Virgin Media 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

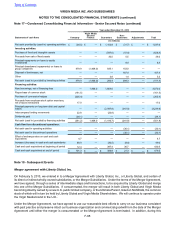

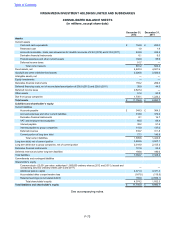

F-65

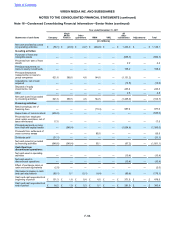

Year ended December 31, 2010

Statements of cash flows Company

Virgin Media

Secured

Finance Guarantors Non-

Guarantors Adjustments Total

(in millions)

Net cash provided by (used in) operating activities £(34.5) £ — £ 1,103.8 £ (31.7) £ — £ 1,037.6

Investing activities:

Purchase of fixed and intangible assets — — (587.0) (41.4) — (628.4)

Proceeds from sale of fixed assets — — 30.5 5.5 — 36.0

Principal repayments on loans to equity

investments — — — 8.4 — 8.4

Principal drawdowns (repayments) on loans to

group companies 479.9 (1,468.0) 835.1 153.0 — —

Disposal of businesses, net ———167.4 —167.4

Other — — 3.8 1.4 — 5.2

Net cash (used in) provided by investing activities 479.9 (1,468.0) 282.4 294.3 —(411.4)

Financing activities:

New borrowings, net of financing fees — 1,468.0 1,604.0 — — 3,072.0

Repurchase of common stock (161.5) — — — — (161.5)

Purchase of conversion hedges (205.4) — — — — (205.4)

Proceeds from employee stock option exercises,

net of taxes reimbursed 17.0 — — — — 17.0

Principal payments on long term debt and capital

leases — — (2,997.9) (241.9) — (3,239.8)

Intercompany funding movements 22.8 — (22.8) — — —

Dividends paid (34.1)————(34.1)

Net cash (used in) provided by financing activities (361.2) 1,468.0 (1,416.7) (241.9) — (551.8)

Cash flow from discontinued operations:

Net cash used in operating activities ———(30.1) — (30.1)

Net cash used in discontinued operations ———(30.1) — (30.1)

Effect of exchange rates on cash and cash

equivalents 4.7 — — — — 4.7

Increase (decrease) in cash and cash equivalents 88.9 — (30.5)(9.4) — 49.0

Cash and cash equivalents at beginning of period 12.4 — 387.4 30.7 —430.5

Cash and cash equivalents at end of period £101.3 £ — £ 356.9 £21.3 £ — £ 479.5

Note 18 - Subsequent Events

Merger agreement with Liberty Global, Inc.

On February 5, 2013, we entered in to a Merger Agreement with Liberty Global, Inc., or Liberty Global, and certain of

its direct or indirect wholly-owned subsidiaries, or the Merger Subsidiaries. Under the terms of the Merger Agreement,

we have agreed, through a series of intermediate steps and transactions, to be acquired by Liberty Global and merge

into one of the Merger Subsidiaries. If consummated, the merger will result in both Liberty Global and Virgin Media

becoming directly owned by a new U.K. public limited company, or the Ultimate Parent, listed on NASDAQ, the common

stock of which will in turn be held by Liberty Global and Virgin Media Shareholders. We will continue to operate under

the Virgin Media brand in the U.K..

Under the Merger Agreement, we have agreed to use our reasonable best efforts to carry on our business consistent

with past practice and preserve intact our business organization and commercial goodwill from the date of the Merger

Agreement until either the merger is consummated or the Merger Agreement is terminated. In addition, during this

Table of Contents

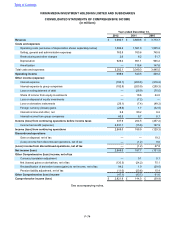

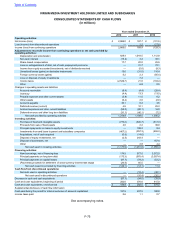

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

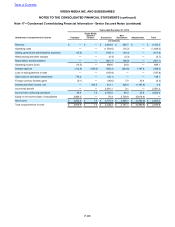

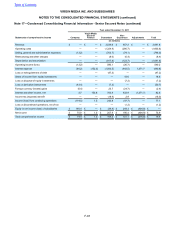

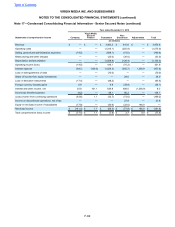

Note 17—Condensed Consolidating Financial Information - Senior Secured Notes (continued)