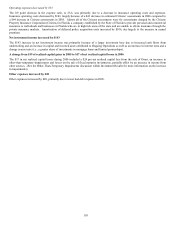

For terrorism, private sector catastrophe reinsurance capacity is limited and generally unavailable for terrorism losses caused by nuclear,

biological, chemical or radiological weapons attacks. As such, the Company’ s principal reinsurance protection against large-scale

terrorist attacks is the coverage currently provided through the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA). On

December 26, 2007, the President signed TRIPRA extending the Terrorism Risk Insurance Act of 2002 (“TRIA”) through the end of

2014. TRIPRA provides a backstop for insurance-related losses resulting from any “act of terrorism” certified by the Secretary of the

Treasury, in concurrence with the Secretary of State and Attorney General, that result in industry losses in excess of $100. In addition,

TRIPRA revised the TRIA definition of a certified “act of terrorism” by removing the requirement that an act be committed “on behalf

of any foreign person or foreign interest.” As a result, domestic acts of terrorism can now be certified as “acts of terrorism” under the

program, subject to the other requirements of TRIPRA. Under the program, in any one calendar year, the federal government would pay

85% of covered losses from a certified act of terrorism after an insurer’ s losses exceed 20% of the company’ s eligible direct commercial

earned premiums of the prior calendar year, up to a combined annual aggregate limit for the federal government and all insurers of $100

billion. If an act of terrorism or acts of terrorism result in covered losses exceeding the $100 billion annual industry aggregate limit, a

future Congress would be responsible for determining how additional losses in excess of $100 billion will be paid.

Among other items, TRIPRA required that the President's Working Group on Financial Markets (“PWG”) continue to perform an

analysis regarding the long-term availability and affordability of insurance for terrorism risk. Among the findings detailed in the PWG's

initial report, released October 2, 2006, were that the high level of uncertainty associated with predicting the frequency of terrorist

attacks, coupled with the unwillingness of some insurance policyholders to purchase insurance coverage, makes predicting long term

development of the terrorism risk market difficult, and that there is likely little potential for future market development for nuclear,

biological, chemical and radiological (NBCR) coverage. A September 2006 study by the U.S. Government Accountability Office on

insuring NBCR terrorism risk similarly concluded that any market-driven expansion of coverage is highly unlikely in the foreseeable

future. TRIPRA requires the Comptroller General to, among other things, study the availability and affordability of insurance coverage

for losses caused by terrorist attacks involving nuclear, biological, chemical or radiological materials and issue a report by December,

2008.

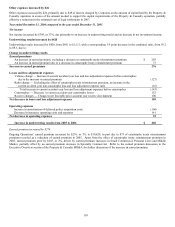

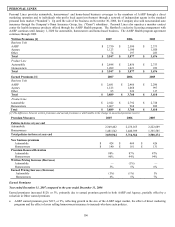

Florida Citizens Assessments

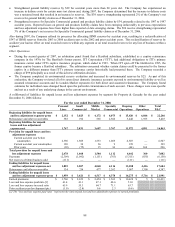

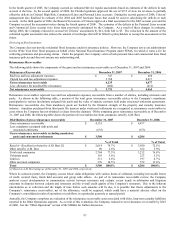

Citizens Property Insurance Corporation in Florida (“Citizens”) provides property insurance to Florida homeowners and businesses that

are unable to obtain insurance from other carriers, including for properties deemed to be “high risk”. Citizens maintains a Personal

Lines account, a Commercial Lines account and a High Risk account. If Citizens incurs a deficit in any of these accounts, Citizens may

impose a “regular assessment” on other insurance carriers in the state to fund the deficits, subject to certain restrictions and subject to

approval by the Florida Office of Insurance Regulation. Carriers are then permitted to surcharge policyholders to recover the

assessments over the next few years. Citizens may also opt to finance a portion of the deficits through issuing bonds and may impose

“emergency assessments” on other insurance carriers to fund the bond repayments. Unlike with regular assessments, however,

insurance carriers only serve as a collection agent for emergency assessments and are not required to remit surcharges for emergency

assessments to Citizens until they collect surcharges from policyholders. Under generally accepted accounting principles, the Company

is required to accrue for regular assessments in the period the assessments become probable and estimable and the obligating event has

occurred. Surcharges to recover the amount of regular assessments may not be recorded as an asset until the related premium is written.

Emergency assessments that may be levied by Citizens are not recorded in the income statement.