Virgin Media 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-25

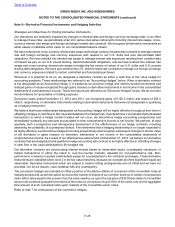

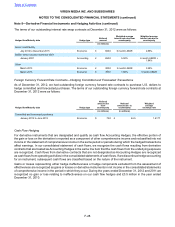

Strategies and Objectives for Holding Derivative Instruments

Our operations are materially impacted by changes in interest rates and foreign currency exchange rates. In an effort

to manage these risks, we periodically enter into various derivative instruments including interest rate swaps, cross-

currency interest rate swaps and foreign exchange forward rate contracts. We recognize all derivative instruments as

either assets or liabilities at fair value on our consolidated balance sheets.

We have entered into cross-currency interest rate swaps and foreign currency forward rate contracts to manage interest

rate and foreign exchange rate currency exposures with respect to our U.S. dollar and euro denominated debt

obligations. We have entered into interest rate swaps to manage interest rate exposures resulting from variable rates

of interest we pay on our U.K. pound sterling denominated debt obligations, and we have entered into interest rate

swaps and cross-currency interest rate swaps to hedge the fair values of certain of our U.S. dollar and U.K. pounds

sterling debt obligations. We have also entered into U.S. dollar forward rate contracts to manage our foreign exchange

rate currency exposures related to certain committed and forecasted purchases.

Whenever it is practical to do so, we designate a derivative contract as either a cash flow or fair value hedge for

accounting purposes. These relationships are referred to as “Accounting Hedges” below. When a derivative contract

is not designated as an Accounting Hedge, it is treated as an economic hedge with mark-to-market movements and

realized gains or losses recognized through gains (losses) on derivative instruments in net income in the consolidated

statements of comprehensive income. These derivatives are referred to as “Economic Hedges” below. We do not enter

into derivatives for speculative or trading purposes.

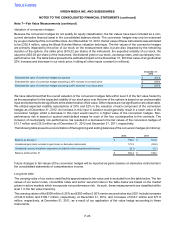

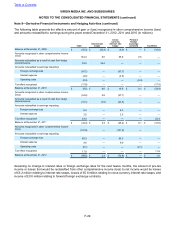

During the years ended December 31, 2012 and 2011, we recognized gains of £152.3 million and losses of £54.5

million, respectively, on derivative instruments relating to derivative instruments that were not designated or qualifying

as a hedging instrument.

We believe that those relationships designated as Accounting Hedges will be highly effective throughout their term in

offsetting changes in cash flow or fair value attributable to the hedged risk. If we determine it is probable that forecasted

transactions to which a hedge contract relates will not occur, we discontinue hedge accounting prospectively and

immediately reclassify any amounts accumulated in other comprehensive income to net income. We perform, at least

quarterly, both a prospective and retrospective assessment of the effectiveness of our hedge contracts, including

assessing the possibility of counterparty default. If we determine that a hedging relationship is no longer expected to

be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in the fair value

of the derivative in gains (losses) on derivative instruments in net income in the consolidated statements of

comprehensive income. As a result of our effectiveness assessment at December 31, 2012, we believe our derivative

contracts that are designated and qualify for hedge accounting will continue to be highly effective in offsetting changes

in cash flow or fair value attributable to the hedged risk.

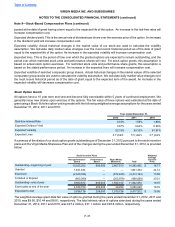

Our derivative contracts are valued using internal models based on observable inputs, counterparty valuations, or

market transactions in either the listed or over-the-counter markets, adjusted for non-performance risk. Non-

performance is based on quoted credit default swaps for counterparties to the contracts and swaps. These derivative

instruments are classified within level 2 in the fair value hierarchy, because we consider all of the significant inputs are

observable. Derivative instruments which are subject to master netting arrangements are not offset and we have not

provided, nor do we require, cash collateral with any counterparty.

The conversion hedges are intended to offset a portion of the dilutive effects of conversion of the convertible notes at

maturity and provide us with the option to receive the number of shares of our common stock (or in certain circumstances

cash) with a value equal to the excess of (a) the value owed by us (up to the cap price of $35.00 per share) to convertible

senior note investors pursuant to the terms of the notes on conversion of up to 90% of the notes over (b) the aggregate

face amount of such converted notes upon maturity of the convertible senior notes.

Refer to note 7 for a discussion of the conversion hedges.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 8—Derivative Financial Instruments and Hedging Activities