The Hartford 2007 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2007 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-28

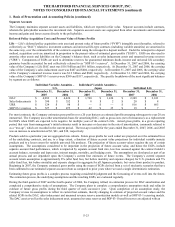

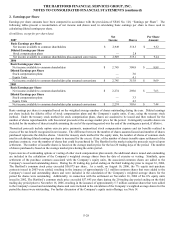

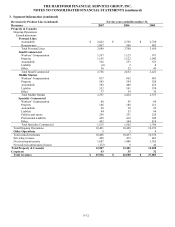

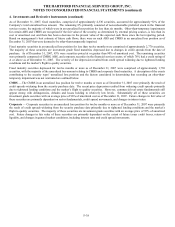

2. Earnings per Share

Earnings per share amounts have been computed in accordance with the provisions of SFAS No. 128, “Earnings per Share”. The

following tables present a reconciliation of net income and shares used in calculating basic earnings per share to those used in

calculating diluted earnings per share.

(In millions, except for per share data)

2007

Net

Income

Shares

Per Share

Amount

Basic Earnings per Share

Net income available to common shareholders $ 2,949 316.3 $ 9.32

Diluted Earnings per Share

Stock compensation plans — 2.8

Net income available to common shareholders plus assumed conversions $ 2,949 319.1 $ 9.24

2006

Basic Earnings per share

Net income available to common shareholders $ 2,745 308.8 $ 8.89

Diluted Earnings per Share

Stock compensation plans — 3.0

Equity Units — 4.1

Net income available to common shareholders plus assumed conversions $ 2,745 315.9 $ 8.69

2005

Basic Earnings per Share

Net income available to common shareholders $ 2,274 298.0 $ 7.63

Diluted Earnings per Share

Stock compensation plans — 3.3

Equity Units — 4.3

Net income available to common shareholders plus assumed conversions $ 2,274 305.6 $ 7.44

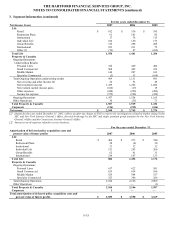

Basic earnings per share is computed based on the weighted average number of shares outstanding during the year. Diluted earnings

per share include the dilutive effect of stock compensation plans and the Company’ s equity units, if any, using the treasury stock

method. Under the treasury stock method for stock compensation plans, shares are assumed to be issued and then reduced for the

number of shares repurchaseable with theoretical proceeds at the average market price for the period. Contingently issuable shares are

included for the number of shares issuable assuming the end of the reporting period was the end of the contingency period, if dilutive.

Theoretical proceeds include option exercise price payments, unamortized stock compensation expense and tax benefits realized in

excess of the tax benefit recognized in net income. The difference between the number of shares assumed issued and number of shares

purchased represents the dilutive shares. Under the treasury stock method for the equity units, the number of shares of common stock

used in calculating diluted earnings per share is increased by the excess, if any, of the number of shares issuable upon settlement of the

purchase contracts, over the number of shares that could be purchased by The Hartford in the market using the proceeds received upon

settlement. The number of issuable shares is based on the average market price for the last 20 trading days of the period. The number

of shares purchased is based on the average market price during the entire period.

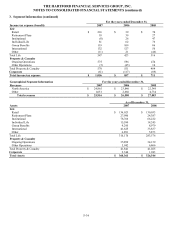

Upon exercise of outstanding options or vesting of other stock compensation plan awards, the additional shares issued and outstanding

are included in the calculation of the Company’ s weighted average shares from the date of exercise or vesting. Similarly, upon

settlement of the purchase contracts associated with the Company’ s equity units, the associated common shares are added to the

Company’s issued and outstanding shares. During the 20 trading day period ending on the third trading day prior to August 16, 2006,

The Hartford’ s common stock price exceeded $56.875 per share. As a result, on August 16, 2006, the 7% equity unit purchase

contracts issued in 2003 were settled, resulting in the issuance of approximately 12.1 million common shares that were added to the

Company’s issued and outstanding shares and were included in the calculation of the Company’ s weighted average shares for the

period the shares were outstanding. Additionally, in connection with the settlement on November 16, 2006 of the 6% equity units

issued in 2002, The Hartford’ s common stock price exceeded $57.645 per share during the 20 trading day period ending on the third

trading day period prior to November 16, 2006, resulting in the issuance of approximately 5.7 million common shares that were added

to the Company’ s issued and outstanding shares and were included in the calculation of the Company’ s weighted average shares for the

period the shares were outstanding. For further discussion of the Company’ s equity units offerings, see Note 14.