Virgin Media 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

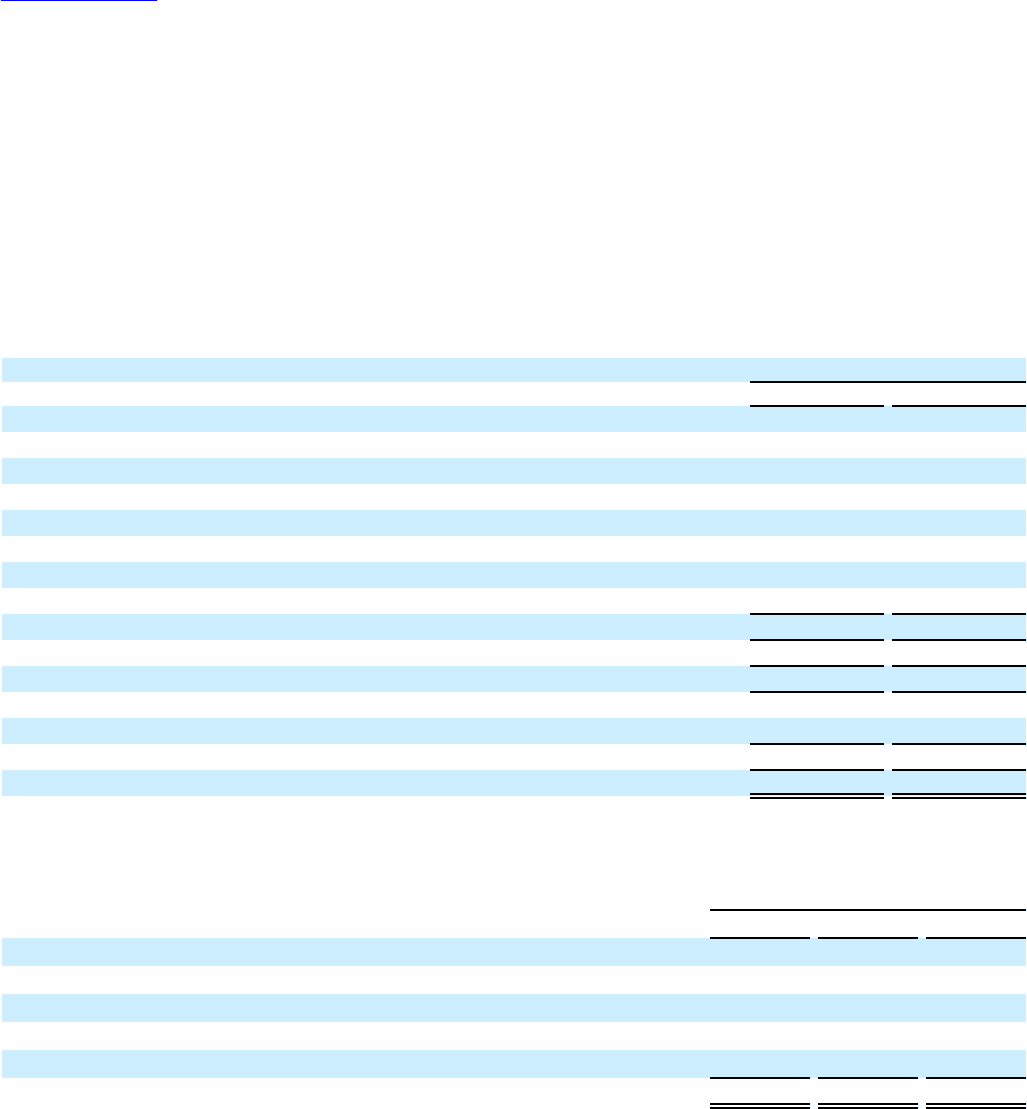

F-108

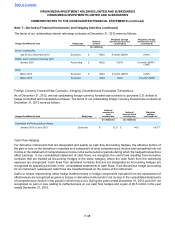

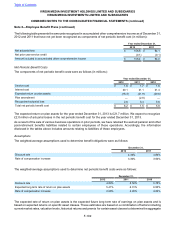

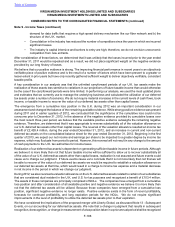

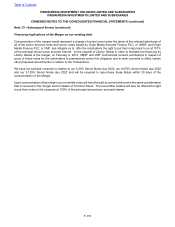

Deferred taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are

reduced by a valuation allowance if, based upon the weight of available evidence, it is more likely than not that we will

not realize some portion or all of the deferred tax assets. Significant components of deferred tax liabilities and assets

are as follows (in millions):

December 31,

2012 2011

Deferred tax assets:

Net operating losses £ 557.5 £ 751.4

Capital losses 2,721.6 3,025.8

Depreciation and amortization 2,008.7 2,115.1

Accrued expenses 25.1 41.6

Employee benefits 24.3 23.5

Derivative instruments 16.1 5.5

Capital costs and others 65.4 79.6

Total deferred tax assets 5,418.7 6,042.5

Valuation allowance for deferred tax assets (2,758.3) (5,947.1)

Total deferred tax assets, net of valuation allowance 2,660.4 95.4

Deferred tax liabilities:

Depreciation and amortization £ 81.3 £ 95.4

Total deferred tax liabilities 81.3 95.4

Net deferred tax assets less deferred tax liabilities £ 2,579.1 £ —

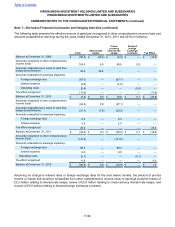

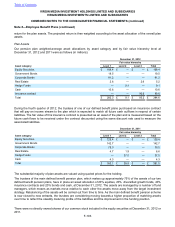

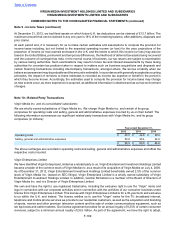

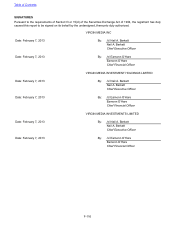

The following table summarizes the movements in our deferred tax valuation allowance during the years ended

December 31, 2012, 2011 and 2010 (in millions):

Year ended December 31,

2012 2011 2010

Balance, January 1 £ 5,947.1 £ 6,373.2 £ 6,607.6

Acquisitions

Effect of changes in U.K. tax rates (464.8) (473.5) (237.3)

Establishment / (Reduction of valuation allowance) (2,579.1) 110.8 (33.6)

(Decrease) increase in valuation allowance due to current year activity (144.9) (63.4) 36.5

Balance, December 31 £ 2,758.3 £ 5,947.1 £ 6,373.2

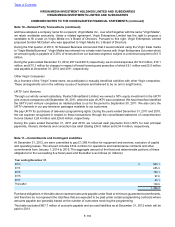

The change in tax rates relates to a reduction in the U.K. corporate income tax rate from 28% to 27% in 2010, to 25%

in 2011, and to 23% in 2012. The deferred tax assets and liabilities presented for 2012 reflect the 23% rate. Further

rate changes have been announced that are expected to reduce the U.K. corporate income tax rate in equal annual

decrements of one percentage point to 21%, but these changes have not yet been enacted.

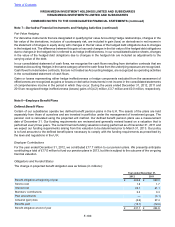

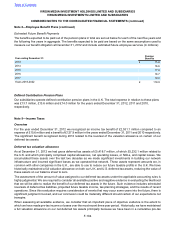

At December 31, 2012, we had deferred tax assets of £372.9 million on U.K. net operating loss carryforwards that

have no expiration date. Pursuant to U.K. law, these losses are only available to offset income of the legal entity that

generated the loss. A portion of the U.K. net operating loss carryforwards relates to dual resident companies, of which

the U.S. net operating loss carryforward amount is £528 million and expires between 2012 and 2028. We also have

U.K. capital loss carryforwards of £11.8 billion that have no expiration date. However, we do not expect to realize any

significant benefit from these capital losses, which can only be used to the extent we generate future U.K. taxable

capital gain income from assets held by subsidiaries owned by the group prior to the merger with Telewest in 2006.

Table of Contents

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 9 - Income Taxes (continued)