Virgin Media 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197

|

|

F-36

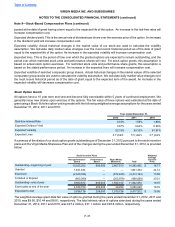

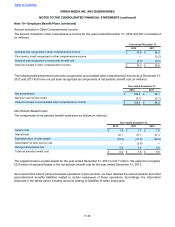

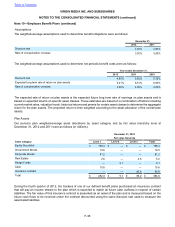

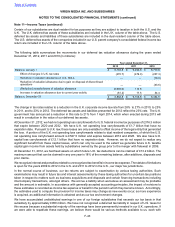

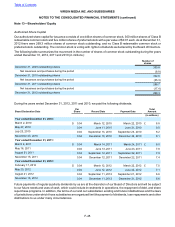

Assumptions

The weighted-average assumptions used to determine benefit obligations were as follows:

December 31,

2012 2011

Discount rate 4.40% 4.80%

Rate of compensation increase 3.30% 3.50%

The weighted-average assumptions used to determine net periodic benefit costs were as follows:

Year ended December 31,

2012 2011 2010

Discount rate 4.80% 5.50% 5.75%

Expected long term rate of return on plan assets 5.41% 6.31% 6.50%

Rate of compensation increase 3.50% 4.00% 4.00%

The expected rate of return on plan assets is the expected future long term rate of earnings on plan assets and is

based on expected returns on specific asset classes. These estimates are based on a combination of factors including

current market rates, valuation levels, historical returns and premia for certain asset classes to determine the aggregate

return for the plan assets. The projected return is then weighted according to the asset allocation of the overall plan

assets.

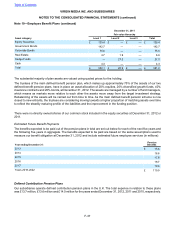

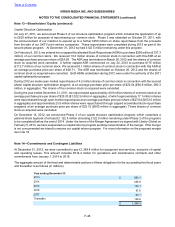

Plan Assets

Our pension plan weighted-average asset allocations by asset category and by fair value hierarchy level at

December 31, 2012 and 2011 were as follows (in millions):

December 31, 2012

Fair value hierarchy

Asset category Level 1 Level 2 Level 3 Total

Equity Securities £ 168.4 £ — £ — £ 168.4

Government Bonds 19.5 — — 19.5

Corporate Bonds 81.2 — — 81.2

Real Estate 2.6 — 2.6 5.2

Hedge Funds — 9.1 — 9.1

Cash 10.6 — — 10.6

Insurance contract — — 90.6 90.6

Total £ 282.3 £ 9.1 £ 93.2 £ 384.6

During the fourth quarter of 2012, the trustees of one of our defined benefit plans purchased an insurance contract

that will pay an income stream to the plan which is expected to match all future cash outflows in respect of certain

liabilities. The fair value of this insurance contract is presented as an asset of the plan and is measured based on the

future cash flows to be received under the contract discounted using the same discount rate used to measure the

associated liabilities.

Table of Contents

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 10—Employee Benefit Plans (continued)