Virgin Media 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

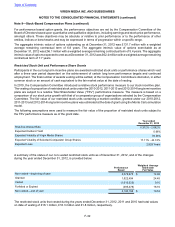

F-42

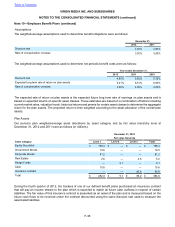

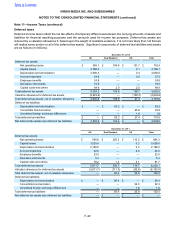

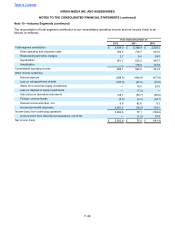

Deferred taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are

reduced by a valuation allowance if, based upon the weight of available evidence, it is not more likely than not that we

will realize some portion or all of the deferred tax assets. Significant components of deferred tax liabilities and assets

are as follows (in millions):

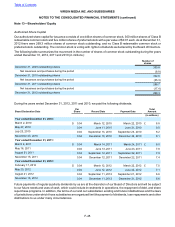

December 31, 2012

UK Dual Resident US Total

Deferred tax assets:

Net operating losses £ 386.1 £ 184.6 £ 131.7 £ 702.4

Capital losses 2,786.0 — 0.1 2,786.1

Depreciation and amortization 2,056.2 — 0.3 2,056.5

Accrued expenses 24.6 — 2.6 27.2

Employee benefits 24.9 — — 24.9

Derivative instruments 16.5 — — 16.5

Capital costs and others 64.9 2.0 2.0 68.9

Total deferred tax assets 5,359.2 186.6 136.7 5,682.5

Valuation allowance for deferred tax assets (2,823.6) — (109.3) (2,932.9)

Total deferred tax assets, net of valuation allowance 2,535.6 186.6 27.4 2,749.6

Deferred tax liabilities:

Depreciation and amortization £ — £ 83.2 £ — £ 83.2

Convertible bond accretion — — 25.8 25.8

Unrealized foreign exchange differences — — 1.6 1.6

Total deferred tax liabilities £ — £ 83.2 £ 27.4 £ 110.6

Net deferred tax assets less deferred tax liabilities £ 2,535.6 £ 103.4 £ — £ 2,639.0

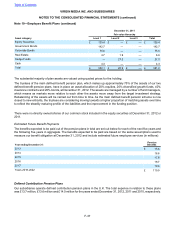

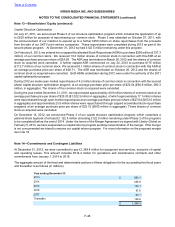

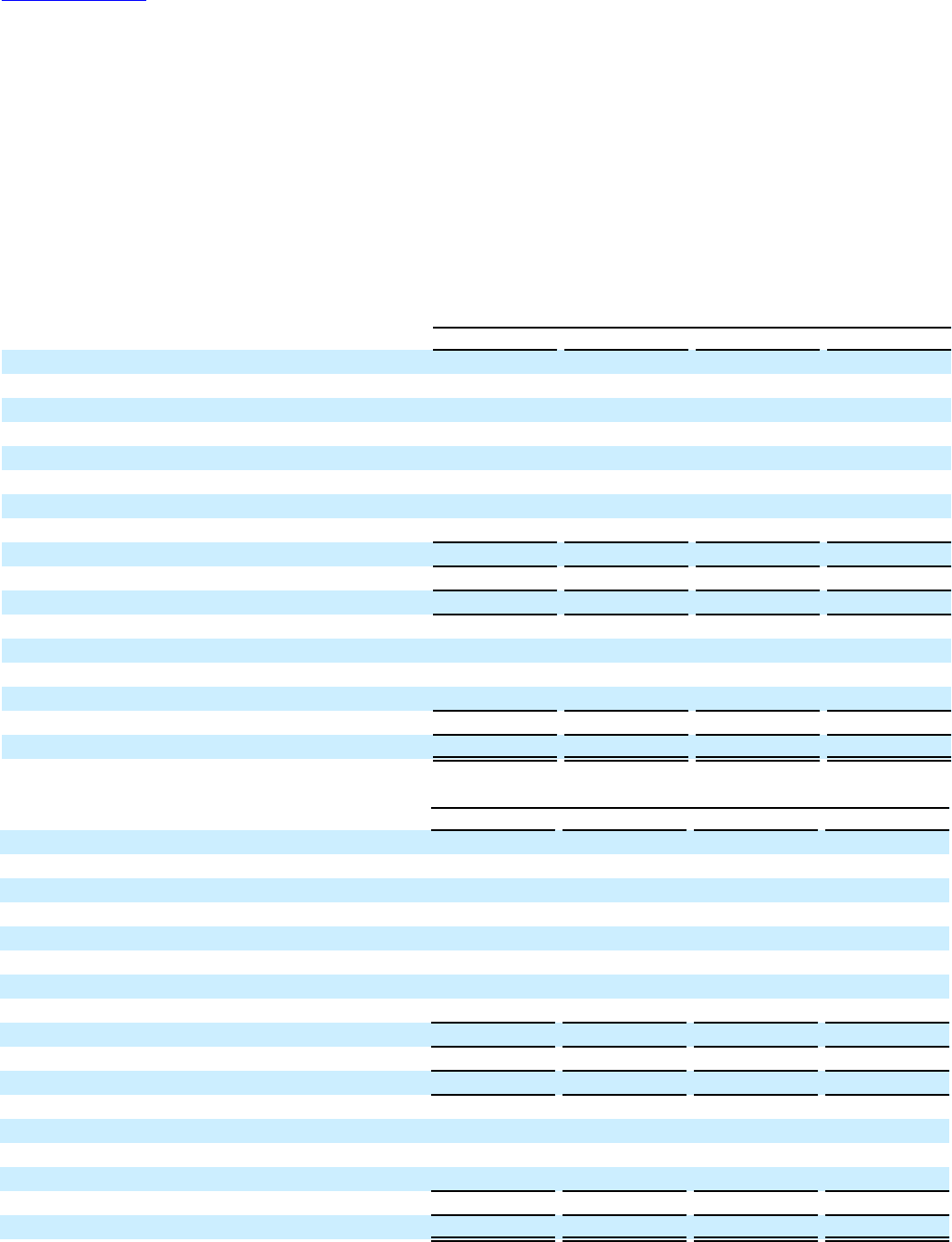

December 31, 2011

UK Dual Resident US Total

Deferred tax assets:

Net operating losses £ 548.8 £ 205.3 £ 110.2 £ 864.3

Capital losses 3,025.8 — 0.2 3,026.0

Depreciation and amortization 2,188.0 — 0.2 2,188.2

Accrued expenses 42.0 — 2.0 44.0

Employee benefits 23.5 — — 23.5

Derivative instruments 5.4 — — 5.4

Capital costs and others 78.2 1.4 2.1 81.7

Total deferred tax assets 5,911.7 206.7 114.7 6,233.1

Valuation allowance for deferred tax assets (5,911.7) (111.3) (80.8) (6,103.8)

Total deferred tax assets, net of valuation allowance — 95.4 33.9 129.3

Deferred tax liabilities:

Depreciation and amortization £ — £ 95.4 £ — £ 95.4

Convertible bond accretion — — 32.3 32.3

Unrealized foreign exchange differences — — 1.6 1.6

Total deferred tax liabilities — 95.4 33.9 129.3

Net deferred tax assets less deferred tax liabilities £ — £ — £ — £ —

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 11—Income Taxes (continued)