Virgin Media 2012 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-91

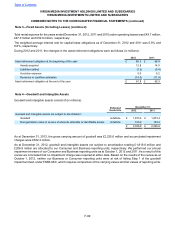

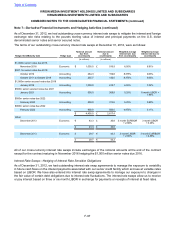

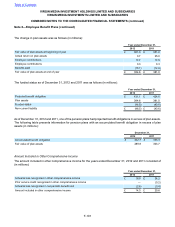

The carrying values of the $500 million 5.25% and £650 million 5.50% senior secured notes due 2021 include increases

of £42.9 million and £109.1 million, respectively, at December 31, 2012 and increases of £45.7 million and £77.9 million,

respectively, at December 31, 2011, as a result of our application of fair value hedge accounting to these instruments.

The effective interest rate on the senior credit facility was 2.4% and 3.3% as at December 31, 2012 and 2011 respectively.

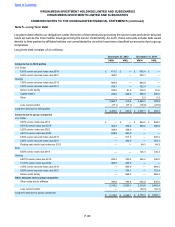

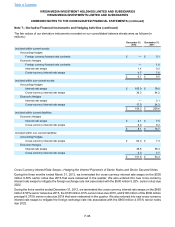

The terms of the senior notes and senior credit facility as at December 31, 2012 are summarized below.

Senior Notes

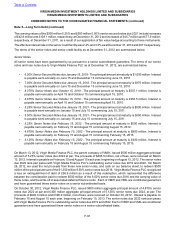

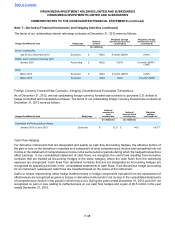

All senior notes have been guaranteed by us pursuant to a senior subordinated guarantee. The terms of our senior

notes and loan notes due to Virgin Media Finance PLC as at December 31, 2012, are summarized below.

• 6.50% Senior Secured Notes due January 15, 2018 - The principal amount at maturity is $1,000 million. Interest

is payable semi-annually on June 15 and December 15 commencing June 15, 2010

• 7.00% Senior Secured Notes due January 15, 2018 - The principal amount at maturity is £875 million. Interest

is payable semi-annually on June 15 and December 15 commencing June 15, 2010

• 8.375% Senior Notes due October 15, 2019 - The principal amount at maturity is $507.1 million. Interest is

payable semi-annually on April 15 and October 15 commencing April 15, 2010.

• 8.875% Senior Notes due October 15, 2019 - The principal amount at maturity is £253.5 million. Interest is

payable semi-annually on April 15 and October 15 commencing April 15, 2010.

• 5.25% Senior Secured Notes due January 15, 2021 - The principal amount at maturity is $500 million. Interest

is payable semi-annually on January 15 and July 15 commencing July 15, 2011.

• 5.50% Senior Secured Notes due January 15, 2021 - The principal amount at maturity is £650 million. Interest

is payable semi-annually on January 15 and July 15 commencing July 15, 2011.

• 5.25% Senior Notes due February 15, 2022 - The principal amount at maturity is $500 million. Interest is

payable semi-annually on February 15 and August 15 commencing August 15, 2012.

• 4.875% Senior Notes due February 15, 2022 - The principal amount at maturity is $900 million. Interest is

payable semi-annually on February 15 and August 15 commencing February 15, 2013.

• 5.125% Senior Notes due February 15, 2022 - The principal amount at maturity is £400 million. Interest is

payable semi-annually on February 15 and August 15 commencing February 15, 2013.

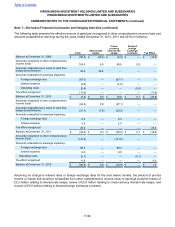

On March 13, 2012, Virgin Media Finance PLC, the parent company of VMIH, issued $500 million aggregate principal

amount of 5.25% senior notes due 2022 at par. The proceeds of $495.5 million, net of fees, were received on March

13, 2012. Interest is payable on February 15 and August 15 each year, beginning on August 15, 2012. The senior notes

due 2022 rank pari passu with Virgin Media Finance PLC's outstanding senior notes due 2019 and 2022. On March

28, 2012, we used the net proceeds from these new senior notes, and cash on our balance sheet, to redeem $500

million of the principal amount of the $1,350 million 9.50% senior notes due 2016. Virgin Media Finance PLC recognized

a loss on extinguishment of debt of £58.6 million as a result of this redemption, which represented the difference

between the consideration paid to redeem $500 million of the 9.50% senior notes due 2016 and the carrying value of

those notes, and the write-off of associated deferred finance costs. Each of VMIH and VMIL are conditional guarantors

and have guaranteed these senior notes on a senior subordinated basis.

On October 30, 2012, Virgin Media Finance PLC, issued $900 million aggregate principal amount of 4.875% senior

notes due 2022 at par and £400 million aggregate principal amount of 5.125% senior notes due 2022, at par. The

proceeds of $893.0 million and £396.9 million, net of fees, were received on October 30, 2012. Interest is payable on

February 15 and August 15 each year, beginning on February 15, 2013. The senior notes due 2022 rank pari passu

with Virgin Media Finance PLC's outstanding senior notes due 2019 and 2022. Each of VMIH and VMIL are conditional

guarantors and have guaranteed these senior notes on a senior subordinated basis.

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

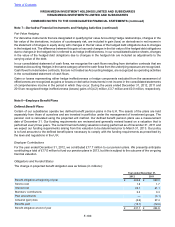

Note 5—Long Term Debt (continued)