Virgin Media 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

CRITICAL ACCOUNTING ESTIMATES

We apply U.S. GAAP in preparing our consolidated financial statements and related financial information, which requires

the use of estimates, assumptions, judgments and subjective interpretations of accounting principles that have an

impact on the assets, liabilities, revenue and expense amounts reported, as well as disclosures about contingencies,

risk and financial condition. An impact could occur because of the individual significance of the item being estimated,

or because of the inherent uncertainty in measuring, at a specific point in time, transactions that are continuous in

nature.

Actual results may differ from these estimates under different assumptions and conditions, so we have set out below

the critical accounting estimates which have the potential to have a significant impact on our financial statements. If

our business changes in the future, then accounting estimates not disclosed below may also become critical.

Our main revenue generating transactions contain relatively few estimates, with revenues being principally driven by

cash received from our Consumer and Business customers, and operating costs being principally non-capitalizable

expenditure on our Network together with expenses incurred in serving our customers.

There are areas of our business, such as the amount of uncollectible accounts receivable, amounts accrued for vacated

properties, the amount to be paid for other liabilities, including contingent liabilities, our pension expense and pension

funding requirements, amounts to be paid under our employee incentive plans, costs for interconnection, goodwill and

indefinite life assets, and long-lived assets where significant or complex estimates are made, however we do not

believe these judgments have a material impact on our financial statements. Actual results could differ from those

estimates.

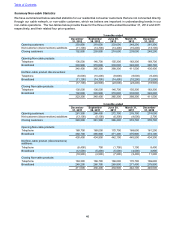

FIXED ASSETS

Our industry is capital intensive, and a significant portion of our resources are spent on extending and upgrading our

network. As of December 31, 2012 and 2011, the net book value of our fixed assets was approximately £4.5 billion

and £4.6 billion, respectively.

We record fixed assets at cost and depreciate them on a straight line basis. Estimating the useful lives of these assets

involves significant judgment. In making these judgments, our management uses its experience and expectations of

the utility of the specific asset being evaluated. We also compare the useful lives assigned to fixed assets by other

companies that operate similar businesses. Changes in technology or changes in the intended use of these assets

may cause the estimated useful life to change, resulting in changes to our depreciation expense. Any revisions to

estimated useful lives are reflected prospectively beginning in the period in which the change in estimate is made. We

estimate that a one year increase in the useful lives of only those fixed assets that we purchased in 2012 would result

in a decrease in our 2012 depreciation expense of £25 million and that a one year decrease would result in an increase

of approximately £42 million in our 2012 depreciation expense.

Costs associated with network construction, initial customer installations, initial installations of new services in customer

premises, and the addition of network equipment to provide new or enhanced services are capitalized. Costs capitalized

as part of initial customer installations include materials and direct labor.

Capitalizable labor costs incurred in connection with customer installations relate to activities such as:

• Dispatching personnel and equipment to the customer's premises;

• Verification that the customer's premises is able to receive our services;

• Physically connecting the customer's premises to our network;

• Set-up of equipment within the customer's premises and connection of that equipment to our network; and

• Programming the equipment so that it is able to function as intended.

We also capitalize certain indirect costs required in order to connect the customer to our network. These indirect costs

relate to the compensation and overhead costs of employees who assist in connecting and activating the customer.

Costs incurred to connect a service to a premises that has previously received the same service are expensed as

incurred, and costs incurred to connect a new service to a premises that has previously received other services are

capitalized. For example, if a premises that has received our telephony service ceases receiving our telephony service,

costs incurred to connect telephony services at that premises at any point in the future would be expensed. Additionally,

if a premises that has received telephony services ceases receiving our services and a new customer occupies that

Table of Contents