Virgin Media 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-83

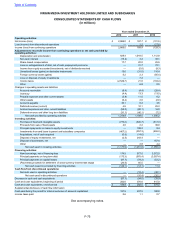

Cash and Cash Equivalents and Restricted Cash

Cash equivalents are short term highly liquid investments purchased with an original maturity of three months or less

and are recorded at amortized cost, which approximates fair value. We had cash and cash equivalents totaling £194.9

million and £282.0 million as at December 31, 2012 and 2011, respectively.

Restricted cash balances of £1.9 million as at December 31, 2012 and £1.9 million as at December 31, 2011 represent

cash balances collateralized against performance bonds given on our behalf.

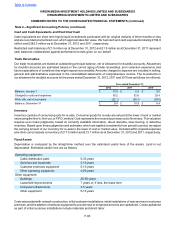

Trade Receivables

Our trade receivables are stated at outstanding principal balance, net of allowance for doubtful accounts. Allowances

for doubtful accounts are estimated based on the current aging of trade receivables, prior collection experience and

future expectations of conditions that might impact recoverability. Amounts charged to expense are included in selling,

general and administrative expenses in the consolidated statements of comprehensive income. The movements in

our allowance for doubtful accounts for the years ended December 31, 2012, 2011 and 2010 are as follows (in millions):

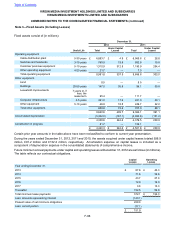

Year ended December 31,

2012 2011 2010

Balance, January 1 £ 10.9 £ 6.4 £ 9.0

Charged to costs and expenses 30.2 32.6 25.4

Write offs, net of recoveries (32.1) (28.1) (28.0)

Balance, December 31 £ 9.0 £ 10.9 £ 6.4

Inventory

Inventory consists of consumer goods for re-sale. Consumer goods for re-sale are valued at the lower of cost or market

value using the first-in, first-out, or FIFO, method. Cost represents the invoiced purchase cost of inventory. This valuation

requires us to make judgments, based on currently available information, about obsolete, slow-moving, or defective

inventory. Based upon these judgments and estimates, which are applied consistently from period to period, we adjust

the carrying amount of our inventory for re-sale to the lower of cost or market value. Included within prepaid expenses

and other current assets is inventory of £17.5 million and £13.1 million as at December 31, 2012 and 2011, respectively.

Fixed Assets

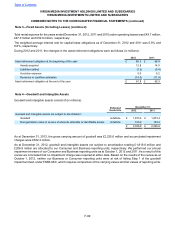

Depreciation is computed by the straight-line method over the estimated useful lives of the assets. Land is not

depreciated. Estimated useful lives are as follows:

Operating equipment:

Cable distribution plant 5-30 years

Switches and headends 3-10 years

Customer premises equipment 5-10 years

Other operating equipment 4-20 years

Other equipment:

Buildings 20-50 years

Leasehold improvements 7 years or, if less, the lease term

Computer infrastructure 3-5 years

Other equipment 5-10 years

Costs associated with network construction, initial customer installations, initial installations of new services in customer

premises, and the addition of network equipment to provide new or enhanced services are capitalized. Costs capitalized

as part of initial customer installations include materials and direct labor.

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 2—Significant Accounting Policies (continued)