Virgin Media 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

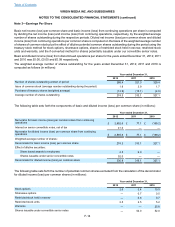

F-14

Basic net income (loss) per common share and basic income (loss) from continuing operations per share is computed

by dividing the net income (loss) and income (loss) from continuing operations, respectively, by the weighted average

number of shares outstanding during the respective periods. Diluted net income (loss) per common share and diluted

income (loss) from continuing operations per common share is computed on the basis of the weighted average number

of shares of common stock plus the effect of dilutive potential common shares outstanding during the period using the

treasury stock method for stock options, sharesave options, shares of restricted stock held in escrow, restricted stock

units and warrants, and the if-converted method for shares potentially issuable under our convertible senior notes.

Basic and diluted income (loss) from discontinued operations per share for the years ended December 31, 2012, 2011

and 2010 was £0.00, £0.00 and £0.08 respectively.

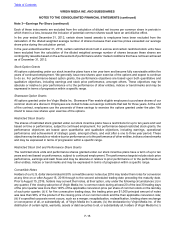

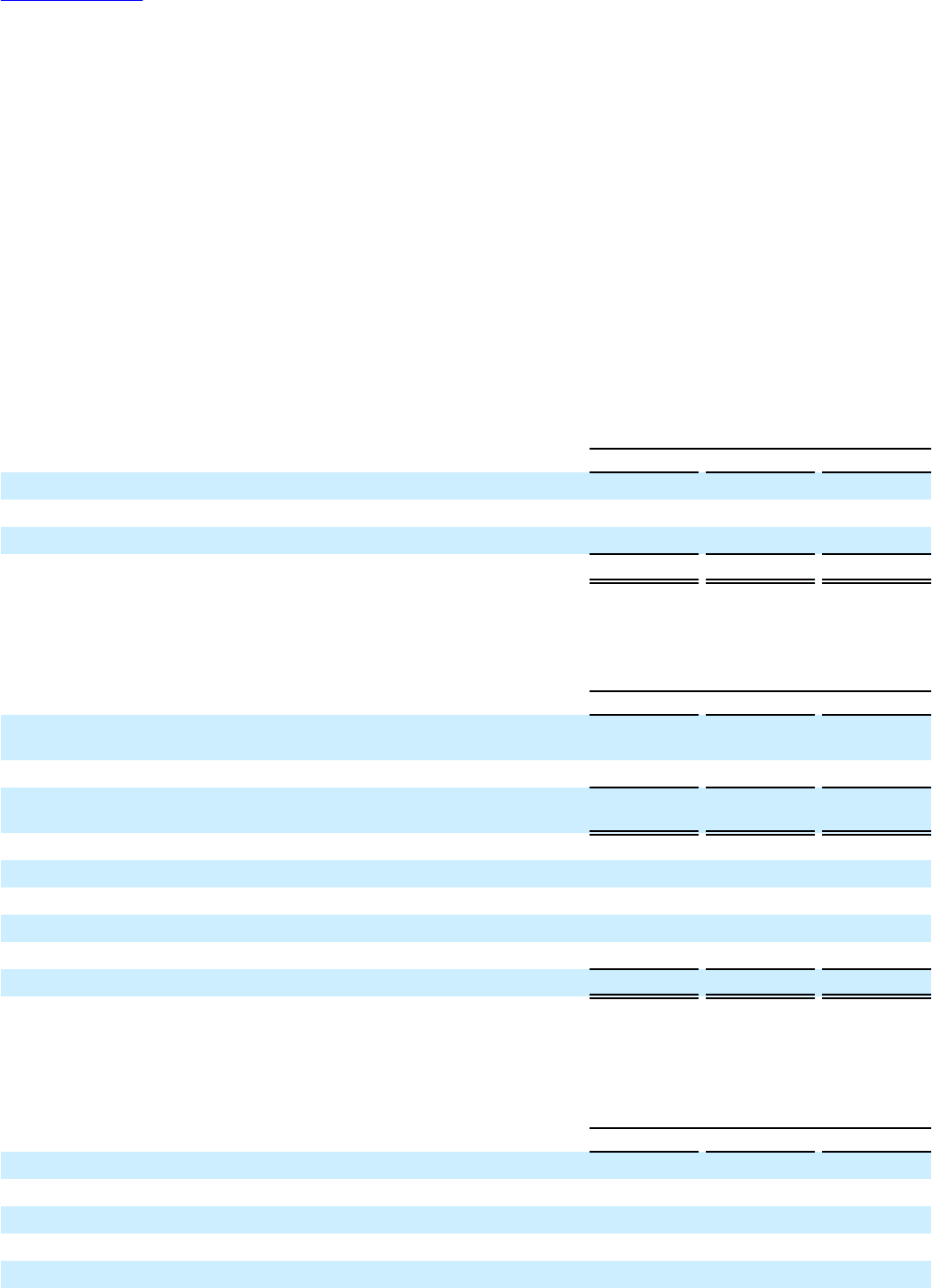

The weighted average number of shares outstanding for the years ended December 31, 2012, 2011 and 2010 is

computed as follows (in millions):

Year ended December 31,

2012 2011 2010

Number of shares outstanding at start of period 286.4 321.3 329.4

Issue of common stock (average number outstanding during the period) 1.8 3.9 1.7

Purchase of treasury shares (weighted average) (13.9) (15.1) (4.0)

Average number of shares outstanding 274.3 310.1 327.1

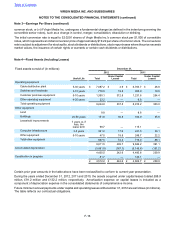

The following table sets forth the components of basic and diluted income (loss) per common share (in millions):

Year ended December 31,

2012 2011 2010

Numerator for basic income (loss) per common share from continuing

operations £ 2,852.6 £ 77.1 £ (169.2)

Interest on senior convertible notes, net of tax 41.0 — —

Numerator for diluted income (loss) per common share from continuing

operations £ 2,893.6 £ 77.1 £ (169.2)

Weighted average number of shares:

Denominator for basic income (loss) per common share 274.3 310.1 327.1

Effect of dilutive securities:

Share based awards to employees 4.5 6.0 —

Shares issuable under senior convertible notes 52.0 — —

Denominator for diluted income (loss) per common share 330.8 316.1 327.1

The following table sets forth the number of potential common shares excluded from the calculation of the denominator

for diluted income (loss) per common shares (in millions):

Year ended December 31,

2012 2011 2010

Stock options 2.6 3.4 10.5

Sharesave options — 0.7 0.5

Restricted stock held in escrow — 0.6 0.7

Restricted stock units 2.5 2.5 5.2

Warrants — — 25.8

Shares issuable under convertible senior notes — 52.0 52.0

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 3—Earnings Per Share