Virgin Media 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

premises and subscribes to both our broadband and telephony services, the costs incurred to connect broadband

services would be capitalized and the costs to connect telephony services would be expensed. We assess a new

service as a product that provides fundamentally new or enhanced functionality to our customers and which delivers

incremental revenues.

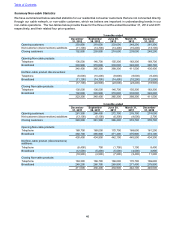

We are required to make judgments regarding the amount of construction and installation costs that are capitalized.

Our capitalization rates for labor costs are based on studies of actual costs as well as operational data demonstrating

the amount of actual time that is spent on specific activities. Our capitalization rates for overhead costs are based on

studies of activities that are incurred in support of capitalizable activities as well as an analysis of the proportion of

those costs that are directly attributable to capitalizable activities. We continuously monitor the appropriateness of our

capitalization policy and update the studies used on a regular basis. We update our policy when necessary to respond

to changes in facts and circumstances, such as the development of new products and services. Changes resulting

from modification to our capitalization have not historically had a material impact on our results.

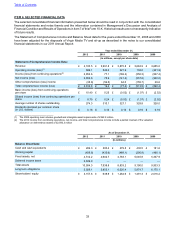

VALUATION ALLOWANCE ON DEFERRED TAX ASSETS

As at December 31, 2012 we had gross deferred tax assets of £5,682.5 million, of which £5,359.2 million related to

the U.K. and which principally comprised capital allowances, net operating losses, or NOLs, and capital losses. We

accumulated these assets over the last two decades as we made significant investments in building our network

infrastructure and incurred significant losses as we operated that network. These assets represent amounts we, in

common with other companies in the U.K., are able to use to reduce our future taxable profits in the U.K. We have

historically maintained a full valuation allowance on both our U.K. and U.S. deferred tax assets, reducing the value of

these assets on our balance sheet to zero.

The assessment of the amount of value assigned to our deferred tax assets under the applicable accounting rules is

highly judgmental. We are required to consider all available positive and negative evidence in evaluating the likelihood

that we will be able to realize the benefit of our deferred tax assets in the future. Such evidence includes scheduled

reversals of deferred tax liabilities, projected future taxable income, tax-planning strategies, and the results of recent

operations. Since this evaluation requires consideration of events that may occur some years into the future, there is

significant judgment involved, and our conclusion could be materially different should certain of our expectations not

transpire.

When assessing all available evidence, we consider an important piece of objective evidence is the extent to which

we have made pre-tax income or losses over the most recent three year period. Historically, we have maintained a

full valuation allowance on our net deferred tax assets principally because we have been in a cumulative pre-tax loss

position over the most recent three year period. While there has been a trend of positive evidence that has been

strengthening in recent years, it was not sufficiently persuasive to outweigh the negative evidence provided by our

cumulative pre-tax loss position. During the year ended December 31, 2012, we emerged from a cumulative pre-tax

loss position in the U.K. for the first time, which removed this important piece of negative evidence from our evaluation.

Our assessment for the year ended December 31, 2012 considered the following positive and negative evidence.

Based on this evidence, we concluded that it was more likely than not that in future periods we will generate sufficient

pre-tax income to utilize substantially all of our U.K. deferred tax assets relating to capital allowances and NOLs:

Positive evidence:

• We have now generated pre-tax income in the U.K. of more than £150 million for two consecutive years

and have utilized some of our available tax assets to reduce the tax liabilities that would have otherwise

arisen in those periods.

• Our U.K. capital allowances and NOLs do not have an expiration date.

• Our financial performance has continued to improve despite challenging macroeconomic conditions.

Steady growth in revenue and operating income has been maintained for three years, and we believe that

financial performance will continue to improve even if the current economic conditions persist.

• Our forecasts of future taxable income indicate that our pre-tax income and taxable income will increase

in the future.

• We have re-financed a significant portion of our high-coupon debt into lower-coupon, longer duration debt

in recent years.

Table of Contents