Virgin Media 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

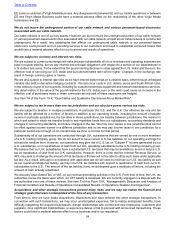

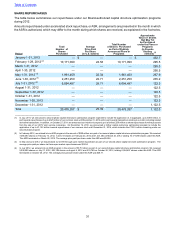

SHARE REPURCHASES

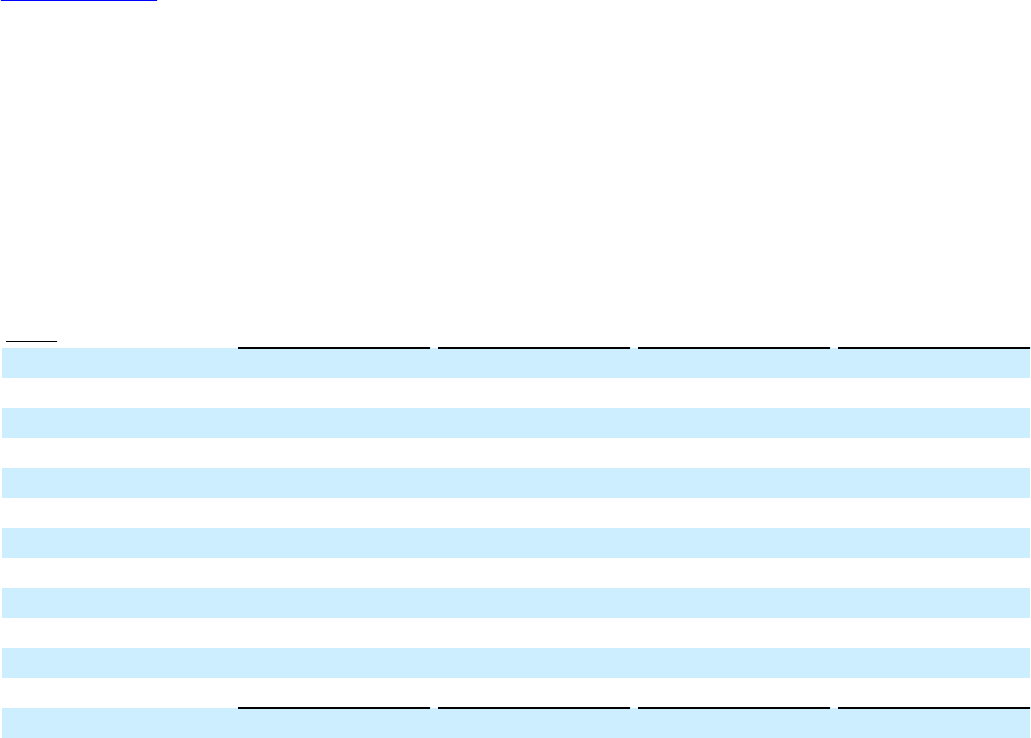

The table below summarizes our repurchases under our Board-authorized capital structure optimization programs

during 2012.

Amounts repurchased under accelerated stock repurchase, or ASR, arrangements are presented in the month in which

the ASR is authorized, which may differ to the month during which shares are received, as explained in the footnotes.

Period

Total

Number of

Shares

Purchased

Average

Price Paid

Per Share

(in U.S. dollars)

Total Number

of Shares Purchased

as Part of Publicly

Announced Plans or

Programs

Approximate

Value of Shares

that May Yet

be Purchased

under the Plans or

Programs

(in Pounds

Sterling

millions)(1)

January 1-31, 2012 — $ — — £ 452.7

February 1-29, 2012 (2) 10,171,090 24.58 10,171,090 295.5

March 1-31, 2012 — — — 295.5

April 1-30, 2012 — — — 295.5

May 1-31, 2012 (3) 1,961,450 22.34 1,961,450 267.9

June 1-30, 2012 (3) 2,251,250 22.71 2,251,250 235.2

July 1-31, 2012 (4) 6,094,497 28.71 6,094,497 122.5

August 1-31, 2012 — — — 122.5

September 1-30, 2012 — — — 122.5

October 1-31, 2012 — — — 122.5

November 1-30, 2012 — — — 122.5

December 1-31, 2012 — — — 1,122.5

Total 20,478,287 $ 25.39 20,478,287 1,122.5

____________________________

(1) In July, 2011, we announced a second phase capital restructure optimization program expected to include the application of, in aggregate, up to £850 million, in

part towards repurchases of up to £625 million of our common stock until December 31, 2012 and in part towards transactions relating to our debt, including related

derivative transactions. In addition, on October 27, 2011, we announced our intention to expend up to a further £250 million on share repurchases from the proceeds

from the sale of our UKTV joint venture companies. On December 14, 2012, we announced a further capital restructure optimization program to include the

application of up to £1,122 million towards repurchases of our common stock until December 31, 2014, which includes the £122.5 million remaining under our

second phase program.

(2) In February 2012, we entered into an ASR program in the amount of $250 million as a part of our second phase capital structure optimization program. We received

7,488,393 shares on February 13, 2012, 1,441,313 shares on February 24, 2012 and 1,241,384 on March 26, 2012, totaling 10,171,090 shares under this ASR.

This ASR terminated on March 26, 2012. The average price paid per share under this ASR was $24.58.

(3) In May and June 2012, we repurchased 4,212,700 through open market repurchases as part of our second phase capital structure optimization program. The

average price paid per share via these open market repurchases was $22.54.

(4) In July 2012, we entered into an ASR program in the amount of $175 million as part of our second phase capital structure optimization program. We received

5,038,509 shares on July 27, 2012, 836,199 shares on August 8, 2012 and 219,789 on October 26, 2012, totaling 6,094,497 shares under this ASR. This ASR

terminated on October 26, 2012. The average price paid per share under this ASR was $28.71.

Table of Contents