Virgin Media 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market Risk Overview

We are exposed to various market risks, including changes in foreign currency exchange rates and interest rates. Market

risk is the potential loss arising from adverse changes in market rates and prices, such as foreign currency exchange and

interest rates. As some of our indebtedness accrues interest at variable rates, we have exposure to volatility in future

cash flows and earnings associated with variable interest rate payments.

Substantially all of our revenues, operating costs and selling, general and administrative expenses are earned and paid

in pounds sterling but we pay interest and principal obligations on some of our indebtedness in U.S. dollars and euros.

As of December 31, 2012, £2,722.3 million, or 46.3%, of our indebtedness based upon contractual obligations, was

denominated in U.S. dollars. As a result, we have exposure to volatility in future cash flows and earnings associated with

changes in foreign exchange rates on payments of principal and interest on a portion of our indebtedness. We have also

committed and forecasted purchases of goods and services in U.S. dollars, euros and South African rand.

The fair market value of long term fixed interest rate debt and the amount of future interest payments on variable interest

rate debt are subject to interest rate risk.

To mitigate the risk from these exposures, we have implemented a cash flow hedging program. The objective of this

program is to reduce but not eliminate the volatility of our cash flows and earnings caused by changes in underlying rates.

To achieve this objective we have entered into a number of derivative instruments. The derivative instruments utilized

comprise interest rate swaps, cross-currency interest rate swaps and foreign currency forward contracts. We do not enter

into derivative instruments for trading or speculative purposes.

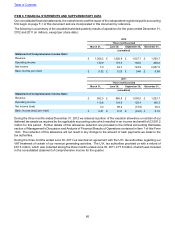

For further details of the accounting for derivative instruments see note 8 to the consolidated financial statements in Item

8 of this Form 10-K. Further discussion of our long term debt and related derivative instruments is also contained within

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital

Resources" in Item 7 of this Form 10-K.

Sensitivity analysis

Interest rate risk

Before taking into account the impact of current hedging arrangements, as of December 31, 2012, we would have had

interest determined on a variable basis on £750 million, or 12.6%, of our long term debt. An increase in interest rates of

one percentage point would increase unhedged gross interest expense by approximately £7.5 million per year.

Exchange rate risk

We are also subject to currency exchange rate risks because substantially all of our revenues, operating costs and selling,

general and administrative expenses are paid in pounds sterling, but we pay interest and principal obligations with respect

to a portion of our indebtedness in U.S. dollars and euros. To the extent that the pound sterling declines in value against

the U.S. dollar and the euro, the effective cost of servicing our U.S. dollar and euro denominated debt will be higher.

Changes in exchange rates result in foreign currency gains or losses, which we have substantially mitigated through

hedges using cross currency interest rate swaps and foreign currency forward contracts. As of December 31, 2012,

£2,722.3 million, or 46.3%, of our indebtedness based upon contractual obligations, was denominated in U.S. dollars. A

1% change in the U.S. dollar to pounds sterling exchange rate would increase unhedged gross interest expense by

approximately £1.7 million per year.

We also purchase goods and services in U.S. dollars, euros and South African rand.

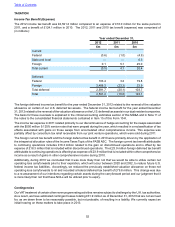

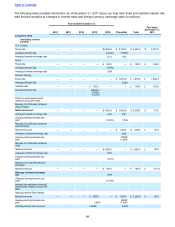

The following tables provide information as of December 31, 2012 and 2011 about our long term fixed and variable interest

rate debt that are sensitive to changes in interest rates and foreign currency exchange rates.

Table of Contents