Virgin Media 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

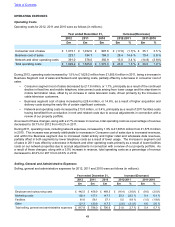

LIQUIDITY AND CAPITAL RESOURCES

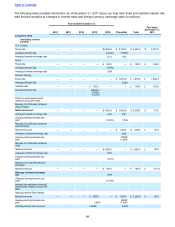

SOURCES AND USES OF CASH

Overview

Our business is capital intensive and we are highly leveraged. We have significant cash requirements for operating

costs, capital expenditures and interest expense. The level of our capital expenditures and operating expenditures

are affected by the significant amounts of capital required to connect customers to our network, expand and upgrade

our network and offer new services. We believe that we will be able to meet our current and medium-term liquidity

and capital requirements, including fixed charges, through cash on hand, cash from operations, available borrowings

under our revolving credit facility, and our ability to obtain future external financing.

Monthly receipts from customers in our Consumer segment together with receipts from our Business customers

continue to be our principal source of cash, and we expect this to continue. Net cash from operating activities decreased

by 9.5% in 2012 to £1,039.7 million, compared to £1,149.1 million and £1,037.6 million in 2011 and 2010 respectively.

During the year we have invested an additional £101.5 million of cash in upgrading our customer's broadband speeds,

which contributed to our total purchase of fixed assets of £783.2 million for the year, compared to £656.7 million in

2011, and £628.4 million in 2010.

During 2012 we paid cash interest of £406.9 million on our borrowings, which was 6.5% lower than the £435.2 million

interest paid in 2011, and 7.3% lower than the £438.8 million interest paid in 2010, with both decreases being principally

due to lower interest rates following the refinancings discussed below.

Cash remaining from our operating and investing activities has been used to improve the maturity and interest profile

of our long term debt, and to continue with our capital return programs.

In 2011 and 2010 we benefited from cash receipts from the disposal of our UKTV and Virgin Media TV businesses

respectively.

Operating Activities

During 2012 net cash provided by operating activities decreased by £109.4 million to £1,039.7 million compared to

£1,149.1 million in 2011. This decrease arises principally from:

• cash payments associated with the early redemption of senior notes;

• and, the beneficial impact in 2011 of receiving a £77.6 million refund from HMRC for VAT which was not

repeated in 2012,

partially offset by:

• improved operating results increasing operating income;

• and, a decrease in cash interest payments as a result of a lower level of debt at lower average interest rates.

In 2011 net cash provided by operating activities increased to £1,149.1 million from £1,037.6 million in 2010, primarily

due to the improvements in operating results, offset by changes in operating assets and liabilities.

Cash paid for interest in 2012, exclusive of amounts capitalized, decreased to £406.9 million from £435.2 million during

2011. This decrease was primarily as a result of a lower level of debt at lower average interest rates during the year

ended December 31, 2012, along with differences in the timing of the interest payments on our senior credit facility

and senior notes. The change in the timing of the interest payments on our senior notes is as a result of the refinancing

activity undertaken during both 2012 and 2011.

Investing Activities

During 2012, cash used in investing activities of £783.7 million principally comprised purchases of fixed assets totaling

£783.2 million, which has increased from £656.7 million in 2011 primarily as a result of our broadband speed upgrade

program. In 2012 we have not benefited from cash inflows from disposals as experienced in 2011 and 2010.

In 2011 cash used in investing activities of £314.7 million principally comprised purchases of fixed assets of totaling

£656.7 million, partially offset by the net proceeds received from the sale of our equity accounted investment in the

UKTV companies and the related principal repayment on loans to equity investments.

Table of Contents